UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 28, 2015

COMERICA INCORPORATED

(Exact name of registrant as specified in its charter)

|

| | | | |

|

| | | | |

Delaware | | 1-10706 | | 38-1998421 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

Comerica Bank Tower

1717 Main Street, MC 6404

Dallas, Texas 75201

(Address of principal executive offices) (zip code)

(214) 462-6831

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01 REGULATION FD DISCLOSURE.

Comerica Incorporated will hold its 2015 annual meeting of shareholders on Tuesday, April 28, 2015, in Dallas, Texas. As part of that meeting, Ralph W. Babb, Jr., Chairman, President and Chief Executive Officer, will make a presentation. A copy of the presentation slides, which will be discussed at the meeting, is attached hereto as Exhibit 99.1. A copy of remarks relating to the presentation slides is attached hereto as Exhibit 99.2.

The information in this report (including Exhibits 99.1 and 99.2 hereto) is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

|

| | | |

99.1 |

| | 2015 Annual Shareholders’ Meeting Presentation Slides |

99.2 |

| | 2015 Annual Shareholders’ Meeting Presentation Slide Remarks |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

|

| | |

| COMERICA INCORPORATED |

| | |

| By: | /s/ Jon W. Bilstrom |

| Name: | Jon W. Bilstrom |

| Title: | Executive Vice President-Governance, Regulatory Relations and Legal Affairs, and Secretary |

Date: April 28, 2015

EXHIBIT INDEX

|

| | | | |

Exhibit No. | | Description |

| | |

99.1 |

| | | 2015 Annual Shareholders’ Meeting Presentation Slides |

99.2 |

| | | 2015 Annual Shareholders’ Meeting Presentation Slide Remarks |

Comerica Incorporated Annual Meeting of Shareholders April 28, 2015Comerica Bank TowerDallas, TX Call to Order 2

Quorum 3 Proposal IElection of Directors 4

Proposal IIRatification of the Appointmentof Independent Auditors 5 Proposal IIIApproval of the 2015 Comerica Incorporated Incentive Plan for Non-Employee Directors 6

Proposal IVApproval of a Non-Binding, Advisory Proposal Approval Executive Compensation 7 A Motion to Vote 8

Polls Open for Voting 9 Polls Closed 10

Voting Results 11 Adjournment 12

Chairman and Chief Executive Officer’s Presentation 13 Safe Harbor Statement Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities LitigationReform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,”“outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,”“outcome,” “continue,” “remain,” “maintain,” “on course,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words andsimilar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as theyrelate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated onthe beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of thispresentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives ofComerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures ofeconomic performance, including statements of profitability, business segments and subsidiaries, estimates of credit trends and global stability.Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks anduncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual resultscould differ materially from those discussed. Factors that could cause or contribute to such differences are changes in general economic, politicalor industry conditions; changes in monetary and fiscal policies, including changes in interest rates; changes in regulation or oversight; Comerica'sability to maintain adequate sources of funding and liquidity; the effects of more stringent capital or liquidity requirements; declines or otherchanges in the businesses or industries of Comerica's customers, including the energy industry; operational difficulties, failure of technologyinfrastructure or information security incidents; reliance on other companies to provide certain key components of business infrastructure; factorsimpacting noninterest expenses which are beyond Comerica's control; changes in the financial markets, including fluctuations in interest rates andtheir impact on deposit pricing; changes in Comerica's credit rating; unfavorable developments concerning credit quality; the interdependence offinancial service companies; the implementation of Comerica's strategies and business initiatives; Comerica's ability to utilize technology toefficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financialinstitutions within Comerica's markets; changes in customer behavior; any future strategic acquisitions or divestitures; management's ability tomaintain and expand customer relationships; management's ability to retain key officers and employees; the impact of legal and regulatoryproceedings or determinations; the effectiveness of methods of reducing risk exposures; the effects of terrorist activities and other hostilities; theeffects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes, fires, droughts and floods; changes in accountingstandards and the critical nature of Comerica's accounting policies. Comerica cautions that the foregoing list of factors is not exclusive. Fordiscussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and ExchangeCommission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the yearended December 31, 2014. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to updateforward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements aremade. For any forward-looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor forforward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 14

15 At the Heart of the Comerica Promise are our Core Values 16 ► Customer-centricity► Collaboration► Integrity► Excellence► Agility► Diversity► Involvement

