Cummins Revenue Falls 9% as Demand Remains Weak

November 01 2016 - 12:24PM

Dow Jones News

By Joshua Jamerson

Engine maker Cummins Inc. said revenue fell more than expected

in the latest period amid a prolonged slump in demand.

Shares fell 4.1% to $123.76 in morning trading.

The decline was mostly attributable to lower truck production in

North America and weak international demand for power-generation

equipment. Currency factors dented the top line by about 2%

compared with last year on a stronger U.S. dollar that makes its

products more expensive overseas. Cummins also has been pressured

by weak commodity prices and soft economic growth in some

developing overseas markets.

Revenue in North America slipped 13% and international sales

dipped 3%, as declines in the Middle East and Africa offset higher

revenue from China.

Over all, the company earned $289 million, or $1.72 a share,

compared with $380 million, or $2.14 a share, a year earlier.

Excluding items, the company earned $2.02 a share; analysts, polled

by FactSet, expected $1.96 a share.

Sales fell about 9% to $4.19 billion, missing projections for

$4.23 billion.

Engine segment sales fell 12% to $1.9 billion, components sales

fell 8% to $1.1 billion and power systems sales fell 13% to $856

million.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

November 01, 2016 12:09 ET (16:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

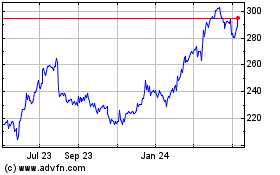

Cummins (NYSE:CMI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cummins (NYSE:CMI)

Historical Stock Chart

From Sep 2023 to Sep 2024