Current Report Filing (8-k)

February 05 2016 - 1:34PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 4, 2016

CARPENTER TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-5828 |

|

23-0458500 |

|

(State of or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer I.D. No.) |

|

P.O. Box 14662

Reading, Pennsylvania |

|

19612-4662 |

|

(Address of principal executive

offices) |

|

(Zip Code) |

(610) 208-2000

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 - Results of Operations and Financial Condition.

On February 4, 2016, Carpenter Technology Corporation held its second quarter fiscal 2016 earnings call, broadcast live by webcast. A copy of the slides presented during the call are furnished as Exhibit 99.1 to this Form 8-K and shall not be deemed to be “filed” for any purpose.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Slides presented during Carpenter Technology Corporation second quarter fiscal 2016 earnings call |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CARPENTER TECHNOLOGY CORPORATION |

|

|

|

|

|

|

|

|

By |

/s/ Damon J. Audia |

|

|

|

Damon J. Audia |

|

|

|

Senior Vice President – Finance and

Chief Financial Officer |

Date: February 5, 2016

2

Exhibit 99.1

Carpenter Technology Corporation 2nd Quarter Fiscal Year 2016 Earnings Call February 4, 2016

Cautionary Statement Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ from those projected, anticipated or implied. The most significant of these uncertainties are described in Carpenter’s filings with the Securities and Exchange Commission, including its annual report on Form 10-K for the year ended June 30, 2015, Form 10-Q for the quarter ended September 30, 2015, and the exhibits attached to those filings. They include but are not limited to: (1) the cyclical nature of the specialty materials business and certain end-use markets, including aerospace, defense, industrial, transportation, consumer, medical, and energy, or other influences on Carpenter’s business such as new competitors, the consolidation of competitors, customers, and suppliers or the transfer of manufacturing capacity from the United States to foreign countries; (2) the ability of Carpenter to achieve cash generation, growth, earnings, profitability, cost savings and reductions, productivity improvements or process changes; (3) the ability to recoup increases in the cost of energy, raw materials, freight or other factors; (4) domestic and foreign excess manufacturing capacity for certain metals; (5) fluctuations in currency exchange rates; (6) the degree of success of government trade actions; (7) the valuation of the assets and liabilities in Carpenter’s pension trusts and the accounting for pension plans; (8) possible labor disputes or work stoppages; (9) the potential that our customers may substitute alternate materials or adopt different manufacturing practices that replace or limit the suitability of our products; (10) the ability to successfully acquire and integrate acquisitions; (11) the availability of credit facilities to Carpenter, its customers or other members of the supply chain; (12) the ability to obtain energy or raw materials, especially from suppliers located in countries that may be subject to unstable political or economic conditions; (13) Carpenter’s manufacturing processes are dependent upon highly specialized equipment located primarily in facilities in Reading and Latrobe, Pennsylvania and Athens, Alabama for which there may be limited alternatives if there are significant equipment failures or a catastrophic event; (14) the ability to hire and retain key personnel, including members of the executive management team, management, metallurgists and other skilled personnel; (15) fluctuations in oil and gas prices and production; (16) the success of restructuring actions; and (17) share repurchases are at Carpenter’s discretion and could be affected by changes in Carpenter’s share price, operating results, capital spending, cash flows, inventory, acquisitions, investments, tax laws and general market conditions. Any of these factors could have an adverse and/or fluctuating effect on Carpenter’s results of operations. The forward-looking statements in this document are intended to be subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Carpenter undertakes no obligation to update or revise any forward-looking statements. Non-GAAP Financial Measures Some of the information included in this presentation is derived from Carpenter’s consolidated financial information but is not presented in Carpenter’s financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Certain of these data are considered “non-GAAP financial measures” under SEC rules. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rationale for the use of the non-GAAP financial measures can be found in the Appendix to this presentation.

2nd Quarter Fiscal Year 2016 Summary Tony Thene President and Chief Executive Officer

Safety is our First Priority 1Q16 TCIR = 2.3 2Q16 TCIR = 1.9 4.8 3.9 3.5 3.9 3.7 3.3 2.1 2.1 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 YTD Total Case Incident Rate (TCIR)

2nd Quarter Summary Focus on our High-End Premium Alloys and Operational Efficiency Continued to Support Stable Margins and Profitability Despite Some Challenging End-Use Markets Overall volume impacted by continued weakness in Energy and Industrial and Consumer end-use markets Aerospace and Defense end-use market benefited from improved mix with sequential volume reflective of supply chain adjustments Ongoing focus on operational efficiency combined with improved product mix supported operating margin stability and profitability during period of lower volume Generated positive free cash flow; up $67 million compared to prior year Maintained solid liquidity position with improved working capital management and reduced capital expenditures Repurchased $50 million of shares during quarter