2014 Financial Accomplishments At 12/31/14 ● 1Reflecting decreases of $48MM in litigation-related expenses and $47MM in pension expense. ● 2Through dividends and share repurchase program. Grew the Bottom Line Shareholder Return Controlling What We Can Control Focus on Relationships • 11% increase in EPS to $3.16• 10% increase in net income to $593MM • 5%, or $2.2B, increase in average loans to $46.6B• 6%, or $3.1B, increase in average deposits to $54.8B• $5MM increase in customer-driven fee income • 6%, or $96MM, decrease in noninterest expenses1• 5 bps of NCOs - Credit quality continued to be strong • 66% of net income, or $392MM, returned to shareholders2• 6% increase in tangible book value per share to $37.72 • Capital position continued to be solid 17 2014 Business Line Accomplishments 18 • Trusted Advisor program rollout to business bankers• New integrated solutions in Treasury Management• Agreement with Vantiv, Inc. for merchant services • Enhancements to Mobile Banking services• Rollout of the ‘banking center of the future’ concept• Introduction of Small Business Resource Center • Business Owner Advisory Services Group success• Professional Trust Alliance as source of fiduciary income Business Bank Wealth ManagementRetail Bank

TexasLargest U.S. Commercial Bank Headquartered in Texas At 3/31/15 Established presence: 1988 Acquired 21 banks in Texas from 1988 to 1995 and completed the acquisition of Sterling in July 2011 Moved headquarters to Dallas: 2007 Today, 135 banking centers in major metropolitan areas 7.7 9.6 10.0 11.0 2011 2012 2013 2014 7.8 10.0 10.2 10.8 2011 2012 2013 2014 Average Loans($ in billions) Average Deposits($ in billions) +42% +38 19 +10% +5% CaliforniaConsiderable Opportunities in Growth Industries At 3/31/15 11.8 12.7 14.0 15.4 2011 2012 2013 2014 12.7 14.6 14.7 16.1 2011 2012 2013 2014 Average Loans($ in billions) Average Deposits($ in billions) Established presence: 1991 Acquired 10 banks from 1991 to 2001 Today, 104 banking centers in major metropolitan areas +30% +27% 20 +10% +10%

MichiganMaintaining Leadership Position At 3/31/15 ● 1Source: FDIC June 2014 Established presence: 1849 #2 deposit market share in Michigan1 214 banking centers in major metropolitan areas 13.9 13.6 13.5 13.3 2011 2012 2013 2014 18.5 19.6 20.3 21.0 2011 2012 2013 2014 Average Loans($ in billions) Average Deposits($ in billions) -4% +13% 21 -1% +3% 19% 21% 23% 24% 28% 58% 53% 42%47% 79% 76% 66% 2011 2012 2013 2014 Dividends Share Repurchases Active Capital Management 1Outlook as of 4/17/15 ● 2See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures ●3Shares repurchased under equity repurchase program Shareholder Payout3($ in millions)2014 Capital Plan Completed: $236MM or 5MM shares repurchased 2Q14 through 1Q15 • $59MM or 1.4MM shares repurchased in 1Q Increased quarterly dividend to $0.20 per share in 2Q14 2015 Capital Plan Target1: Up to $393MM share repurchases over five quarters (2Q15 through 2Q16) Board to consider dividend increase to $0.21 at April 28th meeting Dividends Per Share Growth 0.40 0.55 0.68 0.79 2011 2012 2013 2014 +98% 3 $31.40 $33.36 $35.64 $37.72 2011 2012 2013 2014 Tangible Book Value Per Share2 22

Strong Commitment to Community 23 $8.5 Millioncontributed to not-for-profitorganizations in 2014 73,000+ Hoursvolunteered by employeesin 2014 Leader in Sustainability 24 516,825 Poundsof sensitive paper documents were securely destroyedand recycled at Texas Shred Day events in 2014

