UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 22, 2015

Crown Castle International Corp.

(Exact name of registrant as specified in its charter)

|

| | | | | | | |

| | | | |

Delaware | | 001-16441 | | 76-0470458 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | |

1220 Augusta Drive, Suite 600 Houston, TX | |

77057 | |

(Address of principal executive offices) | | (Zip Code) | |

Registrant's telephone number, including area code: (713) 570-3000

|

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02 — RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On July 22, 2015, Crown Castle International Corp. ("Company") issued a press release disclosing its financial results for the second quarter of 2015. The press release referred to certain supplemental information that was posted as a supplemental information package on the Company's website on July 22, 2015. The July 22, 2015 press release and supplemental information package are furnished herewith as Exhibit 99.1 and 99.2, respectively.

ITEM 9.01 — FINANCIAL STATEMENTS AND EXHIBITS

(c) Exhibits

As described in Item 2.02 of this Report, the following exhibits are furnished as part of this Current Report on Form 8-K:

|

| | |

Exhibit No. | | Description |

99.1 | | Press Release dated July 22, 2015 |

99.2 | | Supplemental Information Package for the period ended June 30, 2015 |

The information in this Form 8-K and Exhibit 99.1 and 99.2 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended ("Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| CROWN CASTLE INTERNATIONAL CORP. | |

| By: | /s/ E. Blake Hawk | |

| | Name: | E. Blake Hawk | |

| | Title: | Executive Vice President

and General Counsel | |

Date: July 22, 2015

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

99.1 | | Press Release dated July 22, 2015 |

99.2 | | Supplemental Information Package for the period ended June 30, 2015 |

|

| | |

| | NEWS RELEASE July 22, 2015

|

|

| |

| Contacts: Jay Brown, CFO |

| Son Nguyen, VP - Corporate Finance |

FOR IMMEDIATE RELEASE | Crown Castle International Corp. |

| 713-570-3050 |

CROWN CASTLE REPORTS SECOND QUARTER 2015 RESULTS

AND RAISES OUTLOOK FOR 2015

SECOND QUARTER 2015 HIGHLIGHTS

| |

• | Exceeded the midpoint of previously provided Outlook, adjusted for the disposition of our Australian subsidiary, for Adjusted EBITDA, AFFO and AFFO per share |

| |

• | Raised full year 2015 Outlook for Adjusted EBITDA, AFFO and AFFO per share |

| |

• | Enhanced long-term growth profile through sale of Australian subsidiary and pending acquisition of Sunesys |

| |

• | Generated Organic Site Rental Revenue growth of 10% year-over-year from new leasing activity and escalations on tenant leases |

July 22, 2015 - HOUSTON, TEXAS - Crown Castle International Corp. (NYSE: CCI) ("Crown Castle") today reported results for the quarter ended June 30, 2015.

"We had a terrific second quarter, allowing us to raise our Outlook for full year 2015," stated Ben Moreland, Crown Castle's President and Chief Executive Officer. "In addition to delivering great results during the second quarter, we also announced several strategic transactions that reflect our focus on delivering attractive long-term total returns for shareholders. The completed sale of our Australian subsidiary, following a very successful fifteen year investment, allows us to redeploy capital toward an opportunity with a higher anticipated growth profile through our pending acquisition of Sunesys, further reinforcing our leadership position in wireless infrastructure in the U.S. Our focus and continued investment in the U.S. is based on our view that the continuing growth in U.S. consumer demand for mobile data, which is projected to increase seven-fold between 2014 and 2019, will require significant investments by the wireless carriers to increase the density of their networks. This positive long-term outlook, combined with our extensive mission-critical portfolio of towers and small cells, gives us confidence in our ability to achieve our stated goal of generating compounded annual growth in AFFO per share of 6% to 7% organically over the next five years. We believe the expected growth in AFFO per share, half of which is comprised of cash escalations on our tenant lease contracts,

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 2 |

together with our current dividend yield of approximately 4% represents an attractive long-term total return profile for shareholders."

CONSOLIDATED FINANCIAL RESULTS

As previously announced, Crown Castle completed the sale of its Australian subsidiary (“CCAL”) on May 28, 2015. Beginning in the second quarter of 2015, Crown Castle’s historical financial results, including for periods prior to May 28, 2015, and current Outlook reflect CCAL as a discontinued operation. As such, unless otherwise indicated, figures presented in this press release do not include financial results from CCAL.

