UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 1, 2015

|

| | |

Carnival Corporation | | Carnival plc |

(Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) |

| |

Republic of Panama | England and Wales |

(State or other jurisdiction of incorporation) | (State or other jurisdiction of incorporation) |

| |

001-9610 | 001-15136 |

(Commission File Number) | (Commission File Number) |

| |

59-1562976 | 98-0357772 |

(IRS Employer Identification No.) | (IRS Employer Identification No.) |

| |

3655 N.W. 87th Avenue Miami, Florida 33178-2428 | Carnival House, 100 Harbour Parade, Southampton SO15 1ST, United Kingdom |

(Address of principal executive offices) (Zip Code) | (Address of principal executive offices) (Zip Code) |

| |

(305) 599-2600 | 011 44 23 8065 5000 |

(Registrant’s telephone number, including area code) | (Registrant’s telephone number, including area code) |

| |

None | None |

(Former name or former address, if changed since last report.) | (Former name, former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 8 - Other Events

Item 8.01 Other Events.

Carnival Corporation & plc is filing this Form 8-K to provide financial information that revises and corrects the accounting for one of our brand’s marine and technical spare parts in order to consistently expense and classify them fleetwide. We evaluated the materiality of this revision and concluded that it was not material to any of our previously issued financial statements. However, had we not revised the accounting, this may have resulted in material inconsistencies to our financial statements in the future.

In order to assist investors prior to the time that we revise previously reported results in future filings, Carnival Corporation & plc is presenting certain financial information to reflect the impact of the revision described above on our annual financial information. This unaudited Carnival Corporation & plc revised consolidated financial information is filed as Exhibits 99.1, 99.2 and 99.3 to this report as follows:

| |

• | Summary Impact of Revision to Prior Period Financial Information as of November 30, 2014 and 2013 and for the years ended November 30, 2014, 2013 and 2012; |

| |

• | Consolidated Statements of Income for the years ended November 30, 2014, 2013 and 2012; |

| |

• | Consolidated Statements of Comprehensive Income for the years ended November 30, 2014, 2013 and 2012; |

| |

• | Consolidated Balance Sheets at November 30, 2014 and 2013; |

| |

• | Consolidated Statements of Cash Flows for the years ended November 30, 2014, 2013 and 2012; |

| |

• | Consolidated Statements of Shareholders' Equity for the years ended November 30, 2014, 2013 and 2012 and |

| |

• | Ratio of Earnings to Fixed Charges for the years ended November 30, 2014, 2013, 2012, 2011 and 2010. |

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Summary Impact of Revision to Prior Period Financial Information.

99.2 Consolidated Statements of Income (Unaudited).

99.2 Consolidated Statements of Comprehensive Income (Unaudited).

99.2 Consolidated Balance Sheets (Unaudited).

99.2 Consolidated Statements of Cash Flows (Unaudited).

99.2 Consolidated Statements of Shareholders' Equity (Unaudited).

99.3 Ratio of Earnings to Fixed Charges (Unaudited).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each of the registrants has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

CARNIVAL CORPORATION | | CARNIVAL PLC |

| | |

By: /s/ Larry Freedman | | By: /s/ Larry Freedman |

Name: Larry Freedman | | Name: Larry Freedman |

Title: Chief Accounting Officer and Controller | | Title: Chief Accounting Officer and Controller |

| | |

Date: May 1, 2015 | | Date: May 1, 2015 |

Exhibit Index

|

| |

Exhibit No. | Description |

| |

99.1 | Summary Impact of Revision to Prior Period Financial Information. |

99.2 | Consolidated Statements of Income (Unaudited). |

99.2 | Consolidated Statements of Comprehensive Income (Unaudited). |

99.2 | Consolidated Balance Sheets (Unaudited). |

99.2 | Consolidated Statements of Cash Flows (Unaudited). |

99.2 | Consolidated Statements of Shareholders' Equity (Unaudited). |

99.3 | Ratio of Earnings to Fixed Charges (Unaudited). |

CARNIVAL CORPORATION & PLC

SUMMARY IMPACT OF REVISION TO PRIOR PERIOD FINANCIAL INFORMATION

In the first quarter of 2015, we revised and corrected the accounting for one of our brands' marine and technical spare parts in order to consistently expense and classify them fleetwide. We evaluated the materiality of this revision and concluded that it was not material to any of our previously issued financial statements. However, had we not revised, this accounting may have resulted in material inconsistencies to our financial statements in the future.