DiversityContinue to receivenational recognition 25

Q&A 27 Supplemental Financial DataReconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in millions) The tangible common equity ratio removes preferred stock and the effect of intangible assets from capital and the effect of intangible assets from total assets. Tangible common equity per share of common stock removes the effect of intangible assets from common shareholders equity per share of common stock.The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry. 28 12/31/14 12/31/13 12/31/12 12/31/11Common shareholders’ equityLess: GoodwillLess: Other intangible assets $7,40263515 $7,15063517 $6,93963522 $6,86563532Tangible common equity $6,752 $6,498 $6,282 $6,198Total assetsLess: GoodwillLess: Other intangible assets $69,19063515 $65,22463517 $65,06663522 $61,00563532Tangible assets $68,540 $64,572 $64,409 $60,338Common equity ratio 10.70% 10.97% 10.67% 11.26%Tangible common equity ratio 9.85 10.07 9.76 10.27 Common shareholders’ equity $7,402 $7,150 $6,939 $6,865Tangible common equity $6,752 $6,498 $6,282 $6,198Shares of common stock outstanding (in millions) 179 182 188 197 Common shareholders’ equity per share of common stock $41.35 $39.22 $36.86 $34.79Tangible common equity per share of common stock 37.72 35.64 33.36 31.40

Comerica Incorporated

2015 Annual Meeting of Shareholders

Remarks of

Ralph W. Babb Jr.

Chairman and CEO

Comerica Incorporated and Comerica Bank

(Slide 14)

Jon W. Bilstrom, Executive Vice President-Governance, Regulatory Relations and Legal Affairs, and Secretary:

Before our Chairman begins his remarks on Comerica's financial results, let me remind you that his presentation and remarks may contain forward-looking statements. In that regard, you should be mindful of the risks and uncertainties that can cause future results to vary from expectations. On screen, you can see our safe harbor statement, which identifies forward-looking statements and important factors that could cause actual results to differ materially from those in the forward-looking statements. Copies are available at the desk in the back of the room for anyone who would like them. Forward-looking statements that meet the Securities and Exchange Commission's criteria are protected against private litigation liability under the federal securities laws. Forward-looking statements speak only as of the date of this presentation and we undertake no obligation to update any forward-looking statements. Also, reconcilements of non-GAAP financial measures can be found in our most recent Annual Report, which is available on our website at www.comerica.com.

Ralph W. Babb, Jr., Chairman and CEO:

Good morning and thank you for joining us.

(Slide 15)

Throughout 2014 we remained focused on keeping our promise of providing a higher level of banking to our customers by serving as their trusted advisor and delivering an exceptional customer experience.

Our colleagues’ dedication to delivering on the Comerica Promise is reflected in the fourteen national and regional 2014 Greenwich Excellence Awards we received last month for Middle Market Banking and Small Business Banking.

(Slide 16)

Our core values shown here are at the heart of the Comerica Promise, which is aimed at raising expectations of what a bank can be.

These core values are ingrained in our culture. They help define who and what we are as an organization, and provide the foundation for our future success.

(Slide 17)

So, with this understanding of the core values that shape our Comerica Promise, I am pleased to provide an overview of some of our significant financial accomplishments in 2014 and first quarter 2015.

In 2014, we generated an 11 percent increase in earnings per share to $3.16, and increased net income 10 percent. The 10 percent increase in net income reflected lower litigation-related expenses, a decrease in pension expense, and our continued drive for efficiency.

Our focus on relationships drove an increase in average total loans of $2.2 billion, or 5 percent, to $46.6 billion, and helped us reach a record level of average deposits of $54.8 billion, with a $3.1 billion, or 6 percent, increase over 2013. We increased deposits in all business lines and all three of our major markets.

Loans continued to grow in the first quarter of 2015, with average loans up $790 million, or 2 percent, relative to the fourth quarter with growth across all of our markets. Average loan growth was driven by increases in Energy, Technology & Life Sciences, National Dealer Services, general Middle Market and Small Business.

Average deposits in the first quarter, compared to the fourth quarter, declined $770 million, or 1 percent, following the robust deposit growth we saw in the fourth quarter.

Customer-driven fee income increased by $5 million in 2014, largely driven by increases in fiduciary income and card fees, partially offset by a decrease in letter of credit fees.

Noninterest expenses decreased $96 million, or 6 percent, to $1.6 billion, compared to 2013, reflecting decreases of $48 million in litigation-related expenses and $47 million in pension expense.

As indicated in our earnings release, noninterest expenses decreased $3 million in the first quarter of 2015, excluding the change in accounting presentation for a card program, as we continued to have well-controlled expenses.