For comparative purposes, the table below presents site rental revenues, site rental gross margin, Adjusted EBITDA, Adjusted Funds from Operations ("AFFO") and AFFO per share for Crown Castle’s second quarter 2015 Outlook previously provided on April 22, 2015 ("Previous Second Quarter 2015 Outlook"), the Previous Second Quarter 2015 Outlook adjusted to reflect CCAL as a discontinued operation, and reported results for the second quarter of 2015.

|

| | | | | |

(in millions, except per share amount) | Midpoint of Previous Second Quarter 2015 Outlook(a) | | Midpoint of Previous Second Quarter 2015 Outlook (Adjusted for Disposition of CCAL) | | Reported Second Quarter 2015 Results |

Site rental revenues | $770 | | $735 | | $737 |

Site rental gross margin | $526 | | $499 | | $500 |

Adjusted EBITDA | $534 | | $509 | | $521 |

AFFO | $351 | | $339 | | $342 |

AFFO per share | $1.05(b) | | $1.02(b) | | $1.03 |

| |

(a) | As previously issued on April 22, 2015; inclusive of expected contribution from CCAL |

| |

(b) | Based on diluted shares outstanding as of March 31, 2015. |

AFFO increased 3% to $342 million in the second quarter of 2015, compared to $332 million in the second quarter of 2014. AFFO per share increased 3% to $1.03 in the second quarter of 2015, compared to $1.00 in the second quarter of 2014. Adjusted EBITDA for the second quarter of 2015 increased 2% to $521 million from $510 million in the same period in 2014. Adjusted EBITDA and AFFO for the second quarter of 2015 benefited from higher than expected network services gross margin contribution, inclusive of $7 million in equipment decommissioning fees.

Total revenues for the second quarter of 2015 increased 2% to $899 million from $878 million for the same period in 2014. Site rental revenues for the second quarter of 2015 increased $26 million, or 4%, to $737 million from $711 million for the same period in the prior year. Organic Site Rental Revenues for the second quarter of 2015 increased from $661 million to $700 million from the same period in the prior year, representing a 6% increase, comprised of approximately 10% growth from new leasing activity and escalations on tenant leases, net of approximately 4% from non-renewals. Site rental gross margin, defined as site rental revenues less site rental cost of operations, increased $16 million, or 3%, to $500 million in the second quarter of 2015 from $484 million in the same period in 2014.

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 3 |

Net income attributable to CCIC common stockholders for the second quarter of 2015 was $1.1 billion, inclusive of a gain of approximately $1 billion from the sale of CCAL and related foreign currency hedge, compared to $23 million of net income for the same period in 2014. Net income attributable to CCIC common stockholders per common share for the second quarter of 2015 was $3.42, inclusive of the previously mentioned gain on the sale of CCAL and related foreign currency hedge, compared to $0.07 per common share in the second quarter of 2014. Funds from Operations ("FFO") increased 57% to $408 million in the second quarter of 2015, compared to $261 million in the second quarter of 2014. FFO per share increased 56% to $1.22 in the second quarter of 2015, compared to $0.78 in the second quarter of 2014.

FINANCING AND INVESTING ACTIVITIES

During the second quarter of 2015, Crown Castle invested approximately $219 million in capital expenditures, comprised of $28 million of land purchases, $27 million of sustaining capital expenditures and $164 million of revenue generating capital expenditures. Revenue generating capital expenditures consisted of $103 million on existing sites and $61 million on the construction of new sites, primarily small cell construction activity.

On June 30, 2015, Crown Castle paid a quarterly common stock dividend of $0.82 per common share, or approximately $274 million in aggregate. Diluted common shares outstanding at June 30, 2015 were 333.7 million.

On May 15, 2015, Crown Castle issued, at par, $1 billion of Senior Secured Tower Revenue Notes ("2015 Tower Revenue Notes"). The 2015 Tower Revenue Notes were issued at a weighted average interest rate of 3.5% with a weighted average expected life of approximately nine years. The net proceeds from the issuance of the 2015 Tower Revenue Notes were used to repay other secured notes and portions of outstanding borrowings under Crown Castle’s revolving credit facility and term loans. As of June 30, 2015, Crown Castle's outstanding debt had a weighted average coupon of 4.2% per annum and a weighted average maturity of six years. Further, Crown Castle's net debt (total debt less cash and cash equivalents) to second quarter annualized Adjusted EBITDA ratio was approximately 5.2x.

As of June 30, 2015, Crown Castle had approximately $339 million in cash and cash equivalents (excluding restricted cash) and approximately $2.2 billion of availability under its revolving credit facility.

"We executed on all fronts during the second quarter by delivering excellent results, increasing our full year 2015 Outlook and positioning our business for long-term growth through continued disciplined capital allocation," stated Jay Brown, Crown Castle's Chief Financial Officer. "Our ability to consistently execute illustrates the strength of our business model and the quality of our portfolio of tower and small cells that we have built and invested in over time. Further, the strength of our business model, the quality of our assets and the strength of our balance sheet give us the confidence to commit to returning capital to shareholders in the form of a dividend, all the while maintaining the ability to invest in growth opportunities that we believe will enhance long-term growth in AFFO and dividends per share."

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 4 |

DISPOSITION OF CCAL

On May 28, 2015, Crown Castle completed the sale of CCAL for an aggregate purchase price of approximately $1.6 billion. At the time of the sale, CCAL was 77.6% owned by Crown Castle. Crown Castle's net proceeds of approximately $1.3 billion, inclusive of an installment payment of approximately $125 million due from the buyers on January 2016, are after accounting for its ownership interest, repayment of intercompany debt owed to it by CCAL and transaction fees and expenses. During the second quarter of 2015, Crown Castle used net proceeds from the sale of CCAL to repay outstanding borrowings under its revolving credit facility and portions of its term loans.

