By Suzanne Kapner

What happens when the hot handbag trend is to not buy a new

one?

Sales of premium handbags and accessories in North America are

forecast to increase 3% to $11.7 billion this year, according to

Barclays. That is down from 8% growth last year, 11% in 2013 and

16% in 2012.

Caroline Cooper, a 21-year-old sales associate from Rockland

County, N.Y., said she would rather spend her money going to

restaurants and Broadway plays.

"I don't need another handbag," she said.

The change in spending habits poses a challenge to Coach Inc.,

Michael Kors Holdings Ltd. and other handbag makers that are

already feeling the effects.

When Michael Kors reports quarterly results on Wednesday,

analysts are forecasting retail sales excluding newly opened or

closed stores to decline more than 9%, according to Thomson

Reuters. That would mark the third consecutive quarter in which

same-store sales fell, and compares with the year ago-period when

they rose 16.4%.

Last week, Coach said North American retail sales fell 11% in

its most recent quarter, an improvement from the 20% decline in the

previous period. Kors stock is down nearly 50% over the past 12

months, while Coach shares are off 25% from their high of $43.56 on

March 2.

"We are seeing consumers a little bit on the sidelines," said

Coach Chief Executive Victor Luis on a conference call last

week.

In an interview, Mr. Luis said shoppers are holding out for new

styles before making a purchase. "They want to be inspired," he

said.

He also attributed the slowing sales across the industry to a

shift by consumers away from larger bags to smaller ones, which

carry lower prices. For instance, a Coach Crosby carryall costs

$395, while a smaller Herald bag costs $140.

The shift comes after Coach helped change an ingrained mind-set

that one handbag was enough. It began in the early 2000s when Coach

added fashionable touches each season, such as new fabrics, colors

and other embellishments, to entice shoppers to purchase multiple

styles. Like Coach, Michael Kors and other players including Kate

Spade & Co. peddled a luxurious image at more affordable prices

with bags selling for around $300, far less than the thousands of

dollars for a typical designer satchel.

By 2013, the average American woman age 18 and older owned 11

handbags and bought more than two new bags each year, according to

market research firm NPD Group. Now, handbag fatigue appears to be

setting in.

"The wardrobe building has started to peak out," said Marshal

Cohen, NPD's chief industry analyst. "If you have 11 handbags, how

many more do you need?"

Instead shoppers are spending the money they are saving from

lower gas prices on entertainment rather than on goods like

clothing and accessories.

Nearly 68% of personal consumption expenditures went toward

services in September, up from 66.5% in June 2014, according to the

Bureau of Economic Analysis. Over the same period, the consumption

of goods fell to 32.3% from 33.5%, though spending remains strong

for electronic devices and items for the home.

The shift in spending coincided with the fall in gas prices,

which peaked on June 20, 2014. "There is pent-up demand for

services, and it's become much more challenging for retailers,"

said Jack Kleinhenz, the National Retail Federation's chief

economist. He added that consumers are once again willing to pay

for little luxuries that they had done without during the

recession, such as having their grass cut or going to expensive

hair salons.

When shoppers decide to splurge on bags and accessories, they

are shying away from big brands in favor of styles that give them

more distinctive looks.

Spending by consumers at businesses with annual revenue of $50

million or less has grown faster than total retail sales for the

past 20 months, according to Sarah Quinlan, the senior vice

president of market insights for MasterCard Advisors. She said that

is a sign consumers are trying to be more unique in their purchases

by seeking out smaller stores.

"The notion of having big companies dictate what you wear is no

longer cool," said Simeon Siegel, an analyst with Nomura. "People

don't want to walk down the street and see everyone wearing the

same thing."

Those trends work against companies like Coach and Michael Kors,

which made their brands accessible to the masses by expanding to

thousands of department, retail and outlet stores.

Mr. Luis takes issue with the notion that Coach is ubiquitous,

and said the company has been taking steps to differentiate itself.

It has added new products, including a line called Coach 1941 that

draws from its leather-house heritage. In addition, it is weaning

itself off bags with a logo print because they have fallen out of

favor. Such bags now account for about 5% of Coach's overall

handbag sales.

Kors wasn't immediately available for comment. Mr. Siegel of

Nomura said the company is likely suffering from a sharp decline in

watch sales as shoppers purchase wearable devices. Still, Kors is

heavily reliant on handbags and accessories, which account for 68%

of its revenue, compared with about 8% for licensed products such

as watches.

Melissa Schwartz, a 22-year-old data researcher from Syosset,

N.Y., said she has no plans to add to the five bags--including a

Michael Kors navy blue satchel--that she already owns. "I'd rather

buy fewer bags, but have them be higher quality," she said.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 20:14 ET (01:14 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

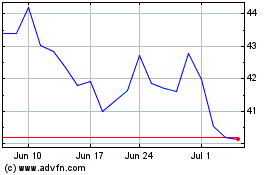

Tapestry (NYSE:TPR)

Historical Stock Chart

From Aug 2024 to Sep 2024

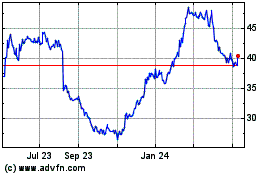

Tapestry (NYSE:TPR)

Historical Stock Chart

From Sep 2023 to Sep 2024