2nd Quarter FY16 End-Use Market Highlights Aerospace and Defense 195.6 52% +3% +5% Engines up both year over year (YOY) and sequentially Fasteners down YOY primarily due to supply chain adjustments Structural up YOY on volume and improved product mix Defense up YOY with continued spending on supported programs Energy 23.9 6% -66% -25% North American (NA) quarterly average directional and horizontal rig count down 58% YOY; down 12% sequentially Significant reduction in drilling and completions demand Focused on positioning for eventual recovery Transportation 34.8 9% +11% -5% Consistent demand signals through calendar 2016 Growing sales for fuel delivery systems applications NA light vehicle volume continues to grow in calendar year 2016 Record Q1-16 impacting sequential comparison Medical 25.8 7% +0% +3% Demand remains steady for differentiated titanium, nickel and cobalt materials Transactional business remains competitive Industrial and Consumer 71.1 19% -26% -5% Exposure to Oil & Gas creates challenging environment for capital equipment and industrial components sectors Reduced consumer confidence negatively impacted spending on some electronics and other consumer goods *Excludes sales through Carpenter’s Distribution businesses Comments Q2-16 Net Sales ex. Surcharge ($M)* vs. Q2-15 vs. Q1-16 Sales ex. surcharge down 15% on 16% lower volume year-over-year as mix improved

2nd Quarter Fiscal Year 2016 Financial Overview Damon Audia Senior Vice President and Chief Financial Officer

Income Statement Summary Relatively flat gross margin despite 3% sequential reduction in volume *Detailed schedule included in Non-GAAP Schedules in Appendix $ Millions, except pounds and per-share amounts Q2-15 Q1-16 Q2-16 Sequential Change $ Millions, except per-share amounts FY14 Actual FY15 Forecast Change Pounds ('000) 67,712 58,422 56,928 (1,494) Pounds ('000) 290,389 313,087 22,698 Net Sales 548.4 455.6 443.8 (11.8) Net Sales 2,173.0 2,541.2 368.2 Sales ex. Surcharge * 445.7 385.1 379.4 (5.7) Sales ex. Surcharge * 1,782.8 2,011.0 228.2 Gross Profit 85.0 68.6 66.3 (2.3) Gross Profit 398.9 452.0 53.1 % of Sales ex. Surcharge 19.1% 17.8% 17.5% -0.3% pts. (0.3) % of Sales ex. Surcharge 22.4% 22.5% 0.1% pts. 0.1 Selling, General and Administrative Expenses 40.0 43.4 44.5 1.1 Selling, General and Administrative Expenses 186.9 244.3 57.4 % of Sales ex. Surcharge 9.0% 11.3% 11.7% 0.4% pts. 0.4 % of Sales ex. Surcharge 10.5% 12.1% 1.7% pts. 1.7 Restructuring Charges 0.0 0.4 0.0 (0.4) Operating Income 186.9 244.3 57.4 Operating Income 45.0 24.8 21.8 (3.0) Operating Income 212.0 207.7 (4.3) % of Sales ex. Surcharge 10.1% 6.4% 5.7% -0.7% pts. (0.7) % of Sales ex. Surcharge 11.9% 10.3% -1.6% pts. (1.6) Operating Income ex. Pension EID, Restructuring Charges and Special Items * 47.4 32.6 29.2 (3.4) Operating Income ex. Pension EID * 233.8 217.2 (16.6) % of Sales ex. Surcharge 10.6% 8.5% 7.7% -0.8% pts. (0.8) % of Sales ex. Surcharge 13.1% 10.8% -2.3% pts. (2.3) Effective Tax Rate 36.9% 44.7% 23.8% -20.9% Effective Tax Rate 32.4% 34.5% 2.1% Net Income 24.1 8.9 11.5 2.6 Net Income 132.8 121.5 (11.3) Diluted Earnings Per Share $0.45 $0.18 $0.23 $0.05 Diluted Earnings Per Share $2.47 $2.27 ($0.20) Adjusted Diluted Earnings per Share * $0.48 $0.26 $0.24 ($0.02) Adjusted Diluted Earnings per Share *

