ConocoPhillips Cuts 2016 Spending Plans, Slashes Dividend -- 2nd Update

February 04 2016 - 6:54PM

Dow Jones News

By Erin Ailworth and Tess Stynes

ConocoPhillips cut its dividend by two-thirds and sliced another

chunk from its budget, underscoring concerns that the oil

industry's downturn could stretch into 2017.

Chief among oil's problem spots: the resiliency of U.S. crude

production, which is declining but slowly, and faltering demand for

crude in large markets like China.

Simply cutting this year's budget to $6.4 billion, down from

$10.1 billion in 2015, wouldn't be enough to weather the downturn,

ConocoPhillips Chief Executive Ryan Lance told investors and

analysts on a call after the company reported a large loss in the

fourth-quarter. The Houston company made what Mr. Lance called a

"gut-wrenching" decision to slash its dividend from 74 cents to 25

cents a share in order to ensure the company's ability to maintain

its financial health while oil prices hovered near 12-year

lows.

"The easy moves were made a long time ago," Mr. Lance said. "We

can't count on a quick fix for prices, and we're not willing to

risk a strong balance sheet."

Analyst Paul Sankey of Wolfe Research questioned the magnitude

of the dividend cut, saying that ConocoPhillips's problems weren't

as dire as those at many of its smaller or weaker rivals.

"Why didn't you tough it out for another year?" Mr. Sankey asked

Mr. Lance during Thursday's call. "I'm just worried that you've

capitulated at the bottom."

ConocoPhillips' shares closed 8.7% lower at $35.29.

The company reported a fourth-quarter loss of $3.45 billion, or

$2.78 a share, as it posted $2.7 billion in asset write-downs to

reflect low oil and natural-gas prices and changes to its

energy-exploration plans. A year earlier, ConocoPhillips recorded a

loss of $39 million, or three cents a share.

Excluding asset write-downs, asset-sale gains and other items,

the adjusted per-share loss was 90 cents, compared with

year-earlier adjusted earnings of 60 cents. Revenue slumped 43% to

$6.77 billion.

Analysts polled by Thomson Reuters had expected per-share loss

of 65 cents and revenue of $9.06 billion.

The company, which in December had projected 2016 capital

expenditures at $7.7 billion, on Thursday also cut its

operating-cost estimate to $7 billion from $7.7 billion.

ConocoPhillips said the reduced capital-spending guidance mostly

reflects diminished activity in the lower 48 U.S. states.

"While we don't know how far commodity prices will fall, or the

duration of the downturn, we believe it's prudent to plan for lower

prices for a longer period of time," Mr. Lance said. "The actions

we have announced will improve net cash flow by $4.4 billion in

2016."

ConocoPhillips said that average selling prices fell 46% from a

year earlier, offsetting an increase in production.

The company plans to divest about $2.3 billion in assets in

2015. On Thursday, the company said it had completed roughly $2

billion in asset sales last year.

Write to Erin Ailworth at Erin.Ailworth@wsj.com and Tess Stynes

at tess.stynes@wsj.com

(END) Dow Jones Newswires

February 04, 2016 18:39 ET (23:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

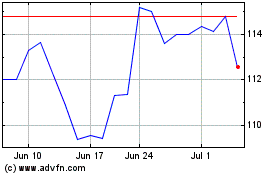

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

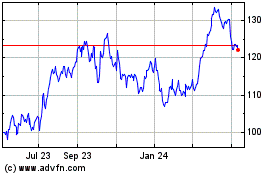

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024