UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of September 2015

Commission File Number: 1-14678

CANADIAN

IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

Commerce Court

Toronto,

Ontario

Canada M5L 1A2

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g 3-2(b) under the Securities Exchange Act of 1934: Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b):

THIS REPORT ON FORM 6-K AND THE

EXHIBITS HERETO SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE AS EXHIBITS TO CANADIAN IMPERIAL BANK OF COMMERCE’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-202584) AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS

FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

Exhibits are filed herewith in connection with the issuance by Canadian Imperial Bank of Commerce

(the “Bank”) of certain of its Senior Global Medium-Term Notes (Structured Notes) (the “Notes”) following the date of this report on Form 6-K, pursuant to the Bank’s shelf registration statement on Form F-3 (File

No. 333-202584):

EXHIBITS

|

|

|

| Exhibit |

|

Description of Exhibit |

|

|

| 5.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to the validity of the Notes under New York law. |

|

|

| 5.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters under Canadian and Ontario law. |

|

|

| 8.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to certain matters of United States federal income taxation. |

|

|

| 8.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters of Canadian federal income taxation. |

|

|

| 23.1 |

|

Consent of Mayer Brown LLP (included in Exhibits 5.1 and 8.1 above). |

|

|

| 23.2 |

|

Consent of Blake, Cassels & Graydon LLP (included in Exhibits 5.2 and 8.2 above). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

|

|

|

| Date: October 2, 2015 |

|

|

|

|

|

|

|

|

|

By: |

|

/s/ David G. Dickinson |

|

|

Name: |

|

David G. Dickinson |

|

|

Title: |

|

Vice-President, Unsecured Funding, Treasury |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description of Exhibit |

|

|

| 5.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to the validity of the Notes under New York law. |

|

|

| 5.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters under Canadian and Ontario law. |

|

|

| 8.1 |

|

Opinion of Mayer Brown LLP, U.S. counsel for the Bank, as to certain matters of United States federal income taxation. |

|

|

| 8.2 |

|

Opinion of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, as to certain matters of Canadian federal income taxation. |

|

|

| 23.1 |

|

Consent of Mayer Brown LLP (included in Exhibits 5.1 and 8.1 above). |

|

|

| 23.2 |

|

Consent of Blake, Cassels & Graydon LLP (included in Exhibits 5.2 and 8.2 above). |

Exhibit 5.1

|

|

|

| October 2, 2015 |

|

Mayer Brown LLP 71 South Wacker Drive Chicago, Illinois 60606

Main Tel (312) 782-0600 Main Fax (312) 701-7711

www.mayerbrown.com |

Canadian Imperial Bank of Commerce

Commerce Court

Toronto, Ontario

Canada M5L1A2

| |

Re: |

Canadian Imperial Bank of Commerce |

Registration Statement on Form F-3

Dear Sirs:

We have represented Canadian

Imperial Bank of Commerce, a bank organized under the Bank Act (Canada) (the “Bank”), in connection with the registration of U.S.$2,000,000,000 aggregate principal amount of debt securities of the Bank (the “Notes”), under a

Registration Statement on Form F-3, file number 333-202584 (the “Registration Statement”), under the Securities Act of 1933, as amended (the “Act”). The Notes are to be issued under an indenture, dated as of September 15,

2012 (the “Indenture”), between the Bank and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”). Certain terms of the Notes will be established by or pursuant to resolutions of the Bank’s Board of Directors

(the “Corporate Proceedings”).

In connection with our representation, we have examined the corporate records of the Bank,

including its bye-laws and other corporate records and documents and have made such other examinations as we consider necessary to render this opinion. In rendering this opinion, we have assumed the genuineness of all signatures, the authenticity of

all documents submitted to us as originals and the conformity to authentic original documents of all documents submitted to us as copies. Based upon the foregoing, it is our opinion that:

(i) assuming that the Indenture has been duly authorized, executed and delivered by the Bank and the Trustee, the Indenture constitutes a

valid and binding obligation of the Bank enforceable against the Bank in accordance with its terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, and subject to general principles of equity

(regardless of whether enforcement is sought in a proceeding in equity or at law); and

Mayer Brown LLP operates in combination with other

Mayer Brown entities with offices in Europe and Asia

and is associated with Tauil & Chequer Advogados, a Brazilian law

partnership.

CIBC

October 2, 2015

Page 2

(ii) assuming that the Corporate Proceedings have been completed and that the Notes have been duly authorized, executed and delivered by the

Bank, authenticated by the Trustee in accordance with the terms of the Indenture and paid for by the purchasers thereof, the Notes will constitute valid and binding obligations of the Bank entitled to the benefits of the Indenture.

