Fund Industry Executives, BV Investment Buy Butterfield Fulcrum

February 09 2011 - 9:59AM

Dow Jones News

Fund industry executives Glenn Henderson and Tim Calveley have

partnered with the $2.6 billion private equity firm BV Investment

Partners to acquire fund administrator Butterfield Fulcrum Group,

taking over from current investors including 3i Group PLC (III.LN)

and Carlyle Group L.P.

Terms of the transaction weren't disclosed. Butterfield Fulcrum,

which serves private equity and hedge fund clients, is now also

backed by Butterfield Bank and Toronto-based Canadian Imperial Bank

of Commerce (CM, CM.T).

The deal will bring Henderson and Calveley full circle to the

company they helped create by merging Fulcrum Group with

Butterfield Fund Services in the summer of 2008.

Henderson was Fulcrum's former chief executive and is still a

shareholder in Butterfield Fulcrum. Calveley was Fulcrum and

Butterfield Fulcrum's chief financial officer and chief risk

officer until 2008.

The two left and acquired FORS Ltd., an independent provider of

family office and wealth management reporting administrative

services, in 2009.

"Although the two businesses have different target clients, they

share a lot of similarities and can leverage on each other's

contacts to help grow," Henderson told Dow Jones Newswires. "Family

offices have become extremely influential in terms of asset

allocations, hedge fund seeding and the setting up of funds of

hedge funds."

The deal is expected to close in the first quarter. After that,

Butterfield Fulcrum and FORS will be housed under a new

Bermuda-headquartered parent company, but the two companies will

operate as separate businesses.

Henderson will take on the roles of chief executive for both the

parent company and Butterfield Fulcrum. Calveley will be chief

operating officer of the parent company.

"The absolute focus of Butterfield Fulcrum will be on being a

full-service front-, middle- and back-office service provider to

our existing clients, helping them with rolling out new funds and

new products," Henderson said.

Butterfield Fulcrum went through a series of changes since the

merger more than two years ago. Chief Executive Akshaya Bhargarva

was replaced by Michael Clark, a former president of Fidelity

Investments' institutional products group, to reflect the firm's

revised focus on the U.S. fund industry. Clark, who told Dow Jones

Newswires last year that the fund administrator is looking to

expand via acquisitions and build a managed accounts platform,

won't stay on after the acquisition.

"Butterfield Fulcrum is not looking at merging or acquiring. I

think delivering outstanding client service to existing clients is

the best way to win new clients," Henderson said. "We will not have

a managed accounts business, as we have no interest in competing

with our hedge fund clients who have a managed account

platform."

Butterfield Fulcrum has more than $70 billion assets under

administration and serves more than 700 funds, while FORS's clients

have assets in excess of $25 billion.

-By Amy Or, Dow Jones Newswires; +1 212 416 3142;

amy.or@dowjones.com

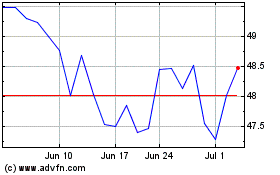

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

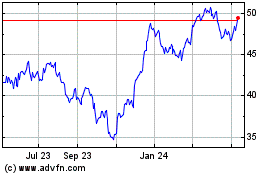

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024