Crown Castle expects to utilize approximately $1.0 billion of its approximately $2.0 billion net operating loss carryforward to fully offset the expected taxable gain from the sale of CCAL. Further, as a result of the sale of CCAL, Crown Castle expects that a significant portion of its common stock dividend distributions during 2015 will be characterized as capital gains distributions.

ACQUISITION OF SUNESYS

On April 30, 2015, Crown Castle announced that it entered into a definitive agreement to acquire Quanta Fiber Networks, Inc. ("Sunesys") for approximately $1.0 billion in cash (subject to certain limited adjustments). Sunesys is a fiber services provider that owns or has rights to nearly 10,000 miles of fiber in major metropolitan markets across the United States, including Los Angeles, Philadelphia, Chicago, Atlanta, Silicon Valley, and northern New Jersey, with approximately 60% of Sunesys' fiber miles located in the top 10 basic trading areas ("BTAs").

The acquisition of Sunesys is expected to further strengthen Crown Castle's leading position in small cell networks by more than doubling Crown Castle's fiber footprint available for small cell deployments and expanding Crown Castle's presence in many of the top U.S. metropolitan markets. Small cells represent a network of antennas, or nodes, connected by fiber and designed to facilitate wireless communications services for multiple operators that are focused on augmenting their network capacity. Today, Crown Castle owns or has rights to approximately 7,000 miles of fiber supporting approximately 15,000 nodes, which contribute approximately 8% to Crown Castle's site rental revenues. Pro forma for the acquisition, Crown Castle will own or have rights to more than 16,000 miles of fiber.

Crown Castle expects the acquisition to close during the third quarter of 2015 and to be immediately accretive to AFFO per share upon closing. The acquisition, which is not included in the Outlook below, is expected to contribute approximately $80 to $85 million to site rental gross margin with approximately $20 million of general and administrative expenses in the first year of Crown Castle's ownership. Crown Castle expects to fund the acquisition of Sunesys with cash on hand and borrowings under its revolving credit facility.

OUTLOOK

This Outlook section contains forward-looking statements, and actual results may differ materially. Information regarding potential risks which could cause actual results to differ from the forward-looking statements herein is set forth below and in Crown Castle's filings with the Securities and Exchange Commission ("SEC").

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 5 |

For comparative purposes, the table below presents the midpoint for site rental revenues, site rental gross margin, Adjusted EBITDA, AFFO and AFFO per share for Crown Castle’s full year 2015 Outlook previously provided on April 22, 2015 ("Previous Full Year 2015 Outlook"), the Previous Full Year 2015 Outlook adjusted to reflect CCAL as a discontinued operation, and current full year 2015 Outlook. As reflected in the table below, Crown Castle has increased the midpoint of its full year 2015 Outlook for site rental revenues, site rental gross margin, Adjusted EBITDA and AFFO by approximately $21 million, $13 million, $27 million and $14 million, respectively, relative to the Previous Full Year 2015 Outlook adjusted to reflect CCAL as a discontinued operation. Crown Castle's third quarter 2015 and full year 2015 Outlook do not include the expected contribution from the acquisition of Sunesys.

|

| | | | | |

(in millions, except per share amount) | Midpoint of Previous Full Year 2015 Outlook(a) | | Midpoint of Previous Full Year 2015 Outlook (Adjusted for Disposition of CCAL) | | Midpoint of Current Full Year 2015 Outlook |

Site rental revenues | $3,075 | | $2,933 | | $2,954 |

Site rental gross margin | $2,099 | | $1,992 | | $2,005 |

Adjusted EBITDA | $2,153 | | $2,054 | | $2,081 |

AFFO | $1,458 | | $1,399 | | $1,413 |

AFFO per share(b) | $4.37 | | $4.19 | | $4.23 |

| |

(a) | As previously issued on April 22, 2015; inclusive of expected contribution from CCAL |

| |

(b) | Based on diluted shares outstanding as of March 31, 2015 and June 30, 2015, as applicable. |

The increased midpoint of full year 2015 Outlook for site rental revenues reflects results from the second quarter and the expected timing benefit from tenant non-renewals occurring later in the year than previously expected. The increased midpoint of full year 2015 Outlook for Adjusted EBITDA includes the aforementioned increase in site rental gross margin and the strong performance year-to-date in network services gross margin contribution. For the full year 2015 Outlook, Crown Castle expects network services gross margin contribution to be approximately $275 million to $280 million, including approximately $25 million to $30 million in equipment decommissioning fees. The third quarter 2015 Outlook for Adjusted EBITDA assumes network services gross margin contribution of approximately $60 million to $65 million, with minimal equipment decommissioning fees expected during the quarter. The increased midpoint of full year 2015 Outlook for AFFO includes the aforementioned increase in Adjusted EBITDA offset by an increase in sustaining capital expenditures primarily related to office facilities during the second and third quarters of 2015. Additional information regarding Crown Castle's expectations for site rental revenues growth, including tenant non-renewals, is available in Crown Castle's quarterly Supplemental Information Package posted in the Investors section of its website.

