Coach, in Turnaround Mode, Reports Sales Growth

August 09 2016 - 8:57AM

Dow Jones News

By Lisa Beilfuss

Handbag maker Coach Inc. said sales at existing North American

stores rose at the best clip in four years during its latest

quarter, evidence that it is benefiting from its turnaround

efforts.

Still, the retailer's shares fell 3.3% to $40.10 in premarket

trading as total sales fell short of expectations.

Chief Executive Victor Luis said in April that the company's

efforts to add new and more stylish designs, upgrade stores and

pull back promotions were finally paying off. The moves were aimed

at reigniting the company's business and reversing sharp sales

declines dragged by overexpansion and heavy discounting. In

addition, Coach has announced layoffs and shuffled its management

ranks.

In its June quarter, sales at North American stores excluding

newly opened or recently closed shops rose 2%. The result is the

best since the June 2012 quarter, and it edged in above the 1.9%

that analysts expected. Total core sales across the continent

jumped 9%, helped by an extra week of sales.

The fiscal fourth-quarter results "capped a year where we

returned the Coach brand to growth" and "elevated brand

perception," Mr. Luis said, despite "the significant and

unanticipated volatility in tourist spending flows."

Mr. Luis highlighted continued growth in Coach's Stuart Weitzman

brand, which it acquired last year, and double-digit increases in

mainland China and Europe. The company brought in $84 million from

Stuart Weitzman during the quarter, up from $79 million in the

previous three months, and said total international sales climbed

15% from a year earlier.

As sales improved and Coach remained focused on expense

management, it lifted its operating margin to 10.1% from 3.9% a

year earlier.

Still, there are signs that Coach has more work to do.

E-commerce sales rose just 1% -- matching the prior quarter's rate

-- and North American department store sales dropped in the

midteens rate.

Over all for the quarter, Coach reported a profit of $81.5

million, or 29 cents a share, up from $11.7 million, or 4 cents a

share, a year earlier. Excluding certain items, earnings per share

rose to 45 cents from 31 cents.

Revenue increased 15% to $1.15 billion. Analysts expected 41

cents in adjusted earnings per share on $1.17 billion in sales,

according to Thomson Reuters.

For the year ending next June, Coach said it projects earnings

to grow by a double-digit percentage and revenue to increase by a

percentage in the low-to-mid single digits. Analysts, on average,

were expecting earnings to rise 11% on a 4% increase in revenue,

according to Thomson Reuters.

Coach also said it sees its operating margin between 18.5% and

19%, or 20% excluding the closure of about 25% of doors and a

reduction in markdown allowances, among other items.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 09, 2016 08:42 ET (12:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

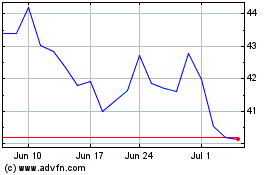

Tapestry (NYSE:TPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

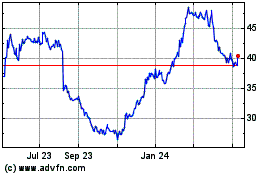

Tapestry (NYSE:TPR)

Historical Stock Chart

From Apr 2023 to Apr 2024