Credit quality remained very strong with only $25 million in net charge-offs, or 5 basis points of average loans. Net charge-offs remained low at $8 million, or 7 basis points, in the first quarter.

We returned $392 million, or 66 percent, of net income to shareholders through dividends and our equity repurchase program, through which we repurchased 5.2 million shares in 2014. We announced dividend increases of 12 percent and 5 percent, on January 1, 2014, and April 22, 2014, respectively.

Comerica continues to maintain a very strong capital position. Our regulatory capital levels remain comfortably above the threshold to be considered well capitalized.

Finally, we increased tangible common equity per share by 6 percent in 2014, to $37.72.

(Slide 18)

Here, you can see some of our business line accomplishments in 2014. We have highlighted those that impact our customers in a meaningful way.

Within our Business Bank, we strive to be strategic partners with our customers; we are their trusted advisors. Our tenured and experienced Business Bank colleagues provide for a consistent delivery of the promise we make to raise the expectations of what a bank can be.

Within the Treasury Management Services area of the Business Bank, we introduced a suite of new integrated solutions to help our customers be more efficient in managing their payables, receivables and cash flow.

In 2014, we also announced our agreement with Vantiv to provide payment processing solutions for our Merchant Services customers. With Vantiv, our Merchant Services customers are able to enjoy the convenience of accepting card payments utilizing the latest in technology, including advanced security products and reporting tools.

Within the Retail Bank, you can see some of our 2014 accomplishments. We have been investing in technology, not only for compliance-related projects, but because customers are increasingly using online means of accessing their accounts and conducting routine banking transactions.

For example, we invested in technology that enabled us to offer a number of enhancements to our consumer mobile banking service in 2014, including alerts, Click & Capture Deposit, person-to-person transfers, and a new, enhanced iPad application.

We piloted our “banking center of the future” concept with its many high tech features in Michigan and Arizona, and will pilot it here in North Texas later this year.

Also within our Retail Bank, we were pleased to introduce our Small Business Resource Center in 2014. The Center is a web-based informational space that brings together tools and resources for business owners, right at their fingertips. These materials and interactive components assist our Small Business customers in taking the right steps to grow and manage their businesses.

Wealth Management provides us the ability to bring private banking, investment management and fiduciary solutions to our Business Bank and Retail Bank customers.

A key strength of Comerica is working with business owners to address the needs of their businesses, as well as their personal wealth goals. Our Business Owner Advisory Services group within Wealth Management, partnering with the Business Bank, has had impressive results, bringing in some $1 billion in new balances in 2014, and nearly $2 billion since its inception in 2012.

Also within Wealth Management is our Professional Trust Alliance. We have agreements with third party broker-dealers to provide trust administration and investment monitoring for their clients. We continue to build this business, which has become a significant contributor to increasing our fiduciary income.

(Slide 19)

Our diverse footprint covers seven of the largest 10 cities in the country, as well as many just outside the top 10. And two of our primary markets – Texas and California – have the largest state economies in the nation. I’ll quickly review each of our three primary markets starting with our headquarters state of Texas.

As you know, we are the largest U.S. commercial bank headquartered in the state, which continues to be a source of great pride for us and our customers.

You can see here a brief snapshot of our presence in Texas, which started in 1988.

The relocation of our corporate headquarters to Dallas in 2007 remains an important part of our legacy in the state. In March, the Dallas Morning News indicated that the economic output of Texas exceeded $1.6 trillion in 2014, which is about the same output as Canada. And that Texas accounted for about one-third of all jobs created in the U.S. since 2005. These are impressive numbers which really show the breadth and scope of the Texas economy.

While the Texas economy is expected to grow in 2015, it is expected to be slower due to the volatility of the energy sector. The Federal Reserve Bank of Dallas expects growth of about 2.2 percent this year in Texas. Both the Fed and our own chief economist believe that the diversification of the Texas economy should help the state in moderating the impact of a slower energy sector.

The drop in oil and gas prices has resulted in a significant reduction in expenditures for oil field development, so we expect to see more evidence of the economic drag on Texas from lower oil prices in the months ahead and the Houston economy, in particular.

We have extensive knowledge of the energy industry, with a long history of managing a solid portfolio that has performed exceptionally well through a number of cycles.

Average loans in Texas were up 10 percent and deposits were up 5 percent in 2014, from 2013. In the first quarter, Texas average loans and deposits were both up 2 percent, relative to the fourth quarter.