We are admitted to practice in the States of Illinois and New York and our opinions expressed herein are limited solely to the Federal laws of

the United States of America and the laws of the States of Illinois and New York, and we express no opinion herein concerning the laws of any other jurisdiction. With respect to all matters of the laws of Canada and Ontario, we understand that you

are relying upon the opinion, dated the date hereof, of Blake, Cassels & Graydon LLP, Canadian counsel for the Bank, and our opinion is subject to the same assumptions, qualifications and limitations with respect to such matters as are

contained in such opinion of Blake, Cassels & Graydon LLP.

In rendering the foregoing opinion, we are not passing upon, and

assume no responsibility for, any disclosure in the Registration Statement or any related prospectus or other offering material regarding the Bank or the Notes or their offering and sale.

The opinions and statements expressed herein are as of the date hereof. We assume no obligation to update or supplement this opinion letter to

reflect any facts or circumstances that may hereafter come to our attention or any changes in applicable law which may hereafter occur.

If a pricing supplement relating to the offer and sale of any particular Notes is prepared and filed by the Bank with the Securities and

Exchange Commission on a future date and the pricing supplement contains a reference to this firm and our opinion substantially in the form set forth below, the consent set forth below shall apply to the reference to us and our opinion in

substantially the following form:

In the opinion of Mayer Brown LLP, when the Notes have been duly completed in accordance with the

Indenture and issued and sold as contemplated by the prospectus supplement and the prospectus, the Notes will constitute valid and binding obligations of the Bank, entitled to the benefits of the Indenture, subject to bankruptcy, insolvency,

fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles. This opinion is given as of the date hereof and is limited to the laws of the

State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and such counsel’s reliance on the Bank and other sources as to certain factual matters, all as

stated in the legal opinion dated October 2, 2015, which has been filed as Exhibit 5.1 to the Bank’s Form 6-K filed on October 2, 2015.

CIBC

October 2, 2015

Page 3

We hereby consent to the filing of this opinion as an exhibit to a Form 6-K to be incorporated by reference in the Registration Statement and

to all references to this firm in such Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

Very truly yours,

/s/ Mayer Brown LLP

Exhibit 5.2

|

|

|

|

|

|

Blake, Cassels & Graydon LLP

Barristers & Solicitors Patent

& Trade-mark Agents 199 Bay Street

Suite 4000, Commerce Court West

Toronto ON M5L 1A9 Canada Tel:

416-863-2400 Fax: 416-863-2653 |

October 2, 2015

Reference: 2105/152

Canadian Imperial Bank of

Commerce

Commerce Court

Toronto, Ontario, Canada M5L 1A2

| Re: |

Canadian Imperial Bank of Commerce |

Issue of U.S.$2,000,000,000 Aggregate Principal

Amount of

Senior Debt Securities

Dear Sirs/Mesdames:

We have acted as Canadian counsel to Canadian Imperial Bank of Commerce (the “Bank”) in connection with the registration under

the U.S. Securities Act of 1933 (the “Act”) of U.S.$2,000,000,000 (or equivalent thereof in other currencies) aggregate amount of senior debt securities (the “Securities”) to be issued pursuant to an indenture dated

as of September 15, 2012 (the “Indenture”) between the Bank and Deutsche Bank Trust Company Americas, as trustee.

We have participated, together with Mayer Brown LLP, United States counsel to the Bank in the preparation of, or have reviewed, the following:

| |

(ii) |

the registration statement of the Bank on Form F-3 (No. 333-202584) dated April 30, 2015 (the “Registration Statement”); |

| |

(iii) |

the prospectus of the Bank dated April 30, 2015 included in the Registration Statement (the “Prospectus”); and |

| |

(iv) |

the prospectus supplement to the Prospectus dated April 30, 2015 (the “Prospectus Supplement”, and together with the Prospectus, the “Program Prospectus”). |

We understand that the Registration Statement and the Program Prospectus were filed with the United States Securities and Exchange

Commission (the “Commission”) in connection with the Securities and that one or more pricing supplements relating to the applicable Securities (the “Pricing Supplements” and, each a “Pricing

Supplement”) will be filed with the Commission in connection with the Securities.