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 6 |

The following table sets forth Crown Castle's current Outlook for third quarter 2015 and full year 2015: |

| | |

(in millions, except per share amounts) | Third Quarter 2015 | Full Year 2015 |

Site rental revenues | $740 to $745 | $2,949 to $2,959 |

Site rental cost of operations | $237 to $242 | $942 to $952 |

Site rental gross margin | $500 to $505 | $2,000 to $2,010 |

Adjusted EBITDA | $510 to $515 | $2,073 to $2,088 |

Interest expense and amortization of deferred financing costs(a) | $125 to $130 | $513 to $528 |

FFO | $347 to $352 | $1,463 to $1,478 |

AFFO | $341 to $346 | $1,405 to $1,420 |

AFFO per share(b) | $1.02 to $1.04 | $4.21 to $4.25 |

Net income (loss) | $90 to $123 | $1,463 to $1,542 |

Net income (loss) per share - diluted(b) | $0.27 to $0.37 | $4.38 to $4.62 |

Net income (loss) attributable to CCIC common stockholders | $79 to $112 | $1,419 to $1,498 |

Net income (loss) attributable to CCIC common stockholders per share - diluted(b) | $0.24 to $0.34 | $4.25 to $4.49 |

| |

(a) | See the reconciliation of "components of interest expense and amortization of deferred financing costs" herein for a discussion of non-cash interest expense. |

| |

(b) | Based on 333.7 million diluted shares outstanding as of June 30, 2015. |

CONFERENCE CALL DETAILS

Crown Castle has scheduled a conference call for Thursday, July 23, 2015, at 10:30 a.m. Eastern Time. The conference call may be accessed by dialing 866-454-4209 and asking for the Crown Castle call (access code 8958600) at least 30 minutes prior to the start time. The conference call may also be accessed live over the Internet at http://investor.crowncastle.com. Supplemental materials for the call have been posted on the Crown Castle website at http://investor.crowncastle.com.

A telephonic replay of the conference call will be available from 1:30 p.m. Eastern Time on Thursday, July 23, 2015, through 1:30 p.m. Eastern Time on Wednesday, October 21, 2015, and may be accessed by dialing 888-203-1112 and using access code 8958600. An audio archive will also be available on the company's website at http://investor.crowncastle.com shortly after the call and will be accessible for approximately 90 days.

ABOUT CROWN CASTLE

Crown Castle provides wireless carriers with the infrastructure they need to keep people connected and businesses running. With approximately 40,000 towers and 15,000 small cell nodes supported by approximately 7,000 miles of fiber, Crown Castle is the nation's largest provider of shared wireless infrastructure with a significant presence in the top 100 US markets. For more information on Crown Castle, please visit www.crowncastle.com.

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 7 |

Non-GAAP Financial Measures and Other Calculations

This press release includes presentations of Adjusted EBITDA, Funds from Operations, Adjusted Funds from Operations, Organic Site Rental Revenues, and Site Rental Revenues, as Adjusted, which are non-GAAP financial measures. These non-GAAP financial measures are not intended as alternative measures of operating results or cash flow from operations (as determined in accordance with Generally Accepted Accounting Principles ("GAAP")). Each of the amounts included in the calculation of Adjusted EBITDA, FFO, AFFO, Organic Site Rental Revenues, and Site Rental Revenues, as Adjusted, are computed in accordance with GAAP, with the exception of: (1) sustaining capital expenditures, which is not defined under GAAP and (2) our adjustment to the income tax provision in calculations of AFFO for periods prior to our REIT conversion.

Our measures of Adjusted EBITDA, FFO, AFFO, Organic Site Rental Revenues and Site Rental Revenues, as Adjusted, may not be comparable to similarly titled measures of other companies, including other companies in the tower sector or those reported by other REITs. Our FFO and AFFO may not be comparable to those reported in accordance with National Association of Real Estate Investment Trusts, including with respect to the impact of income taxes for periods prior to our REIT conversion.

Adjusted EBITDA, FFO, AFFO, Organic Site Rental Revenues and Site Rental Revenues, as Adjusted, are presented as additional information because management believes these measures are useful indicators of the financial performance of our core businesses. In addition, Adjusted EBITDA is a measure of current financial performance used in our debt covenant calculations.

Adjusted EBITDA. Crown Castle defines Adjusted EBITDA as net income (loss) plus restructuring charges (credits), asset write-down charges, acquisition and integration costs, depreciation, amortization and accretion, amortization of prepaid lease purchase price adjustments, interest expense and amortization of deferred financing costs, gains (losses) on retirement of long-term obligations, net gain (loss) on interest rate swaps, gains (losses) on foreign currency swaps, impairment of available-for-sale securities, interest income, other income (expense), benefit (provision) for income taxes, cumulative effect of change in accounting principle, income (loss) from discontinued operations, and stock-based compensation expense.