Free Cash Flow Summary The clerical accuracy of certain amounts may be impacted due to rounding. Lower capital expenditures and less sequential inventory build delivering positive free cash flow while maintaining strong liquidity ok ok ok ok ok ok ok ok ok ok ok Plan Plan Plan Plan ok ok $ Millions Q1-14 Q1-15 vs LY $ Millions Q1 Q2 FY15 YTD Q1 Q2 FY16 YTD $ Millions FY13 Q1-14 Q2-14 Q3-14 Q4-14 FY14 $ Millions FY14 Q1 Q2 Q3 Q4 FY15 $ Millions FY10 FY11 FY12 FY13 FY14 Net Income + Non-cash Items 76 60 (16) Net Income + Non-cash Items 61 133 193 54 61 115 Net Income + Non-cash Items 331 76 69 76 73 294 Net Income + Non-cash Items 294 80 74 84 93 331 Net Income + Non-cash Items 124 196 286 331 294 Inventory (47) (31) 16 Inventory (31) (31) (62) (33) (2) (35) Inventory (15) (47) (12) (1) 23 (37) Inventory (37) (33) (16) 15 19 (15) Inventory (19) (116) (77) (15) (37) Working Capital / Other 12 (10) (22) Other working capital (12) (88) (99) 21 (29) (8) Working Capital / Other 18 12 (32) 8 1 (11) Working Capital / Other (11) 17 (28) (16) 42 15 Working Capital / Other 11 (16) (63) 18 (11) Total Net Working Capital / Other (35) (41) (6) Total Net Working Capital (43) (119) (161) (12) (31) (43) Total Net Working Capital / Other 3 (35) (44) 7 24 (48) Total Net Working Capital / Other (48) (16) (44) (1) 61 0 Total Net Working Capital / Other (8) (132) (140) 3 (48) Pension Plan Contributions - Required (1) (3) (2) Pension Plan Contributions (3) (1) (4) 0 0 0 Pension Plan Contributions - Required (70) (1) (2) (2) (1) (6) Pension Plan Contributions - Required (6) (2) (2) (2) (9) (15) Pension Plan Contributions - Required 0 (4) (30) (70) (6) Net Cash from Operating Activities 40 16 (24) Net Cash from Operating Activities 15 13 28 42 30 72 Net Cash from Operating Activities 189 40 23 81 96 240 Net Cash from Operating Activities 240 62 28 81 145 316 Net Cash from Operating Activities 116 60 116 189 240 Purchases of property, equipment and software - Other (23) (11) 12 Purchases of property, equipment and software (59) (68) (127) (30) (20) (50) Purchases of property, equipment and software - Other (114) (23) (19) (20) (19) (81) Purchases of property, equipment and software - Other (81) (31) (29) (23) (17) (100) Purchases of property, equipment and software - Other (44) (80) (158) (114) (81) Dividends paid (9) (10) (1) Dividends paid (10) (10) (19) (9) (9) (18) Dividends paid (38) (9) (10) (9) (10) (38) Dividends paid (38) (9) (10) (9) (10) (38) Dividends paid (32) (32) (34) (38) (38) Other (1) 1 Other - (1) (1) 4 1 5 Other 0 (1) 1 0 0 (1) Other (1) 0 Other Investing (37) 17 0 (1) Free Cash Flow (60) (54) 6 Free Cash Flow (54) (66) (119) 7 2 9 Free Cash Flow (159) (60) (100) (22) 35 (148) Free Cash Flow (148) (13) (25) 45 108 115 Free Cash Flow 40 (89) (59) (159) (148) Free Cash Flow - AOP (124) (76) (11) 79 (132) Free Cash Flow - AOP (13) (25) 45 108 115 Cash 66 29 31 21 Available Credit Line 492 455 493 453 Total Liquidity 558 484 524 474 Q1-14 -60 Q2-14 -100 Q3-14 -22 Q4-14 35 Q1-15 -54 Q2-15 -66

Share Repurchase Program Update Repurchased 5.7 million shares (11% of outstanding) since inception for $221 million Authorized share repurchase program beginning October 2014 Up to $500M of share repurchases authorized over two year period Repurchase at Company’s discretion based on capital needs of the business, general market conditions and market price of stock May be discontinued at any time FY15 Q1-16 Q2-16 Program to Date Share Purchase Total ($ millions) 124.5 45.9 50.4 220.8 Number of Shares Purchased (millions) 3.0 1.2 1.5 5.7

Business Update and Growth Enablers Tony Thene President and Chief Executive Officer

