Report of Foreign Issuer (6-k)

July 20 2015 - 3:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of July 2015

Commission File

Number: 1-14678

CANADIAN IMPERIAL BANK OF COMMERCE

(Translation of registrant’s name into English)

Commerce Court,

Toronto, Ontario, Canada M5L 1A2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1): ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant

to Rule 12g 3-2(b) under the Securities Exchange Act of 1934:

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto

duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CANADIAN IMPERIAL BANK OF COMMERCE |

|

|

|

|

| Date: July 20, 2015 |

|

|

|

By: |

|

/s/ Michelle Caturay |

|

|

|

|

Name: |

|

Michelle Caturay |

|

|

|

|

Title: |

|

Vice-President, Corporate Secretary and Associate General

Counsel |

Table of Contents

CIBC Board Mandate

Exhibit 99.1

|

|

|

|

|

Canadian Imperial Bank of Commerce

Board of Directors Mandate |

| (1) |

The members of the Board of Directors have the duty to supervise the management of the business and affairs of CIBC. The Board, directly and through its committees and the Chair of the Board, provides direction to

management, generally through the Chief Executive Officer, to pursue the best interests of CIBC. |

| 2. |

MEMBERSHIP, ORGANIZATION AND MEETINGS |

| (1) |

General — The composition and organization of the Board, including the number, qualifications and remuneration of directors, the number of Board meetings, Canadian residency requirements, quorum

requirements, meeting procedures and notices of meetings are as established by the Bank Act (Canada) and the by-laws of CIBC. |

| (2) |

Meeting Attendance and Preparation — Members of the Board are expected to attend meetings of the Board and any Board committees of which the directors are a member and to review related meeting

materials in advance, in accordance with policies established by the Board. |

| (3) |

Independence — The Board shall establish independence standards for the directors, and, at least annually, shall determine the independence of each director in accordance with these standards. A

majority of the directors shall be independent in accordance with these standards. |

| (4) |

Access to Management and Outside Advisors — The Board shall have unrestricted access to management and employees of CIBC. The Board shall have the authority to retain and terminate external legal

counsel, consultants or other advisors to assist it in fulfilling its responsibilities and to set and pay the compensation of these advisors without consulting or obtaining the approval of any officer of CIBC. CIBC shall provide appropriate funding,

as determined by the Board, for the services of these advisors. |

| (5) |

Secretary and Minutes — The Corporate Secretary, his or her designate or any other person the Board requests, shall act as secretary of Board meetings. Minutes of Board meetings shall be recorded and

maintained by the Corporate Secretary and subsequently presented to the Board for approval. |

| (6) |

Meetings Without Management — The Board shall hold unscheduled or regularly scheduled meetings, or portions of regularly scheduled meetings, at which management is not present. |

| 3. |

ACCOUNTABILITIES AND RESPONSIBILITIES |

The Board shall have the accountabilities and

responsibilities set out below. In addition to these accountabilities and responsibilities, the Board shall perform such duties as may be required by the Bank Act (Canada), requirements of the stock exchanges on which the securities of CIBC

are listed and all other applicable laws.

| |

(a) |

Strategic Plans — The Board shall oversee the development of CIBC’s strategic direction, process, plan and priorities. At least annually, the Board shall review and, if advisable, approve

management’s strategic plan. In discharging this responsibility, the Board shall review management’s recommendation for CIBC’s risk appetite and the alignment of the strategic plan with this risk appetite. The Board shall also review

emerging trends, the competitive environment, and their potential impact on CIBC’s risk profile, as well as significant business practices and products. |

1

Canadian Imperial Bank of Commerce

Board of Directors Mandate

| |

(b) |

Financial and Capital Plans — The Board shall review and, if advisable, approve CIBC’s annual financial and capital plans and, with the assistance of the Risk Management Committee, capital policies. In

discharging this responsibility, the Board shall review and, if advisable, approve policies recommended by management on the authorization of legal capital, major investments and significant allocation of capital. |

| |

(c) |

Monitoring — On a regular basis the Board shall review and approve strategic benchmarks, management’s implementation of CIBC’s strategy against those benchmarks, and management’s

implementation of CIBC’s financial and capital plans. The Board shall review and, if advisable, approve any material amendments to, or variances from, these plans. |

| |

(a) |

Risk Appetite — At least annually, the Board shall, with the assistance of the Risk Management Committee, review, and if advisable, approve CIBC’s total bank risk appetite statement. On a regular basis,

the Board shall review, with the assistance of the Risk Management Committee, management’s assessment of risk profile and performance of the Bank relative to the risk appetite. |

| |

(b) |

Identification of Risks — At least annually, the Board shall, with the assistance of the Risk Management Committee or Audit Committee, as applicable, review reports provided by management of material risks

associated with CIBC’s businesses and operations, review the implementation by management of systems to manage these risks and review reports by management relating to the operation of, and any material deficiencies in, these systems.

|

| |

(c) |

Verification of Controls — The Board shall, with the assistance of the Risk Management Committee or Audit Committee, as applicable, verify that internal, financial, non-financial and business control and

information systems have been established by management and that CIBC is applying appropriate standards of corporate conduct for these controls. |

| |

(d) |

Credit and Investment Delegation — At least annually, the Board shall, with the assistance of the Risk Management Committee, review and, if advisable, approve a resolution regarding the delegation of certain

credit approvals and investment authority to management. |

| (3) |

Human Resource Management |

| |

(a) |

General — At least annually, the Board shall, with the assistance of the Management Resources and Compensation Committee, review CIBC’s approach to human resource management and executive compensation.