Funds from Operations ("FFO"). Crown Castle defines Funds from Operations as net income plus real estate related depreciation, amortization and accretion and asset write-down charges, less noncontrolling interest and cash paid for preferred stock dividends, and is a measure of funds from operations attributable to CCIC common stockholders.

FFO per share. Crown Castle defines FFO per share as FFO divided by the diluted weighted average common shares outstanding.

Adjusted Funds from Operations ("AFFO"). Crown Castle defines Adjusted Funds from Operations as FFO before straight-line revenue, straight-line expense, stock-based compensation expense, non-cash portion of tax provision, non-real estate related depreciation, amortization and accretion, amortization of non-cash interest expense, other (income) expense, gain (loss) on retirement of long-term obligations, net gain (loss) on interest rate swaps, gains (losses) on foreign currency swaps, acquisition and integration costs, and adjustments for noncontrolling interests, and less capital improvement capital expenditures and corporate capital expenditures.

AFFO per share. Crown Castle defines AFFO per share as AFFO divided by diluted weighted average common shares outstanding.

Site Rental Revenues, as Adjusted. Crown Castle defines Site Rental Revenues, as Adjusted, as site rental revenues, as reported, less straight-line revenues.

Organic Site Rental Revenues. Crown Castle defines Organic Site Rental Revenues as site rental revenues, as reported, less straight-line revenues, the impact of tower acquisitions and construction, foreign currency adjustments and certain non recurring items.

Sustaining capital expenditures. Crown Castle defines sustaining capital expenditures as either (1) corporate related capital improvements, such as buildings, information technology equipment and office equipment or (2) capital improvements to tower sites that enable our customers' ongoing quiet enjoyment of the tower.

The tables set forth below reconcile these non-GAAP financial measures to comparable GAAP financial measures. The components in these tables may not sum to the total due to rounding.

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 8 |

Reconciliations of Non-GAAP Financial Measures to Comparable GAAP Financial Measures and Other Calculations:

Adjusted EBITDA for the three months ended June 30, 2015 and 2014 is computed as follows:

|

| | | | | | | |

| For the Three Months Ended |

| June 30, 2015 | | June 30, 2014 |

(in millions) | | | |

Net income (loss) | $ | 1,154.4 |

| | $ | 35.4 |

|

Adjustments to increase (decrease) net income (loss): | | | |

Income (loss) from discontinued operations | (987.9 | ) | | (10.1 | ) |

Asset write-down charges | 3.6 |

| | 3.1 |

|

Acquisition and integration costs | 2.4 |

| | 19.1 |

|

Depreciation, amortization and accretion | 253.2 |

| | 246.6 |

|

Amortization of prepaid lease purchase price adjustments | 5.1 |

| | 5.7 |

|

Interest expense and amortization of deferred financing costs(a) | 134.5 |

| | 144.5 |

|

Gains (losses) on retirement of long-term obligations | 4.2 |

| | 44.6 |

|

Gains (losses) on foreign currency swaps | (59.8 | ) | | — |

|

Interest income | (0.3 | ) | | (0.1 | ) |

Other income (expense) | (0.2 | ) | | 5.9 |

|

Benefit (provision) for income taxes | (4.1 | ) | | (3.1 | ) |

Stock-based compensation expense | 16.0 |

| | 17.9 |

|

Adjusted EBITDA(b) | $ | 520.9 |

| | $ | 509.5 |

|

| |

(a) | See the reconciliation of "components of interest expense and amortization of deferred financing costs" herein for a discussion of non-cash interest expense. |

| |

(b) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

Adjusted EBITDA for the quarter ending September 30, 2015 and the year ending December 31, 2015 are forecasted as follows:

|

| | | |

| Q3 2015 | | Full Year 2015 |

(in millions) | Outlook | | Outlook |

Net income (loss) | $90 to $123 | | $1,463 to $1,542 |

Adjustments to increase (decrease) net income (loss): | | | |

Income (loss) from discontinued operations | $0 to $0 | | $(1,001) to $(1,001) |

Asset write-down charges | $4 to $6 | | $17 to $27 |

Acquisition and integration costs | $2 to $5 | | $9 to $12 |

Depreciation, amortization and accretion | $251 to $256 | | $1,000 to $1,020 |

Amortization of prepaid lease purchase price adjustments | $4 to $6 | | $19 to $21 |

Interest expense and amortization of deferred financing costs(a) | $125 to $130 | | $513 to $528 |