SAO Segment Summary Q2 Operating Results Q2 Business Results Q3 Outlook Steep declines in Energy and Industrial & Consumer end-use markets drove lower year-over-year sales volumes Sequentially, volumes were slightly lower primarily due to further weakness in Energy end-use market Improving operating margins for both comparisons driven by stronger sales mix and operating cost improvements Overall volumes expected to be up modestly with similar sales mix to Q2-16 Persistent focus on driving operational efficiencies as well as cost improvements Actively expanding customer base seeking incremental opportunities SAO Q2-15 Q1-16 Q2-16 vs PY vs Q1 Pounds ('000) 65,600 56,814 54,794 (10,806) (2,020) Sales ex. Surcharge ($M) 332.4 301.6 299.2 (33.2) (2.4) Op Inc ex. EID ($M) 43.4 41.1 41.5 (1.9) 0.4 % of Sales ex. Surcharge 13.1% 13.6% 13.9% 0.8% 0.3% PEP Q2-15 Q1-16 Q2-16 vs PY vs Q1 Pounds ('000) 3,790 3,805 3,741 (49) (64) Sales ex. Surcharge ($M) 136.0 120.1 113.4 (22.6) (6.7) Op Inc ex. EID ($M) 12.2 8.5 4.8 (7.4) (3.7) % of Sales ex. Surcharge 9.0% 7.1% 4.2% -4.8% -2.9% Q2-15 120.1 Q2-16 0 vs PY Op Income Adjusted ($M)* 63.5 ###### 35.1 (28.4) Diluted EPS Reported $ 0.57 47.0 $(0.03) $ (0.60) Diluted EPS Adjusted** $ 0.57 $ 0.32 $ (0.25)

PEP Segment Summary Q2 Operating Results Q2 Business Results Q3 Outlook Sales and operating income performance year-over-year primarily driven by weak Oil and Gas demand due to reduced drilling activity Sequential sales lower than expected – down 7% driven by: Continued decline in Oil & Gas demand Weaker demand in Distribution businesses Softer demand for Aerospace titanium products Profitability in Q3 expected to be similar to Q2 Continuing to align cost structure with end-use markets environment Working to strengthen market position in Energy for eventual recovery Continued sequential headwinds from Oil & Gas Early indications of normalizing orders for Aerospace titanium products * Pounds related to manufactured tons for Dynamet and Carpenter Powder Products only SAO Q4-14 Q3-15 Q4-15 vs PY vs Q3 Pounds ('000) 77,933 67,232 68,575 (9,358) 1,343 Sales ex. Surcharge ($M) 369.1 360.0 382.4 13.3 22.4 Op Inc ex. EID ($M) 63.0 37.9 52.1 (10.9) 14.2 % of Sales ex. Surcharge 17.1% 10.5% 13.6% -3.5% 3.1% PEP Q2-15 Q1-16 Q2-16 vs PY vs Q1 Pounds* ('000) 4,224 2,956 2,800 (1,424) (156) Sales ex. Surcharge ($M) 133.4 91.4 85.2 (48.2) (6.2) Op Inc (Loss) ex. EID ($M) 12.6 (0.4) (2.9) (15.5) (2.5) % of Sales ex. Surcharge 9.4% -0.4% -3.4% -12.8% -3.0% Q4-14 91.4 Q4-15 0 vs PY Op Income Adjusted ($M)* 63.5 ###### 35.1 (28.4) Diluted EPS Reported $ 0.57 47.0 $(0.03) $(0.60) Diluted EPS Adjusted** $ 0.57 $ 0.32 $(0.25)

Growth Enablers Carpenter Today Focus on high-value specialty alloys with limited exposure to commodity stainless steel markets Products serve demanding applications in attractive end-use markets Commitment to innovation and being preferred solutions provider Opportunities include building on Aerospace portfolio, further penetration of Transportation end-use market and investing in new offerings

Investing in the Future VAP: Vendor Approved Process Athens Facility Powder Products Achievements to Date Facility is fully operational 89% of customer site non-VAP certifications complete 75% of Oil & Gas completions achieved Two VAP qualifications completed for nickel superalloy used for aerospace rings Looking Forward to Calendar Years 2016-17 Finalize internal development processes and work with customers on VAP qualifications Achieve most stringent aerospace engine parts qualifications from customers and their supply chain partners Carpenter Powder Products One of the world’s largest suppliers of spherical gas atomized metal powders Manufacturing facilities: Pennsylvania, Rhode Island, Alabama and Sweden Superalloys and titanium powder production capabilities investments underway Powder Products Opportunity Expected to be one of the fastest growing segments in overall metals market Additive manufacturing represents major growth opportunity across end-use markets