(Slide 20)

Turning to our California market, you can see here that we have had a presence in the state since 1991, and have acquired 10 banks there over a decade, from 1991-2001. California is home to our Technology & Life Sciences business, Entertainment group and Financial Services Division, which is our title and escrow business.

Our expertise in these businesses and others help differentiate us from the competition in California. California also is the largest market for our National Dealer Services business – another industry in which we have accumulated years of experience.

Our most recent California economic index shows 10 straight months of growth. Jobs in California increased by 3.1 percent for the 12 months ending in February, according to the U.S. Bureau of Labor Statistics, outpacing the U.S. as a whole. The steady and strong performance of California has been a major benefit to the U.S. economy.

Our average loans and deposits in California in 2014 were both up 10 percent compared to 2013. And in the first quarter, average loans in California grew 3 percent, while average deposits declined, following very robust activity in the fourth quarter, while period-end deposits were up 5 percent from year-end.

(Slide 21)

Michigan continues to be an important market for Comerica. We have maintained our #2 deposit market share in the state, based on the most recent FDIC data. We continue to

benefit from our reputation as a steady, reliable main street bank, committed to the region.

We were proud to support the City of Detroit through our $1 million commitment to the grand bargain, which helped the city successfully emerge from bankruptcy, while supporting city pensioners and protecting the great works at the Detroit Institute of Arts.

Our most recent Michigan economic index shows three straight months of growth, indicating favorable economic conditions in the state.

Average loans in Michigan were relatively stable in 2014 compared to 2013, and average deposits increased 3 percent. Average loans and deposits in Michigan each increased 1 percent in the first quarter, relative to the fourth quarter.

(Slide 22)

As I previously mentioned, we completed our 2014 capital plan, which included the repurchase of 5.2 million shares under our equity repurchase program. When combined with the dividends paid, we returned 66 percent of 2014 net income to shareholders.

Our 2015 capital plan includes equity repurchases up to $393 million. The plan also includes a 1 cent, or 5 percent increase in Comerica’s quarterly dividend, to be considered by the board later today, as we continue to increase our dividend.

As you can see on the lower left chart, our tangible book value per share has been steadily increasing over the past several years as we continue to focus on creating long-term shareholder value.

(Slide 23)

At this time, I would like to update you on our strong focus on community, diversity and sustainability.

Our commitment to the community continued in 2014 as we provided more than $8.5 million to not-for-profit organizations in our markets. Our dedicated employees raised some $2.2 million for the United Way and Black United Fund, and donated their personal time with more than 73,000 hours spent helping to make a positive difference in the communities we serve. We also are engaged in our communities through service on non-profit boards.

(Slide 24)

Comerica continues to be recognized for its commitment to sustainability.

In 2014, we were listed for a second consecutive year on the CDP Carbon Performance Leadership Index, and were one of the top-ranked U.S. banks in the Newsweek Green Rankings, among other recognition of our sustainability program.

One initiative that showcased our commitment to community and sustainability was our community shred days, where Comerica helped individuals and businesses discard documents safely and sustainably.

(Slide 25)

Our focus on diversity continues to receive important national recognition.

We were once again ranked among the top five in the DiversityInc “Top 10 Regional Companies for Diversity.”

And LATINA Style Magazine recognized our bank, once again, as being among the “50 Best Companies for Latinas to Work for in the U.S.”

Comerica also earned a perfect rating of 100 percent on the Human Rights Campaign 2014 Corporate Equality Index, a national benchmarking survey and report on LGBT workplace equality.

(Slide 26)

In closing, we plan to stay with our relationship banking strategy, which has served us well for over 165 years.

We are in the right markets with the right products and services, and with the right people who remain focused on building long-lasting customer relationships.

(Slide 27)

Thank you. At this time, I would be happy to answer any of your questions.

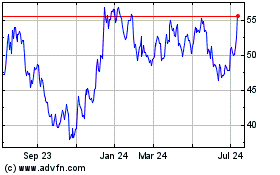

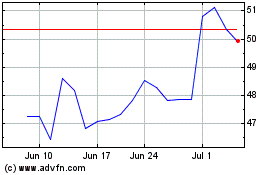

Comerica (NYSE:CMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comerica (NYSE:CMA)

Historical Stock Chart

From Apr 2023 to Apr 2024