Report of Foreign Issuer (6-k)

August 27 2015 - 9:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

| For the month of August, 2015 |

Commission File Number: 1-14678 |

CANADIAN IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into

English)

Commerce Court

Toronto, Ontario

Canada M5L 1A2

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ______

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

_____

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g 3-2(b) under the Securities Exchange Act of 1934:

If yes is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g 3-2(b): _____

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

| |

CANADIAN IMPERIAL BANK OF COMMERCE |

| |

|

|

|

| |

|

|

|

| Date: August

27, 2015 |

By: |

/s/ Stephen Forbes |

|

| |

Name: |

Stephen Forbes |

|

| |

Title: |

Executive Vice-President |

|

Exhibits

| Exhibits |

|

Description |

| |

|

|

| 99.1 |

|

News Release Dated August 27, 2015 - CIBC Announces New Normal Course Issuer Bid |

Exhibit 99.1

CIBC Announces New Normal Course Issuer Bid

TORONTO, Aug. 27, 2015 /CNW/ - CIBC (TSX: CM) (NYSE:

CM) today announced its intention to seek Toronto Stock Exchange (TSX) approval for a normal course issuer bid. Purchases of common

shares for cancellation will be made subject to CIBC's ongoing capital requirements. Such purchases will not exceed eight million

common shares, or approximately 2% of its outstanding common shares over a 12 month period.

CIBC will file a notice of intention to make a normal course

issuer bid with the TSX and this bid would commence following TSX acceptance of this notice and continue for up to one year.

Purchases would be made through the facilities of the TSX,

alternative Canadian trading systems or the New York Stock Exchange, in accordance with applicable regulatory requirements. CIBC

intends to periodically establish an automatic program under which its broker, CIBC World Markets Inc., would repurchase CIBC shares

pursuant to the bid within a defined set of criteria which CIBC would not vary. The price paid for the common shares will

be the market price at the time of the purchase. The common shares repurchased under the normal course issuer bid will be cancelled.

Between September 18, 2014 and August 26, 2015, CIBC did not

purchase any of its common shares for cancellation pursuant to its current normal course issuer bid.

A NOTE ABOUT FORWARD-LOOKING STATEMENTS: From time to time,

we make written or oral forward-looking statements within the meaning of certain securities laws, including in this press release

report, in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission and in other communications.

These statements include, but are not limited to, statements about our potential normal course issuer bid purchases and about our

financial condition, priorities, targets, ongoing objectives, strategies and outlook. Forward-looking statements are subject to

inherent risks and uncertainties that may be general or specific. A variety of factors, many of which are beyond our control, could

cause actual results to differ materially from the expectations expressed in any of our forward-looking statements, including general

business and economic conditions worldwide; amendments to, and interpretations of, risk-based capital guidelines; and changes in

monetary and economic policy. We do not undertake to update any forward-looking statement except as required by law.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking and business clients. Through our

three major business units - Retail and Business Banking, Wealth Management and Wholesale Banking - CIBC offers a full range of

products and services through its comprehensive electronic banking network, branches and offices across Canada with offices in

the United States and around the world. You can find other news releases and information about CIBC in our Media Centre on our

corporate website at www.cibc.com/ca/media-centre/.

SOURCE CIBC - Investor Relations

%CIK: 0001045520

For further information:

Erica Belling, Director, Investor & Financial Communications,

(416) 594-7251 or erica.belling@cibc.com.

CO: CIBC - Investor Relations

CNW 05:49e 27-AUG-15

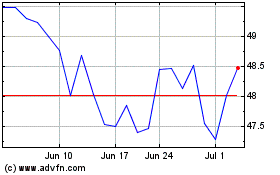

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Aug 2024 to Sep 2024

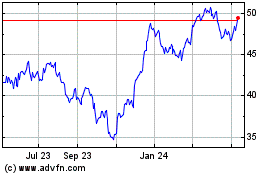

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Sep 2023 to Sep 2024