|

| |

(b) |

Chief Executive Officer — The Board shall review and, if advisable, approve the appointment or removal of CIBC’s Chief Executive Officer. |

| |

(c) |

Succession Review — At least annually, the Board shall, with the assistance of the Corporate Governance Committee and the Management Resources and Compensation Committee, as applicable, review the Chair of

the Board, the Chief Executive Officer and the management succession planning process of CIBC (including talent management and leadership development). |

2

Canadian Imperial Bank of Commerce

Board of Directors Mandate

| |

(d) |

Integrity of Management — The Board shall, to the extent feasible, satisfy itself as to the integrity of the Chief Executive Officer and other management and that the Chief Executive Officer and other

management strive to create a culture of integrity throughout CIBC. |

| |

(a) |

General — At least annually, the Board shall, with the assistance of the Corporate Governance Committee, review CIBC’s approach to corporate governance, including the governance principles and

guidelines applicable to CIBC. |

| |

(b) |

Director Independence — At least annually, the Board shall, with the assistance of the Corporate Governance Committee, evaluate the director independence standards established by the Board and the ability of

each director to act independently from management in fulfilling its duties. |

| |

(c) |

Ethics Reporting — At least annually, the Board shall, with the assistance of the Corporate Governance Committee and the Risk Management Committee, as applicable, review reports provided by management on

compliance with, or material deficiencies of policies relating to employee conduct, ethics and reputation and legal risks and approve changes it considers appropriate. |

| |

(d) |

Organizational Change — The Board shall review and, if advisable, approve any significant changes to CIBC’s organization structure, controls or the independence of key control groups, if such a review

was not conducted by (or approval obtained from) a committee of the Board. |

| (5) |

Financial Information |

| |

(a) |

General — At least annually, the Board shall, with the assistance of the Audit Committee, review CIBC’s internal controls relating to financial information and reports provided by management on material

deficiencies in, or material changes to, these controls. |

| |

(b) |

Integrity of Financial Information — The Board shall, with the assistance of the Audit Committee, review the integrity of CIBC’s financial information and systems, the effectiveness of internal controls

and management’s assertion on internal control and disclosure control procedures. |

| |

(a) |

General — At least annually, the Board shall review CIBC’s overall communications strategy, including measures for receiving feedback from CIBC shareholders. |

| |

(b) |

Disclosure Policy — At least annually, with the assistance of the Corporate Governance Committee the Board shall, if advisable, approve material changes to CIBC’s disclosure policies. |

| |

(c) |

Board Communication — The Board shall review and approve a communication framework between the Board and its stakeholders which discloses a contact to receive feedback from stakeholders to the Board.

|

| (7) |

Committees of the Board |

| |

(a) |

Board Committees — The Board has established the following committees of the Board: the Management Resources and Compensation Committee; the Audit Committee; the Risk Management Committee; and the Corporate

Governance Committee (which is also responsible for the duties of a Conduct Review Committee under the Bank Act (Canada)). Subject to applicable law, the Board may establish other Board committees or merge or dispose of any Board committee.

|

3

Canadian Imperial Bank of Commerce

Board of Directors Mandate

| |

(b) |

Committee Mandates — The Board has approved mandates for each Board committee, and shall approve mandates for each new Board committee. At least annually, each mandate shall be reviewed, and, based on

recommendations of the Corporate Governance Committee and the Chair of the Board, as applicable, approved by the Board. |

| |

(c) |

Delegation to Committees — The Board has delegated for approval or review the matters set out in each Board committee’s mandate to that committee. |

| |

(d) |

Consideration of Committee Recommendations — As required, the Board shall consider for approval the specific matters delegated for review to Board committees. |

| |

(e) |

Board/Committee Communication — To foster effective communication between the Board and each Board committee, each committee chair shall provide a report to the Board on material matters considered by the

committee at the first Board meeting after the committee’s meeting. To foster effective communication between each Board committee, the chair or another member of each committee may be a member of the Corporate Governance Committee.

|

| (8) |

Regulators — The Board shall consider reports from management, as required, on material developments in CIBC’s relationship with its regulators. At least annually, the Board shall meet with

CIBC’s primary regulator, the Office of the Superintendent of Financial Institutions. |

| 4. |

DIRECTOR DEVELOPMENT AND EVALUATION |

| (1) |

Each new director shall participate in CIBC’s orientation program and each director shall participate in CIBC’s continuing director development programs. |

| (2) |

At least annually, with the assistance of the Corporate Governance Committee, the Board shall evaluate and review the performance of the Board, each of its committees, each of the directors and the adequacy of this

mandate. |

| 5. |

CURRENCY OF THE BOARD MANDATE |

| |

This |

mandate was last revised and approved by the Board on May 28, 2015 |

4

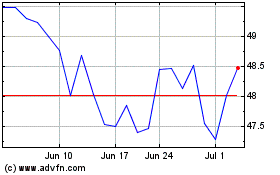

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

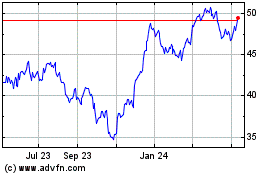

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024