Norfolk Southern to Cut Jobs, Rail Lines -- 2nd Update

January 27 2016 - 3:10PM

Dow Jones News

By Laura Stevens and Betsy Morris

Norfolk Southern Corp. on Wednesday unveiled a five-year

restructuring plan that will eliminate 1,200 jobs next year, idle

track, close and combine operations and pare back both capital

spending and stock buybacks in an effort clearly aimed at fending

off another hostile takeover attempt by Canadian Pacific Railway

Ltd.

Norfolk Southern Chief Executive James Squires told analysts in

his fourth quarter earnings call that the plan would cut costs by

$130 million next year and result in annual savings of $650 million

by 2020.

The news was delivered along with the announcement of a near 30%

decline in fourth quarter profit, to $361 million, or $1.20 a

share, down from $511 million, or $1.64 a share, which came in

three cents below analysts' expectations.

Dismal energy markets have depressed rail cargo over the past

year. Norfolk Southern was hurt by declining coal and fuel

surcharge revenue in the latest quarter, which together accounted

for 84% of revenue declines.

Norfolk Southern's strategic plan is designed to reassure and

bolster support among shareholders in the face of a possible proxy

fight with Canadian Pacific. The plan plays to the eastern

railroad's strengths, increasing its on-time performance to

service-sensitive customers in the automotive and consumer markets

and continuing to woo business from trucking. The railroad also

expects to capitalize on new business from an expanded Panama

Canal.

"We serve main population centers, and there's more of a market

for consumer goods where our tracks go," Mr. Squires said in an

interview.

Not all analysts were impressed. Norfolk Southern has three

times rejected a roughly $30 billion merger bid from Canadian

Pacific. While Mr. Squires wouldn't touch that subject, analysts

still pushed him. Analysts wanted to know why he couldn't cut jobs

and reduce capital spending more aggressively. Noting that CP has

proposed to cut about $1.2 billion in costs over the same five-year

period as Norfolk Southern's plan, one analyst asked: "what is it

about your business that you feel CP does not understand that makes

shareholders better off with $650 million dollars of improvement

versus...a $1.2 billion improvement plan?"

Mr. Squires answered that his plan is flexible and might get

more aggressive.

It has been expected that CP's chief executive Hunter Harrison

will launch a proxy fight to win Norfolk Southern. In his own

earnings call last week, he said he has talked to more than half of

Norfolk Southern's shareholders and "all indications" are they

support him. But he cautioned that shareholders don't hold all the

cards, noted growing challenges, and said he might have to rethink

his strategy. Since then, some analysts have speculated he might

abandon his campaign for Norfolk Southern.

While Mr. Squires declined to discuss CP's next move, he said he

talks to his shareholders all the time. "We've spoken to virtually

all of our major shareholders over the last several months in order

to get their feedback and their guidance," Mr. Squires said in the

interview. "And one thing we heard from them was 'we want more

details on your strategic plan'. That's what we gave them

today."

Norfolk Southern shares rose more than 2%, to $70.40 in morning

trading. That is still down significantly from a 52-week high hit

in February of $112.05.

In the most recent quarter, revenue dropped 12% to $2.52

billion. Analysts surveyed by Thomson Reuters forecast earnings of

$1.23 a share on $2.57 billion in revenue. The latest quarter

included $31 million in restructuring costs.

Coal revenues fell 20% to $433 million due to warmer weather and

a continuing shift to cheaper natural gas as a source of energy at

power plants. Intermodal revenue fell 13% to $563 million.

Write to Laura Stevens at laura.stevens@wsj.com and Betsy Morris

at betsy.morris@wsj.com

(END) Dow Jones Newswires

January 27, 2016 14:55 ET (19:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

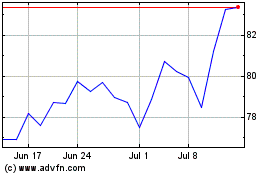

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024