CORRECT:DNB Offers $2 Billion Deal As Covered Bond Market Shatters Record

March 22 2011 - 4:18PM

Dow Jones News

First came the Canadians. Now, issuers from France, Sweden and

Norway are selling covered bonds in the U.S., making 2011 the

busiest first quarter on record for these mortgage-backed

securities.

With a week to go in March, foreign banks have sold close to $11

billion of covered bonds--securities backed by a specific pool of

mortgages--in the U.S., according to data provider Dealogic. That

is more than twice as many as they sold here in all of 2007, the

peak of the housing boom, and more than any year since Dealogic

began counting in 1995.

No domestic issuer has stepped forward to tap this market so far

because--unlike U.S.-style mortgage-backed securities--banks

issuing covered bonds must hold the mortgages on their books and

meet additional capital requirements. Unlike residential

mortgage-backed securities that failed after the housing bubble

burst, covered bonds let investors recoup money from banks that

issue the bonds as well as from mortgages in the bonds

themselves.

Covered bonds are popular in Europe but not in the U.S., partly

because banks are not eager to shoulder the additional risk

inherent in such bonds but also because investors are wary of what

would happen to the assets if an issuing bank failed and was taken

over by the Federal Deposit Insurance Corp.

Foreign issues come with guarantees from their respective

governments.

DNB Nor Boligkreditt AS (DNBNOR.OS) of Norway announced a

five-year $2 billion covered bond backed by the Norwegian

government Tuesday. That follows a $2 billion covered bond from

Swedbank Mortgage AB of Sweden on Monday, and a $1 billion covered

bond from Caisse Centrale DesJardins du Quebec last week.

As many as $60 billion of covered bonds may be sold in the U.S.

this year, according to an estimate from Barclays Capital. That

would be about twice as many as were sold here in 2010, according

to data provider Dealogic.

In 2007, before the credit crisis, foreign and domestic banks

sold a $10.7 billion of U.S. dollar-denominated covered bonds. Bank

of America Corp. (BAC) was the last U.S. bank to issue a covered

bond, a $2 billion dollar-denominated deal in July 2007.

Bank of Montreal (BMO, BMO.T) issued the first covered bond of

2011, a $1.5 billion, five-year deal sold via the private Rule 144a

market.

National Bank of Canada (NTIOF, NA.T) followed with a $1

billion, three-year covered bond. Canadian Imperial Bank of

Commerce (CM, CM.T) also sold a $2 billion covered bond in January,

creating a trifecta of Canadian sellers of U.S. dollar-denominated

bonds early in the year.

-By Anusha Shrivastava, Dow Jones Newswires; 212-416-2227;

anusha.shrivastava@dowjones.com

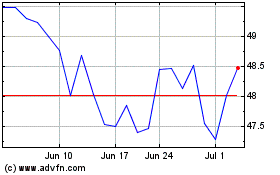

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

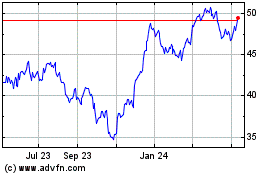

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024