Outlook and Closing Comments Well Positioned as Preferred Solutions Provider for High-end Premium Alloy Markets; Initiatives Aimed at Supporting Margin Growth as Volumes Return Actively managing business to maximize results with some challenging end-use markets Expect second half volume to be up modestly compared to first half, primarily due to continued weakening of oil and gas market impacting our Energy as well as Industrial and Consumer end-use markets Focused on identifying additional cost reductions and incremental volume opportunities Committed to improving working capital efficiency and maintaining capital spending discipline Prudently executing against share repurchase program Selectively investing in new technologies to position company for growth over longer term

Appendix of Non-GAAP Schedules

Restructuring Charges and Special Items * Income Tax Items Discrete income tax charge recorded in Q2-15 as a result of a tax law change. Discrete income tax charge recorded in Q1-16 as a result of decision to sell equity method investment in India. Discrete income tax benefit recorded in Q2-16 as a result of a tax law change. Note: The Restructuring Charges and Special Items amounts above are shown on an after-tax basis. For the pre-tax impacts, see Slide 19 $ per-share Q3-15 Q4-15 Income Statement Classification Diluted (Loss) / Earnings per Share As Reported ($0.03) $0.44 Reduction in Force & Severance Costs $0.13 $0.03 Restructuring Charges Site Closure Costs $0.02 $0.02 Restructuring Charges Ultra-fine Grain Materials Development Exit $0.17 Restructuring Charges Sub-total Restructuring Charges $0.32 $0.05 Consulting Costs $0.03 $0.03 SG&A Expenses Restructuring Charges & Special Items $0.35 $0.08 Diluted Earnings per Share ex. Restructuring Charges & Special Items $0.32 $0.52 $ Millions, except per-share amounts Q2-15 Q1-16 Q2-16 Income Statement Classification As Reported Net Income 24.1 8.9 11.5 Diluted Earnings per Share $0.45 $0.18 $0.23 Restructuring Charges - 0.3 - Restructuring Charges Consulting Costs - 1.7 1.7 SG&A Expenses Income Tax Items* 1.6 2.0 (0.8) Income Tax Expense Restructuring Charges and Special Items 1.6 4.0 0.9 Net Income excl. Restructuring Charges and Special Items 25.7 12.9 12.4 Adjusted Diluted Earnings per Share $0.48 $0.26 $0.24

Non-GAAP Schedules (Unaudited) Operating Margin Excluding Surcharge, Pension Earnings, Interest and Deferrals "Pension EID", Restructuring Charges and Special Items $ Millions Q2-15 Q1-16 Q2-16 Net sales 548.4 455.6 443.8 Less: surcharge revenue 102.7 70.5 64.4 Consolidated Net Sales Excluding Surcharge 445.7 385.1 379.4 Operating income 45.0 24.8 21.8 Pension EID 2.4 4.8 4.8 Operating Income Excluding Pension EID 47.4 29.6 26.6 Restructuring Charges and Special Items Restructuring costs - 0.4 - Consulting costs - 2.6 2.6 Operating Income Excluding Pension EID, Restructuring Charges and Special Items 47.4 32.6 29.2 Operating Margin Excluding Surcharge, Pension EID, Restructuring Charges and Special Items 10.6% 8.5% 7.7% Management believes that removing the impacts of raw material surcharge from operating margin provides a more consistent basis for comparing results of operations from period to period. In addition, management believes that excluding the impact of pension EID, which may be volatile due to changes in the financial markets, is helpful in analyzing the true operating performance of the Company. Management believes that removing the impact of restructuring charges and special items is helpful in analyzing the operating performance of the Company, as these costs are not indicative of ongoing operating performance.

Non-GAAP Schedules (Unaudited) Free Cash Flow $ Millions Q2-15 Q2-16 FY15 YTD FY16 YTD Net cash provided from operating activities 12.5 30.1 27.5 71.6 Purchases of property, equipment and software (68.4) (19.6) (127.4) (49.5) Proceeds from disposals of property and equipment - 0.2 0.1 0.3 Other - - - 4.0 Dividends paid (9.6) (8.9) (19.3) (17.9) Free Cash Flow (65.5) 1.8 (119.1) 8.5 Management believes that the free cash flow measure provides useful information to investors regarding our financial condition because it is a measure of cash generated which management evaluates for alternative uses.

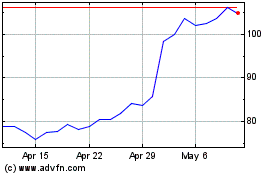

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

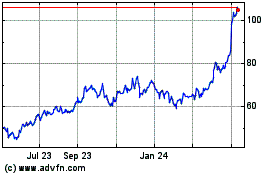

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024