The effects of this revision on our Consolidated Statements of Income were as follows (in millions, except per share data):

|

| | | | | | | | | | | |

| Year Ended November 30, 2014 |

| As Previously

Reported | | Adjustment | | As Revised |

Other ship operating | $ | 2,445 |

| | $ | 18 |

| | $ | 2,463 |

|

Depreciation and amortization | $ | 1,635 |

| | $ | 2 |

| | $ | 1,637 |

|

Operating income | $ | 1,792 |

| | $ | (20 | ) | | $ | 1,772 |

|

Income before income taxes | $ | 1,245 |

| | $ | (20 | ) | | $ | 1,225 |

|

Net income | $ | 1,236 |

| | $ | (20 | ) | | $ | 1,216 |

|

Earnings per share | | | | | |

Basic | $ | 1.59 |

| | $ | (0.02 | ) | | $ | 1.57 |

|

Diluted | $ | 1.59 |

| | $ | (0.03 | ) | | $ | 1.56 |

|

|

| | | | | | | | | | | |

| Year Ended November 30, 2013 |

| As Previously

Reported | | Adjustment | | As Revised |

Other ship operating | $ | 2,589 |

| | $ | 21 |

| | $ | 2,610 |

|

Depreciation and amortization | $ | 1,588 |

| | $ | 2 |

| | $ | 1,590 |

|

Operating income | $ | 1,352 |

| | $ | (23 | ) | | $ | 1,329 |

|

Income before income taxes | $ | 1,072 |

| | $ | (23 | ) | | $ | 1,049 |

|

Net income | $ | 1,078 |

| | $ | (23 | ) | | $ | 1,055 |

|

Earnings per share | | | | | |

Basic | $ | 1.39 |

| | $ | (0.03 | ) | | $ | 1.36 |

|

Diluted | $ | 1.39 |

| | $ | (0.03 | ) | | $ | 1.36 |

|

|

| | | | | | | | | | | |

| Year Ended November 30, 2012 |

| As Previously

Reported | | Adjustment | | As Revised |

Other ship operating | $ | 2,233 |

| | $ | 12 |

| | $ | 2,245 |

|

Depreciation and amortization | $ | 1,527 |

| | $ | 1 |

| | $ | 1,528 |

|

Operating income | $ | 1,642 |

| | $ | (13 | ) | | $ | 1,629 |

|

Income before income taxes | $ | 1,302 |

| | $ | (13 | ) | | $ | 1,289 |

|

Net income | $ | 1,298 |

| | $ | (13 | ) | | $ | 1,285 |

|

Earnings per share | | | | | |

Basic | $ | 1.67 |

| | $ | (0.01 | ) | | $ | 1.66 |

|

Diluted | $ | 1.67 |

| | $ | (0.02 | ) | | $ | 1.65 |

|

CARNIVAL CORPORATION & PLC

SUMMARY IMPACT OF REVISION TO PRIOR PERIOD FINANCIAL INFORMATION

(CONTINUED)