Gains (losses) on retirement of long-term obligations | $0 to $0 | | $4 to $4 |

Gains (losses) on foreign currency swaps | $0 to $0 | | $(60) to $(60) |

Interest income | $(2) to $0 | | $(2) to $0 |

Other income (expense) | $(1) to $2 | | $0 to $2 |

Benefit (provision) for income taxes | $(6) to $(2) | | $(17) to $(9) |

Stock-based compensation expense | $15 to $17 | | $63 to $68 |

Adjusted EBITDA(b) | $510 to $515 | | $2,073 to $2,088 |

| |

(a) | See the reconciliation of "components of interest expense and amortization of deferred financing costs" herein for a discussion of non-cash interest expense. |

| |

(b) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 9 |

FFO and AFFO for the quarter ending September 30, 2015 and the year ending December 31, 2015 are forecasted as follows:

|

| | | |

| Q3 2015 | | Full Year 2015 |

(in millions, except share and per share amounts) | Outlook | | Outlook |

Net income(a) | $90 to $123 | | $462 to $541 |

Real estate related depreciation, amortization and accretion | $248 to $251 | | $986 to $1,001 |

Asset write-down charges | $4 to $6 | | $17 to $27 |

Dividends on preferred stock | $(11) to $(11) | | $(44) to $(44) |

FFO(c)(d)(f) | $347 to $352 | | $1,463 to $1,478 |

| | | |

FFO (from above) | $347 to $352 | | $1,463 to $1,478 |

Adjustments to increase (decrease) FFO: | | | |

Straight-line revenue | $(30) to $(25) | | $(118) to $(103) |

Straight-line expense | $21 to $26 | | $88 to $103 |

Stock-based compensation expense | $15 to $17 | | $63 to $68 |

Non-cash portion of tax provision | $(8) to $(3) | | $(34) to $(19) |

Non-real estate related depreciation, amortization and accretion | $3 to $5 | | $14 to $19 |

Amortization of non-cash interest expense | $7 to $12 | | $32 to $43 |

Other (income) expense | $(1) to $2 | | $0 to $2 |

Gains (losses) on retirement of long-term obligations | $0 to $0 | | $4 to $4 |

Gains (losses) on foreign currency swaps | $0 to $0 | | $(60) to $(60) |

Acquisition and integration costs | $2 to $5 | | $9 to $12 |

Capital improvement capital expenditures | $(12) to $(10) | | $(41) to $(36) |

Corporate capital expenditures | $(19) to $(17) | | $(55) to $(50) |

AFFO(c)(d)(f) | $341 to $346 | | $1,405 to $1,420 |

Weighted average common shares outstanding — diluted(b)(e) | 333.7 | | 333.7 |

AFFO per share(c)(f) | $1.02 to $1.04 | | $4.21 to $4.25 |

| |

(a) | For full year 2015 Outlook, net income is exclusive of income from discontinued operations of $1.0 billion and related noncontrolling interest. |

| |

(b) | Based on diluted shares outstanding as of June 30, 2015. |

| |

(c) | See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion for our definitions of FFO and AFFO. |

| |

(d) | FFO and AFFO are reduced by cash paid for preferred stock dividends. |

| |

(e) | The diluted weighted average common shares outstanding assumes no conversion of preferred stock in the share count. |

| |

(f) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 10 |

Organic Site Rental Revenue growth for the year ending December 31, 2015 is forecasted as follows:

|

| | | | | | | |

| Midpoint of Full Year | | |

(in millions of dollars) | 2015 Outlook | | Full Year 2014 |

GAAP site rental revenues | $ | 2,954 |

| | $ | 2,867 |

|

Site rental straight-line revenues | (111 | ) | | (183 | ) |

Other - Non-recurring | — |

| | (5 | ) |

Site Rental Revenues, as Adjusted(a)(c) | $ | 2,844 |

| | $ | 2,678 |

|

Cash adjustments: | | | |

Other | — |

| | |

New tower acquisitions and builds(b) | (20 | ) | | |

Organic Site Rental Revenues(a)(c)(d) | $ | 2,823 |

| | |

Year-Over-Year Revenue Growth | | | |

GAAP site rental revenues | 3.0 | % | | |

Site Rental Revenues, as Adjusted | 6.2 | % | | |

Organic Site Rental Revenues(e)(f) | 5.4 | % | | |

| |

(a) | Includes amortization of prepaid rent. |

| |

(b) | The financial impact of new tower acquisitions and builds is excluded from organic site rental revenues until the one-year anniversary of the acquisition or build. |

| |

(c) | Includes Site Rental Revenues, as Adjusted, from the construction of new small cell nodes. |

| |

(d) | See "Non-GAAP Financial Measures and Other Calculations" herein. |

| |

(e) | Year-over-year Organic Site Rental Revenue growth for the year ending December 31, 2015: |

|

| | |

| Midpoint of Full Year 2015 Outlook |

New leasing activity | 6.0 | % |

Escalators | 3.4 | % |

Organic Site Rental Revenue growth, before non-renewals | 9.4 | % |

Non-renewals | (4.0 | )% |

Organic Site Rental Revenue growth | 5.4 | % |

| |

(f) | Calculated as the percentage change from Site Rental Revenues, as Adjusted, for the prior period when compared to Organic Site Rental Revenue for the current period. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 11 |

