Australia Banks In 25-Strong Debt Syndicate For BHP's Potash Bid

September 20 2010 - 12:55AM

Dow Jones News

Australia's big four banks are among 25 lenders who have picked

up a share of BHP Billiton Ltd.'s (BHP) US$45 billion syndicated

loan facility for its takeover bid for Potash Corp. of Saskatchewan

Inc. (POT).

A term sheet issued over the weekend by lead managers Santander,

Barclays Capital, BNP Paribas, J.P. Morgan and Royal Bank of

Scotland, confirmed the syndicate would be divided evenly between

the 25 banks in the syndicate.

Each bank--including Australia & New Zealand Banking Group

Ltd. (ANZ.AU), Commonwealth Bank of Australia (CBA.AU), National

Australia Bank Ltd. (NAB.AU) and Westpac Banking Corp. (WBK)--will

provide US$1.8 billion of funding for the $38.6 billion hostile

bid.

Other banks on the syndicate include Banco Bilbao Vizcaya

Argentaria, The Bank of Tokyo-Mitsubishi UFJ, Ltd, Canadian

Imperial Bank of Commerce, Credit Agricole Corporate and Investment

Bank; ING Bank N.V.; Intesa Sanpaolo S.p.A. London Branch; Lloyds

TSB Bank plc; Mediobanca SpA; Mizuho Corporate Bank, Ltd; Scotia

Capital; Societe Generale Corporate and Investment Banking;

Standard Chartered Bank; Sumitomo Mitsui Banking Corporation; UBS

Investment Bank and UniCredit Bank AG.

Toronto Dominion Bank has committed to the facilities as lead

arranger and bookrunner.

BHP last month launched an all-cash offer of $130 a share direct

to Potash Corp.'s shareholders after the Potash Corp.'s board of

directors rejected the offer as "grossly inadequate".

-By Rebecca Thurlow, Dow Jones Newswires; 61-2-8272-4679;

rebecca.thurlow@dowjones.com

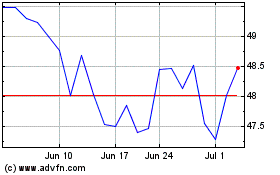

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

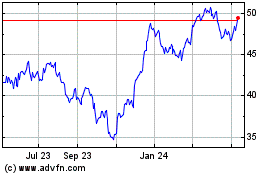

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024