For the purposes of our opinions below,

we have examined such statutes, public and corporate records, opinions, certificates and other documents, and considered such questions of law, as we have considered relevant and necessary as a basis for the opinions hereinafter set forth. In such

examination we have assumed the genuineness of all signatures and the authenticity of all documents submitted to us as originals, and the conformity to original documents of all documents submitted to us as certified or photostatic copies, in

portable document format or facsimiles.

|

|

|

|

|

Page

2

|

For the

purposes of the opinions expressed herein, we have, without independent investigation or verification, assumed that the Indenture has been duly authorized, executed and delivered by, and constitutes, a legal, valid and binding obligation of, each

party thereto other than the Bank.

The opinions contained herein are limited to matters governed by the laws of the Province of Ontario

and the federal laws of Canada applicable therein. Such opinions are expressed with respect to the laws of the Province of Ontario in effect on the date of this opinion and we do not accept any responsibility to take into account or inform the

addressees, or any other person authorized to rely on this opinion, of any changes in law, facts or other developments subsequent to this date that do or may affect the opinions we express, nor do we have any obligation to advise you of any other

change in any matter addressed in this opinion or to consider whether it would be appropriate for any other person other than the addressees to rely on our opinion.

With respect to the amalgamation and governance of the Bank as a Schedule I bank under the Bank Act (Canada) (the “Bank

Act”) referred to in paragraph 1 below, we have relied, without independent investigation or verification, exclusively upon a Certificate of Confirmation dated September 30, 2015 issued by the Office of the Superintendent of Financial

Institutions and a certificate of the Vice President, Corporate Secretary and Associate General Counsel of the Bank dated September 30, 2015 (the “Secretary’s Certificate”), which we have assumed continues to be accurate

on the date hereof.

For the purposes of expressing the opinions set forth below we have also relied on the Secretary’s Certificate

as to certain factual matters which we have not independently verified.

In expressing the opinion set forth in paragraph 2 below, we have

assumed that the Securities will be issued in accordance with the provisions of the February 25, 2015 resolutions of the Board of Directors of the Bank attached as an exhibit to the Secretary’s Certificate and that such resolutions will

not have been modified, repealed or superseded prior to the date of the issuance of any of the Securities in any way that would affect the substance of such opinion.

We express no opinion with respect to:

| |

(a) |

the effect of any provision of the Indenture which purports to allow the severance of invalid, illegal or unenforceable provisions or restrict their effect; |

| |

(b) |

the validity, binding nature or enforceability of any provision of the Indenture which suggests that modifications, amendments or waivers that are not in writing will not be effective; |

| |

(c) |

the enforceability of any provision of the Indenture that purports to waive or limit rights or defences of a party; |

| |

(d) |

the enforceability of, nor as to the manner in which a court in the Province of Ontario would interpret and apply any provision which refers to, incorporates by reference or requires compliance with, any law, statute,

rule or regulation of any jurisdiction other than Ontario, British Columbia, Alberta, Québec and/or Canada; |

|

|

|

|

|

Page

3

|

| |

(e) |

the effectiveness of provisions which purport to relieve a person from a liability, obligation or duty otherwise owed or required by law; and |

| |

(f) |

the availability of any equitable remedy, including those of specific performance and injunction, which remedies are only available in the discretion of a court of competent jurisdiction and/or authority.

|

Based and relying upon and subject to the qualifications set forth herein, we are of the opinion that:

| 1. |

The Bank is a bank amalgamated under and governed by the Bank Act and has the corporate power to execute, deliver and perform its obligations under the Indenture, and has the corporate power to create, issue, sell and

deliver the Securities; |

| 2. |

when the creation, issuance and sale of a particular issuance of Securities have been duly authorized by all necessary corporate action of the Bank, and when such Securities have been duly executed, authenticated and

issued in accordance with the Indenture, as applicable, and delivered against payment therefor, such Securities will be validly issued and to the extent validity of such Securities is a matter governed by the laws of the Province of Ontario or the

federal laws of Canada applicable therein, will be valid and binding obligations of the Bank enforceable in accordance with their terms; |

| 3. |

the Indenture has been duly authorized by the Bank and to the extent execution and delivery are matters governed by the laws of the Province of Ontario or the federal laws of Canada applicable therein, the Indenture,

with respect to the provisions thereof governed by the laws of the Province of Ontario and the federal laws of Canada applicable therein, constitutes a legal, valid and binding obligation of the Bank enforceable in accordance with its terms; and

|

| 4. |

The statements in the Prospectus included in the Registration Statement under the heading “Limitations on Enforcement of U.S. Laws Against CIBC, Its Management and Others” insofar as such

statements constitute statements of Canadian federal or Ontario law, have been reviewed by us and fairly summarize the matters described therein and are accurate in all material respects. |

