Falling Oil Price Puts Canada's Oil-Sands Growth Under Scrutiny

August 09 2011 - 4:50PM

Dow Jones News

The recent steep drop in crude oil prices isn't good news for

Canada's oil-sands industry, which boasts large reserves but

requires high up-front costs for development.

With oil futures prices dropping more than 30% since April from

above $110 a barrel to below $80 a barrel Tuesday, profits will be

squeezed at several projects and some under construction may be

halted if they no longer make economic sense.

The Canadian oil-sands industry currently produces 1.6 million

barrels a day and is set to add nearly another million barrels a

day by the end of this decade, according to the Canadian

Association of Petroleum Producers, an industry group.

Experts disagree on how low oil prices would have to drop before

producers would have to cancel or delay projects under

construction. It also depends on where each producer predicts oil

prices will be in the future. Longer dated West Texas Intermediate

oil futures, for example, still put the U.S. benchmark price close

to $90 a barrel, showing the market still expects oil to rise over

time.

Bob Dunbar, president of the Calgary consulting firm Strategy

West Inc., has a more conservative outlook than most. He said new

oil sands mining projects require long-term WTI prices between $90

to $100 a barrel, due in part to labor and material cost inflation

as producers have crowded the field with new projects.

Though he said it is "probably a little bit premature" to say

the recent drop in crude will halt the industry's growth, Dunbar

expects some projects to be halted eventually.

"It's not reasonable that all of those projects are going to

proceed anyway," Dunbar said. "There's more than the industry can

sustain--we just don't have enough engineering or skilled

labor."

Other analysts put the long-term WTI oil price for new mining

projects lower, between $60 and $80 a barrel.

BMO Capital Markets analyst Randy Ollenberger sees new mining

projects profitable at WTI prices of $70 a barrel and up, while

Jackie Forrest, director of global oil research for the consulting

firm IHS CERA sees them profitable at between $60 and $70 a barrel.

Already built mining projects can turn a profit as low as $30 a

barrel WTI, they said.

"I don't think anyone will be canceling projects yet,"

Ollenberger said, pointing to the higher price for longer-term oil

futures, and his firm's average price WTI forecast for next year of

$95 a barrel.

Forrest said new projects are still profitable. "They are going

to be making less money than they were prior to the drop in oil

prices," she said, "but the reality is these projects still make

economic sense."

Companies pursuing oil sands mining project include Suncor

Energy Inc. (SU, SU.T), Exxon Mobil Corp. (XOM)-controlled Imperial

Oil Ltd. (IMO, IMO.T), Canadian Natural Resources Ltd. (CNQ,

CNQ.T), Royal Dutch Shell (RDSA, RDSA.LN) and Total SA (TOT, FP.FR)

are among the companies pursuing oil sands mining projects.

Mining projects make up about half of the expected production

growth in the oil sands industry. The rest are underground

steam-injection, or "SAGD" projects that require much lower prices

to justify new projects, in the range of $45 to $70 a barrel, the

analysts said. Most of the mining companies also have SAGD project,

as well as companies including Cenovus Energy Inc. (CVE, CVE.T),

Husky Energy Inc. (HUSKF, HSE.T), Nexen Inc. (NXY, NXY.T), MEG

Energy Corp. (MEGEF, MEG.T) and Athabasca Oil Sands Corp. (ATHOF,

ATH.T).

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

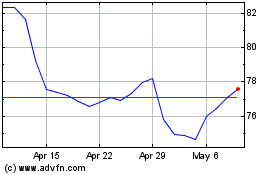

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

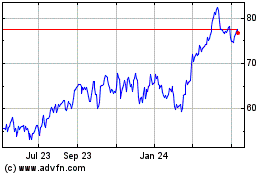

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Apr 2023 to Apr 2024