Organic Site Rental Revenue growth for the quarter ended June 30, 2015 is as follows:

|

| | | | | | | |

| Three Months Ended June 30, |

(in millions of dollars) | 2015 | | 2014 |

Reported GAAP site rental revenues | $ | 737 |

| | $ | 711 |

|

Site rental straight-line revenues | (31 | ) | | (50 | ) |

Other - Non-recurring | — |

| | — |

|

Site Rental Revenues, as Adjusted(a)(c) | $ | 706 |

| | $ | 661 |

|

Cash adjustments: | | | |

Other | — |

| | |

New tower acquisitions and builds(b) | (6 | ) | | |

Organic Site Rental Revenues(a)(c)(d) | $ | 700 |

| | |

Year-Over-Year Revenue Growth | | | |

Reported GAAP site rental revenues | 3.7 | % | | |

Site Rental Revenues, as Adjusted | 6.8 | % | | |

Organic Site Rental Revenues(e)(f) | 5.9 | % | | |

| |

(a) | Includes amortization of prepaid rent. |

| |

(b) | The financial impact of new tower acquisitions and builds is excluded from organic site rental revenues until the one-year anniversary of the acquisition or build. |

| |

(c) | Includes Site Rental Revenues, as Adjusted from the construction of new small cell nodes. |

| |

(d) | See "Non-GAAP Financial Measures and Other Calculations" herein. |

| |

(e) | Quarter-over-quarter Organic Site Rental Revenue growth for the quarter ending June 30, 2015: |

|

| | |

| Three Months Ended June 30, 2015 |

New leasing activity | 6.3 | % |

Escalators | 3.4 | % |

Organic Site Rental Revenue growth, before non-renewals | 9.8 | % |

Non-renewals | (3.8 | )% |

Organic Site Rental Revenue Growth | 5.9 | % |

| |

(f) | Calculated as the percentage change from Site Rental Revenues, as Adjusted, for the prior period when compared to Organic Site Rental Revenues for the current period. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 12 |

FFO and AFFO for the three and six months ended June 30, 2015 and 2014 are computed as follows:

|

| | | | | | | | | | | | | | | |

| For the Three Months | | For the Six Months Ended |

(in millions, except share and per share amounts) | June 30, 2015 | | June 30, 2014 | | June 30, 2015 | | June 30, 2014 |

Net income(a) | $ | 166.5 |

| | $ | 25.3 |

| | $ | 278.3 |

| | $ | 118.5 |

|

Real estate related depreciation, amortization and accretion | 248.9 |

| | 243.1 |

| | 496.5 |

| | 484.9 |

|

Asset write-down charges | 3.6 |

| | 3.1 |

| | 12.2 |

| | 5.7 |

|

Dividends on preferred stock | (11.0 | ) | | (11.0 | ) | | (22.0 | ) | | (22.0 | ) |

FFO(b)(c)(e) | $ | 408.1 |

| | $ | 260.5 |

| | $ | 765.0 |

| | $ | 587.2 |

|

Weighted average common shares outstanding — diluted(d) | 333.7 |

| | 333.1 |

| | 333.7 |

| | 333.0 |

|

FFO per share(b)(e) | $ | 1.22 |

| | $ | 0.78 |

| | $ | 2.29 |

| | $ | 1.76 |

|

| | | | | | | |

FFO (from above) | $ | 408.1 |

| | $ | 260.5 |

| | $ | 765.0 |

| | $ | 587.2 |

|

Adjustments to increase (decrease) FFO: | | | | | | | |

Straight-line revenue | (31.3 | ) | | (49.8 | ) | | (61.9 | ) | | (99.0 | ) |

Straight-line expense | 25.0 |

| | 26.7 |

| | 49.6 |

| | 51.9 |

|

Stock-based compensation expense | 16.0 |

| | 17.9 |

| | 32.8 |

| | 29.8 |

|

Non-cash portion of tax provision | (10.8 | ) | | (5.1 | ) | | (14.4 | ) | | (9.9 | ) |

Non-real estate related depreciation, amortization and accretion | 4.2 |

| | 3.5 |

| | 8.4 |

| | 6.9 |

|

Amortization of non-cash interest expense | 12.1 |

| | 20.6 |

| | 23.8 |

| | 41.5 |

|

Other (income) expense | (0.2 | ) | | 5.9 |

| | 0.1 |

| | 8.7 |

|

Gains (losses) on retirement of long-term obligations | 4.2 |

| | 44.6 |

| | 4.2 |

| | 44.6 |

|

Gains (losses) on foreign currency swaps | (59.8 | ) | | — |

| | (59.8 | ) | | — |

|

Acquisition and integration costs | 2.4 |

| | 19.1 |

| | 4.4 |

| | 24.8 |

|

Capital improvement capital expenditures | (10.7 | ) | | (4.1 | ) | | (18.2 | ) | | (7.9 | ) |