The effects of this revision on our Consolidated Statements of Comprehensive Income were as follows (in millions):

|

| | | | | | | | | | | |

| Year Ended November 30, 2014 |

| As Previously

Reported | | Adjustment | | As Revised |

Net income | $ | 1,236 |

| | $ | (20 | ) | | $ | 1,216 |

|

Total comprehensive income | $ | 459 |

| | $ | (20 | ) | | $ | 439 |

|

|

| | | | | | | | | | | |

| Year Ended November 30, 2013 |

| As Previously

Reported | | Adjustment | | As Revised |

Net income | $ | 1,078 |

| | $ | (23 | ) | | $ | 1,055 |

|

Total comprehensive income | $ | 1,446 |

| | $ | (23 | ) | | $ | 1,423 |

|

|

| | | | | | | | | | | |

| Year Ended November 30, 2012 |

| As Previously

Reported | | Adjustment | | As Revised |

Net income | $ | 1,298 |

| | $ | (13 | ) | | $ | 1,285 |

|

Total comprehensive income | $ | 1,300 |

| | $ | (13 | ) | | $ | 1,287 |

|

The effects of this revision on our Consolidated Balance Sheets were as follows (in millions):

|

| | | | | | | | | | | |

| November 30, 2014 |

| As Previously

Reported | | Adjustment | | As Revised |

Inventories | $ | 364 |

| | $ | (15 | ) | | $ | 349 |

|

Total current assets | $ | 1,503 |

| | $ | (15 | ) | | $ | 1,488 |

|

Property and equipment, net | $ | 32,773 |

| | $ | 46 |

| | $ | 32,819 |

|

Other assets | $ | 859 |

| | $ | (115 | ) | | $ | 744 |

|

Total assets | $ | 39,532 |

| | $ | (84 | ) | | $ | 39,448 |

|

Retained earnings | $ | 19,242 |

| | $ | (84 | ) | | $ | 19,158 |

|

Total shareholders' equity | $ | 24,288 |

| | $ | (84 | ) | | $ | 24,204 |

|

Total liabilities and shareholders' equity | $ | 39,532 |

| | $ | (84 | ) | | $ | 39,448 |

|

CARNIVAL CORPORATION & PLC

SUMMARY IMPACT OF REVISION TO PRIOR PERIOD FINANCIAL INFORMATION

(CONTINUED)

|

| | | | | | | | | | | |

| November 30, 2013 |

| As Previously

Reported | | Adjustment | | As Revised |

Inventories | $ | 374 |

| | $ | (14 | ) | | $ | 360 |

|

Total current assets | $ | 1,937 |

| | $ | (14 | ) | | $ | 1,923 |

|

Property and equipment, net | $ | 32,905 |

| | $ | 46 |

| | $ | 32,951 |

|

Other assets | $ | 760 |

| | $ | (94 | ) | | $ | 666 |

|

Total assets | $ | 40,104 |

| | $ | (62 | ) | | $ | 40,042 |

|

Accrued liabilities | $ | 1,126 |

| | $ | 2 |

| | $ | 1,128 |

|

Total current liabilities | $ | 6,720 |

| | $ | 2 |

| | $ | 6,722 |

|

Retained earnings | $ | 18,782 |

| | $ | (64 | ) | | $ | 18,718 |

|

Total shareholders' equity | $ | 24,556 |

| | $ | (64 | ) | | $ | 24,492 |

|

Total liabilities and shareholders' equity | $ | 40,104 |

| | $ | (62 | ) | | $ | 40,042 |

|

This non-cash revision did not impact our operating cash flows for any period. The effects of this revision on the individual line items within operating cash flows on our Consolidated Statements of Cash Flows were as follows (in millions):

|

| | | | | | | | | | | |

| Year Ended November 30, 2014 |

| As Previously

Reported | | Adjustment | | As Revised |

Net income | $ | 1,236 |

| | $ | (20 | ) | | $ | 1,216 |

|

Depreciation and amortization | $ | 1,635 |

| | $ | 2 |

| | $ | 1,637 |

|

Inventories | $ | 1 |

| | $ | — |

| | $ | 1 |

|

Insurance recoverables, prepaid expenses and other | $ | 401 |

| | $ | 21 |

| | $ | 422 |

|

Claims reserves and accrued and other liabilities | $ | (379 | ) | | $ | (3 | ) | | $ | (382 | ) |