The opinions set forth in paragraph 3 above as to the enforceability of the Indenture are subject to and may be limited by the following

qualifications:

| |

(i) |

general principals of principles of equity, including the principle of granting equitable remedies such as specific performance and injunctive relief, are subject to the discretion exercisable by a court of competent

authority and/or jurisdiction; |

| |

(ii) |

enforceability may be limited by bankruptcy, insolvency, winding-up, liquidation or other similar laws of general application affecting the enforcement of creditors’ rights generally (including the provisions of

the Bank Act respecting such matters); |

|

|

|

|

|

Page

4

|

| |

(iii) |

the enforcement of any rights against the Bank under the Indenture with respect to indemnity or contribution may be limited by applicable law and may not be ordered by a court on the grounds of public policy and may,

therefore, not be available in any particular instance; |

| |

(iv) |

a court in the Province of Ontario may decline to enforce provisions in any document which purport to allow a determination, calculation or certificate of a party thereto as to any matter provided for therein to be

final, conclusive or binding upon any other party thereto if such determination is found to be inaccurate on its face or to have been reached or made on any arbitrary or fraudulent; |

| |

(v) |

enforceability of the Indenture or a provision of the Indenture may be subject to the provisions of the Limitations Act, 2002 (Ontario), and we express no opinion as to whether a court may find any provision of

the Indenture to be unenforceable on the basis that such provision is an attempt to vary or exclude a limitation period under such Act; and |

| |

(vi) |

pursuant to the Currency Act (Canada), a judgment by a court in any province in Canada may be awarded in Canadian currency only and such judgment may be based on a rate of exchange which may be the rate in

existence on a day other than the day of payment of such judgment. |

The opinions expressed herein are provided solely for

the benefit of the addressees in connection with the filing of the Registration Statement with the Commission and are not to be transmitted to any other person, nor are they to be relied upon by an other person or for any other purpose or referred

to in any public document or filed with any government agency or other person without our prior express consent. The opinions expressed herein may be relied upon by Mayer Brown LLP for the purposes of its opinion addressed to the Bank with respect

to the subject matter hereof.

If a Pricing Supplement relating to the offer and sale of particular Securities is prepared and filed by

the Bank with the Commission on a date after the date hereof and such Pricing Supplement contains a reference to Blake, Cassels & Graydon LLP and our opinion substantially in the form set forth below, the consent set forth below shall apply

to the reference to us and our opinion in substantially the following form:

In the opinion of Blake, Cassels & Graydon LLP, as

Canadian counsel to the Bank, the issue and sale of the Securities has been duly authorized by all necessary corporate action of the Bank in conformity with the Indenture, and when the Securities have been duly executed, authenticated and issued in

accordance with the Indenture, the Securities will be validly issued and, to the extent validity of the Securities is a matter governed by the laws of the Province of Ontario or the laws of Canada applicable therein, and will be valid obligations of

the Bank, subject to applicable bankruptcy, insolvency and other laws of general application affecting creditors’ rights, equitable principles, and subject to limitations as to the currency in which judgments in Canada may be rendered, as

prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to the laws of the Province of Ontario and the federal laws of Canada applicable thereto. In addition, this opinion is subject to customary

assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signature, and to

|

|

|

|

|

Page

5

|

such counsel’s

reliance on the Bank and other sources as to certain factual matters, all as stated in the opinion letter of such counsel dated October 2, 2015, which has been filed as Exhibit 5.2 to the Bank’s Form 6-K filed with the SEC on

October 2, 2015.

We hereby consent to this filing of this opinion as an exhibit to a Form 6-K to be incorporated by reference in the

Registration Statement and to the references to us under the headings “Limitations on Enforcement of U.S. Laws Against CIBC, Its Management and Others” and “Legal Matters” in the Prospectus. In giving such consent,

we do not thereby admit that we come within the category of persons whose consent is required by the Act or the rules and regulations promulgated thereunder.

Yours very truly,

/s/ Blake, Cassels & Graydon LLP

Exhibit 8.1

|

|

|

| October 2, 2015 |

|

Mayer Brown LLP

71 South Wacker Drive

Chicago, Illinois 60606

Main Tel (312) 782-0600

Main Fax (312) 701-7711

www.mayerbrown.com |

Canadian Imperial Bank of Commerce

Commerce Court

Toronto, Ontario

Canada M5L1A2

| |

Re: |

Canadian Imperial Bank of Commerce |

Registration Statement on Form F-3

Dear Sirs:

We have represented Canadian

Imperial Bank of Commerce, a bank organized under the Bank Act (Canada) (the “Bank”), in connection with the registration of U.S.$2,000,000,000 aggregate principal amount of debt securities of the Bank (the “Notes”), under a

Registration Statement on Form F-3, file number 333-202584 (the “Registration Statement”), under the Securities Act of 1933, as amended (the “Act”). The Notes are to be issued under an indenture, dated as of September 15,

2012 (the “Indenture”), between the Bank and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”).