|

| | | | | | | | | | | |

| Year Ended November 30, 2013 |

| As Previously

Reported | | Adjustment | | As Revised |

Net income | $ | 1,078 |

| | $ | (23 | ) | | $ | 1,055 |

|

Depreciation and amortization | $ | 1,588 |

| | $ | 2 |

| | $ | 1,590 |

|

Inventories | $ | 19 |

| | $ | 2 |

| | $ | 21 |

|

Insurance recoverables, prepaid expenses and other | $ | 402 |

| | $ | 22 |

| | $ | 424 |

|

Claims reserves and accrued and other liabilities | $ | (330 | ) | | $ | (3 | ) | | $ | (333 | ) |

|

| | | | | | | | | | | |

| Year Ended November 30, 2012 |

| As Previously

Reported | | Adjustment | | As Revised |

Net income | $ | 1,298 |

| | $ | (13 | ) | | $ | 1,285 |

|

Depreciation and amortization | $ | 1,527 |

| | $ | 1 |

| | $ | 1,528 |

|

Inventories | $ | (16 | ) | | $ | (1 | ) | | $ | (17 | ) |

Insurance recoverables, prepaid expenses and other | $ | 148 |

| | $ | 8 |

| | $ | 156 |

|

Claims reserves and accrued and other liabilities | $ | (192 | ) | | $ | 5 |

| | $ | (187 | ) |

CARNIVAL CORPORATION & PLC

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(in millions, except per share data)

|

| | | | | | | | | | | |

| Years Ended November 30, |

| 2014 | | 2013 | | 2012 |

Revenues | | | | | |

Cruise | | | | | |

Passenger tickets | $ | 11,889 |

| | $ | 11,648 |

| | $ | 11,658 |

|

Onboard and other | 3,780 |

| | 3,598 |

| | 3,513 |

|

Tour and other | 215 |

| | 210 |

| | 211 |

|

| 15,884 |

| | 15,456 |

| | 15,382 |

|

Operating Costs and Expenses | | | | | |

Cruise | | | | | |

Commissions, transportation and other | 2,299 |

| | 2,303 |

| | 2,292 |

|

Onboard and other | 519 |

| | 539 |

| | 558 |

|

Fuel | 2,033 |

| | 2,208 |

| | 2,381 |

|

Payroll and related | 1,942 |

| | 1,859 |

| | 1,742 |

|

Food | 1,005 |

| | 983 |

| | 960 |

|

Other ship operating | 2,463 |

| | 2,610 |

| | 2,245 |

|

Tour and other | 160 |

| | 143 |

| | 154 |

|

| 10,421 |

| | 10,645 |

| | 10,332 |

|

Selling and administrative | 2,054 |

| | 1,879 |

| | 1,720 |

|

Depreciation and amortization | 1,637 |

| | 1,590 |

| | 1,528 |

|

Ibero goodwill and trademark impairment charges | — |

| | 13 |

| | 173 |

|

| 14,112 |

| | 14,127 |

| | 13,753 |

|

Operating Income | 1,772 |

| | 1,329 |

| | 1,629 |

|

Nonoperating (Expense) Income | | | | | |

Interest income | 8 |

| | 11 |

| | 10 |

|

Interest expense, net of capitalized interest | (288 | ) | | (319 | ) | | (336 | ) |

(Losses) gains on fuel derivatives, net | (271 | ) | | 36 |

| | (7 | ) |

Other income (expense), net | 4 |

| | (8 | ) | | (7 | ) |

| (547 | ) | | (280 | ) | | (340 | ) |

Income Before Income Taxes | 1,225 |

| | 1,049 |

| | 1,289 |

|

Income Tax (Expense) Benefit, Net | (9 | ) | | 6 |

| | (4 | ) |

Net Income | $ | 1,216 |

| | $ | 1,055 |

| | $ | 1,285 |

|

Earnings Per Share | | | | | |

Basic | $ | 1.57 |

| | $ | 1.36 |

| | $ | 1.66 |

|

Diluted | $ | 1.56 |

| | $ | 1.36 |

| | $ | 1.65 |

|

Dividends Declared Per Share | $ | 1.00 |

| | $ | 1.00 |

| | $ | 1.50 |

|

CARNIVAL CORPORATION & PLC

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

(in millions)

|

| | | | | | | | | | | |

| Years Ended November 30, |

| 2014 | | 2013 | | 2012 |

Net Income | $ | 1,216 |

| | $ | 1,055 |

| | $ | 1,285 |

|

Items Included in Other Comprehensive (Loss) Income | | | | | |

Change in foreign currency translation adjustment | (746 | ) | | 332 |

| | 25 |

|

Other | (31 | ) | | 36 |

| | (23 | ) |

Other Comprehensive (Loss) Income | (777 | ) | | 368 |

| | 2 |

|

Total Comprehensive Income | $ | 439 |

| | $ | 1,423 |

| | $ | 1,287 |

|

CARNIVAL CORPORATION & PLC

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in millions, except par values)

|

| | | | | | | |

| November 30, | | November 30, |

| 2014 | | 2013 |

ASSETS | | | |

Current Assets | | | |

Cash and cash equivalents | $ | 331 |

| | $ | 462 |

|

Trade and other receivables, net | 332 |

| | 405 |

|

Insurance recoverables | 154 |

| | 381 |

|

Inventories | 349 |

| | 360 |

|

Prepaid expenses and other | 322 |

| | 315 |

|

Total current assets | 1,488 |

| | 1,923 |

|

Property and Equipment, Net | 32,819 |

| | 32,951 |

|

Goodwill | 3,127 |

| | 3,210 |

|

Other Intangibles | 1,270 |

| | 1,292 |

|

Other Assets | 744 |

| | 666 |

|

| $ | 39,448 |

| | $ | 40,042 |

|

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

Current Liabilities | | | |

Short-term borrowings | $ | 666 |

| | $ | 60 |

|

Current portion of long-term debt | 1,059 |

| | 1,408 |

|

Accounts payable | 626 |

| | 639 |

|

Claims reserve | 262 |

| | 456 |

|

Accrued liabilities and other | 1,276 |

| | 1,128 |

|

Customer deposits | 3,032 |

| | 3,031 |

|

Total current liabilities | 6,921 |

| | 6,722 |

|

Long-Term Debt | 7,363 |

| | 8,092 |

|

Other Long-Term Liabilities | 960 |

| | 736 |

|

Shareholders’ Equity | | | |

Common stock of Carnival Corporation, $0.01 par value; 1,960 shares authorized; 652 shares at 2014 and 651 shares at 2013 issued | 7 |

| | 7 |

|

Ordinary shares of Carnival plc, $1.66 par value; 216 shares at 2014 and 2013 issued | 358 |

| | 358 |

|

Additional paid-in capital | 8,384 |

| | 8,325 |

|

Retained earnings | 19,158 |

| | 18,718 |

|

Accumulated other comprehensive (loss) income | (616 | ) | | 161 |

|

Treasury stock, 59 shares at 2014 and 2013 of Carnival Corporation and 32 shares at 2014 and 2013 of Carnival plc, at cost | (3,087 | ) | | (3,077 | ) |

Total shareholders’ equity | 24,204 |

| | 24,492 |

|

| $ | 39,448 |

| | $ | 40,042 |

|

CARNIVAL CORPORATION & PLC

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in millions)

|

| | | | | | | | | | | |

| Years Ended November 30, |

| 2014 | | 2013 | | 2012 |

OPERATING ACTIVITIES | | | | | |

Net income | $ | 1,216 |

| | $ | 1,055 |

| | $ | 1,285 |

|

Adjustments to reconcile net income to net cash provided by operating activities |