We

have reviewed the discussion set forth under the heading “Certain Income Tax Consequences—United States Taxation” (the “Discussion”) in the prospectus supplement dated April 30, 2015. The statements in the Discussion

constitute our opinion with respect to the material United States federal income tax consequences of the purchase, ownership and disposition of the Notes, subject to the qualifications and limitations set forth in such discussion. It is possible

that contrary positions may be taken by the Internal Revenue Service and that a court may agree with such contrary positions.

The

opinions and statements expressed herein are as of the date hereof. Any change in applicable laws or facts and circumstances surrounding the transaction, or any inaccuracy in the statements, facts assumptions or representations upon which we have

relied, may affect the continuing validity of our opinion as set forth herein. We assume no obligation to update or supplement this opinion letter to reflect any facts or circumstances that may hereafter come to our attention or any changes in

applicable law which may hereafter occur.

Mayer Brown LLP operates in combination with other Mayer Brown entities with offices in Europe

and Asia

and is associated with Tauil & Chequer Advogados, a Brazilian law partnership.

CIBC

October 2, 2015

Page 2

We hereby consent to the filing of this opinion as an exhibit to a Form

6-K to be incorporated by reference in the Registration Statement and to any reference to us, in our capacity as special U.S. tax counsel to the Bank, or any opinion of ours delivered in that capacity in a product supplement, product prospectus

supplement, pricing supplement or similar document relating to the offer and sale of any particular Note or Notes prepared and filed by the Bank with the Securities and Exchange Commission on this date or a future date. In giving this consent, we do

not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act.

Very truly yours,

/s/ Mayer Brown LLP

Exhibit 8.2

|

|

|

|

|

|

Blake, Cassels & Graydon LLP

Barristers & Solicitors Patent

& Trade-mark Agents 199 Bay Street

Suite 4000, Commerce Court West

Toronto ON M5L 1A9 Canada Tel:

416-863-2400 Fax: 416-863-2653 |

October 2, 2015

Canadian

Imperial Bank of Commerce

Commerce Court

Toronto, Ontario,

Canada M5L 1A2

| RE: |

Canadian Imperial Bank of Commerce |

Issue of U.S.$2,000,000,000 of Senior Global

Medium Term Notes

Ladies and Gentlemen:

We have acted

as Canadian special counsel to Canadian Imperial Bank of Commerce (the “Bank”) in connection with the registration under the U.S. Securities Act of 1933 (the “Act”) of U.S.$2,000,000,000 (or equivalent thereof in

other currencies) aggregate amount of senior debt securities (the “Notes”) to be issued pursuant to the Prospectus Supplement dated April 30, 2015 (the “Prospectus Supplement”) and the Prospectus dated

April 30, 2015 contained in the Registration Statement on Form F-3, File No. 333-202584 (the “Registration Statement”). We hereby confirm to you that the statements set forth under the heading “Certain Canadian

Income Tax Consequences” in the Prospectus Supplement constitute our opinion as of the date hereof with respect to the principal Canadian federal income tax considerations generally applicable to holders of Notes described therein, subject

to the qualifications, assumptions, limitations and understandings set out therein and subject to any superseding statements which may be included in our opinion included in any pricing supplement issued by the Bank in connection with a particular

offering of Notes.

We hereby consent to the filing of this opinion as an exhibit to a Form 6-K of the Bank filed with the Securities and

Exchange Commission and thereby incorporated by reference into the Bank’s Registration Statement. In giving such consent, we do not admit that we are within the category of persons whose consent is required under Section 7 of the

Securities Act of 1933, as amended, or the rules and regulations promulgated thereunder.

Very truly yours,

/s/ Blake, Cassels & Graydon LLP

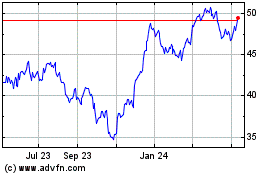

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

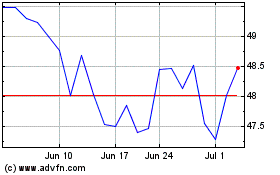

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024