Depreciation and amortization | 1,637 |

| | 1,590 |

| | 1,528 |

|

Losses on ship sales and ship impairments, net | 2 |

| | 163 |

| | 49 |

|

Goodwill, trademark and other impairment charges | — |

| | 27 |

| | 173 |

|

Share-based compensation | 52 |

| | 42 |

| | 39 |

|

Losses (gains) on fuel derivatives, net | 271 |

| | (36 | ) | | 7 |

|

Other, net | 35 |

| | 35 |

| | 12 |

|

Changes in operating assets and liabilities | | | | | |

Receivables | 75 |

| | (128 | ) | | (15 | ) |

Inventories | 1 |

| | 21 |

| | (17 | ) |

Insurance recoverables, prepaid expenses and other | 422 |

| | 424 |

| | 156 |

|

Accounts payable | 9 |

| | 79 |

| | (24 | ) |

Claims reserves and accrued and other liabilities | (382 | ) | | (333 | ) | | (187 | ) |

Customer deposits | 92 |

| | (105 | ) | | (7 | ) |

Net cash provided by operating activities | 3,430 |

| | 2,834 |

| | 2,999 |

|

INVESTING ACTIVITIES | | | | | |

Additions to property and equipment | (2,583 | ) | | (2,149 | ) | | (2,332 | ) |

Proceeds from sale of ships | 42 |

| | 70 |

| | 46 |

|

Insurance proceeds for a ship | — |

| | — |

| | 508 |

|

Other, net | 34 |

| | 23 |

| | 6 |

|

Net cash used in investing activities | (2,507 | ) | | (2,056 | ) | | (1,772 | ) |

FINANCING ACTIVITIES | | | | | |

Proceeds from (repayments of) short-term borrowings, net | 617 |

| | 4 |

| | (224 | ) |

Principal repayments of long-term debt | (2,466 | ) | | (2,212 | ) | | (1,052 | ) |

Proceeds from issuance of long-term debt | 1,626 |

| | 2,687 |

| | 946 |

|

Dividends paid | (776 | ) | | (1,164 | ) | | (779 | ) |

Purchases of treasury stock | — |

| | (138 | ) | | (90 | ) |

Sales of treasury stock | — |

| | 35 |

| | — |

|

Other, net | (29 | ) | | 8 |

| | 9 |

|

Net cash used in financing activities | (1,028 | ) | | (780 | ) | | (1,190 | ) |

Effect of exchange rate changes on cash and cash equivalents | (26 | ) | | (1 | ) | | (22 | ) |

Net (decrease) increase in cash and cash equivalents | (131 | ) | | (3 | ) | | 15 |

|

Cash and cash equivalents at beginning of year | 462 |

| | 465 |

| | 450 |

|

Cash and cash equivalents at end of year | $ | 331 |

| | $ | 462 |

| | $ | 465 |

|

CARNIVAL CORPORATION & PLC

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(UNAUDITED)

(in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

stock | | Ordinary

shares | | Additional

paid-in

capital | | Retained

earnings | | Accumulated

other comprehensive

(loss) income | | Treasury

stock | | Total

shareholders’

equity |

Balances at November 30, 2011 | $ | 6 |

| | $ | 357 |

| | $ | 8,180 |

| | $ | 18,321 |

| | $ | (209 | ) | | $ | (2,851 | ) | | $ | 23,804 |

|

Net income | — |

| | — |

| | — |

| | 1,285 |

| | — |

| | — |

| | 1,285 |

|

Other comprehensive income | — |

| | — |

| | — |

| | — |

| | 2 |

| | — |

| | 2 |

|

Cash dividends declared | — |

| | — |

| | — |

| | (1,168 | ) | | — |

| | — |

| | (1,168 | ) |

Purchases of treasury stock under the Repurchase Program and other | — |

| | — |

| | 72 |

| | — |

| | — |

| | (107 | ) | | (35 | ) |

Balances at November 30, 2012 | 6 |

| | 357 |

| | 8,252 |

| | 18,438 |

| | (207 | ) | | (2,958 | ) | | 23,888 |

|

Net income | — |

| | — |

| | — |

| | 1,055 |

| | — |

| | — |

| | 1,055 |

|

Other comprehensive income | — |

| | — |

| | — |

| | — |

| | 368 |

| | — |

| | 368 |

|

Cash dividends declared | — |

| | — |

| | — |

| | (775 | ) | | — |

| | — |

| | (775 | ) |

Purchases and sales under the Stock Swap program | — |

| | — |

| | 10 |

| | — |

| | — |

| | (9 | ) | | 1 |

|

Purchases of treasury stock under the Repurchase Program and other | 1 |

| | 1 |

| | 63 |

| | — |

| | — |

| | (110 | ) | | (45 | ) |

Balances at November 30, 2013 | 7 |

| | 358 |

| | 8,325 |

| | 18,718 |

| | 161 |

| | (3,077 | ) | | 24,492 |

|

Net income | — |

| | — |

| | — |

| | 1,216 |

| | — |

| | — |

| | 1,216 |

|

Other comprehensive loss | — |

| | — |

| | — |

| | — |

| | (777 | ) | | — |

| | (777 | ) |

Cash dividends declared | — |

| | — |

| | — |

| | (777 | ) | | — |

| | — |

| | (777 | ) |

Other | — |

| | — |

| | 59 |

| | 1 |

| | — |

| | (10 | ) | | 50 |

|

Balances at November 30, 2014 | $ | 7 |

| | $ | 358 |

| | $ | 8,384 |

| | $ | 19,158 |

| | $ | (616 | ) | | $ | (3,087 | ) | | $ | 24,204 |

|

CARNIVAL CORPORATION & PLC

RATIO OF EARNINGS TO FIXED CHARGES

(UNAUDITED)

(in millions, except ratios)

|

| | | | | | | | | | | | | | | | | | | |

| Years Ended November 30, |

| 2014 | | 2013 | | 2012 | | 2011 | | 2010 |

Net income (as previously reported) | $ | 1,236 |

| | $ | 1,078 |

| | $ | 1,298 |

| | $ | 1,912 |

| | $ | 1,978 |

|

Effect of revision | (20 | ) | | (23 | ) | | (13 | ) | | — |

| | (3 | ) |

Net income (revised) | 1,216 |

| | 1,055 |

| | 1,285 |

| | 1,912 |

| | 1,975 |

|

Income tax (benefit) expense, net | 9 |

| | (6 | ) | | 4 |

| | — |

| | 1 |

|

Income before income taxes | 1,225 |

| | 1,049 |

| | 1,289 |

| | 1,912 |

| | 1,976 |

|

Fixed charges | | | | | | | | | |

Interest expense, net | 288 |

| | 319 |

| | 336 |

| | 365 |

| | 378 |

|

Interest portion of rent expense (a) | 21 |

| | 20 |

| | 19 |

| | 20 |

| | 21 |

|

Capitalized interest | 21 |

| | 15 |

| | 17 |

| | 21 |

| | 26 |

|

Total fixed charges | 330 |

| | 354 |

| | 372 |

| | 406 |

| | 425 |

|

Fixed charges not affecting earnings | | | | | | | | | |

Capitalized interest | (21 | ) | | (15 | ) | | (17 | ) | | (21 | ) | | (26 | ) |

Earnings before fixed charges | $ | 1,534 |

| | $ | 1,388 |

| | $ | 1,644 |

| | $ | 2,297 |

| | $ | 2,375 |

|

Ratio of earnings to fixed charges | 4.6 |

| | 3.9 |

| | 4.4 |

| | 5.7 |

| | 5.6 |

|

(a) Represents one-third of rent expense, which we believe to be representative of the interest portion of rent expense.

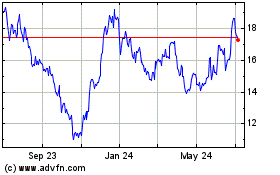

Carnival (NYSE:CCL)

Historical Stock Chart

From Aug 2024 to Sep 2024

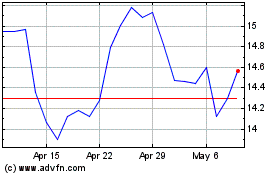

Carnival (NYSE:CCL)

Historical Stock Chart

From Sep 2023 to Sep 2024