Corporate capital expenditures | (16.8 | ) | | (7.6 | ) | | (26.0 | ) | | (15.1 | ) |

AFFO(b)(c)(e) | $ | 342.4 |

| | $ | 332.3 |

| | $ | 708.1 |

| | $ | 663.5 |

|

Weighted average common shares outstanding — diluted(d) | 333.7 |

| | 333.1 |

| | 333.7 |

| | 333.0 |

|

AFFO per share(b)(e) | $ | 1.03 |

| | $ | 1.00 |

| | $ | 2.12 |

| | $ | 1.99 |

|

| |

(a) | Exclusive of income from discontinued operations and related noncontrolling interest of $988 million and $10 million for the three months ended June 30, 2015 and 2014, respectively and $1.0 billion and $20 million for the six months ended June 30, 2015 and 2014, respectively. |

| |

(b) | See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion of our definitions of FFO and AFFO. |

| |

(c) | FFO and AFFO are reduced by cash paid for preferred stock dividends. |

| |

(d) | The diluted weighted average common shares outstanding assumes no conversion of preferred stock in the share count. |

| |

(e) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 13 |

The midpoint of the Previous Second Quarter 2015 Outlook and Previous Full Year 2015 Outlook for Adjusted EBITDA adjusted to reflect CCAL as a discounted operation are reconciled as follows:

|

| | | |

| Q2 2015 | | Full Year 2015 |

(in millions) | Adjusted Previous Outlook | | Adjusted Previous Outlook |

Net income (loss) | $78 to $111 | | $367 to $446 |

Adjustments to increase (decrease) net income (loss): | | | |

Asset write-down charges | $4 to $6 | | $19 to $29 |

Acquisition and integration costs | $0 to $3 | | $4 to $4 |

Depreciation, amortization and accretion | $250 to $255 | | $996 to $1,016 |

Amortization of prepaid lease purchase price adjustments | $4 to $6 | | $19 to $21 |

Interest expense and amortization of deferred financing costs | $133 to $138 | | $531 to $546 |

Gains (losses) on retirement of long-term obligations | $0 to $0 | | $0 to $0 |

Interest income | $(2) to $0 | | $(3) to $(1) |

Other income (expense) | $(1) to $2 | | $1 to $3 |

Benefit (provision) for income taxes | $(3) to $1 | | $(15) to $(7) |

Stock-based compensation expense | $15 to $17 | | $63 to $68 |

Adjusted EBITDA(a) | $509 | | $2,054 |

| |

(a) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The midpoint of the Previous Second Quarter 2015 Outlook and Previous Full Year 2015 Outlook for FFO and AFFO adjusted to reflect CCAL as a discounted operation are reconciled as follows:

|

| | | |

| Q2 2015 | | Full Year 2015 |

(in millions, except share and per share amounts) | Adjusted Previous Outlook | | Adjusted Previous Outlook |

Net income | $78 to $111 | | $367 to $446 |

Real estate related depreciation, amortization and accretion | $247 to $250 | | $982 to $997 |

Asset write-down charges | $4 to $6 | | $19 to $29 |

Dividends on preferred stock | $(11) to $(11) | | $(44) to $(44) |

FFO(a)(b)(e) | $339 to $344 | | $1,387 to $1,402 |

| | | |

FFO (from above) | $339 to $344 | | $1,387 to $1,402 |

Adjustments to increase (decrease) FFO: | | | |

Straight-line revenue | $(34) to $(29) | | $(117) to $(102) |

Straight-line expense | $22 to $27 | | $86 to $101 |

Stock-based compensation expense | $15 to $17 | | $63 to $68 |

Non-cash portion of tax provision | $(9) to $(4) | | $(30) to $(15) |

Non-real estate related depreciation, amortization and accretion | $3 to $5 | | $14 to $19 |

Amortization of non-cash interest expense | $10 to $15 | | $30 to $41 |

Other (income) expense | $(1) to $2 | | $1 to $3 |

Acquisition and integration costs | $0 to $3 | | $4 to $4 |

Capital improvement capital expenditures | $(11) to $(9) | | $(40) to $(35) |

Corporate capital expenditures | $(10) to $(8) | | $(34) to $(29) |

AFFO(a)(b)(e) | $339 | | $1,399 |

Weighted average common shares outstanding — diluted(d) | 333.9 | | 333.9 |

AFFO per share(a)(e) | $1.02 | | $4.19 |

| |

(a) | Based on diluted shares outstanding as of March 31, 2015. |

| |

(b) | See "Non-GAAP Financial Measures and Other Calculations" herein for a discussion for our definitions of FFO and AFFO. |

| |

(c) | FFO and AFFO are reduced by cash paid for preferred stock dividends. |

| |

(d) | The diluted weighted average common shares outstanding assumes no conversion of preferred stock in the share count. |

| |

(e) | The above reconciliation excludes line items included in our definition which are not applicable for the periods shown. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 14 |

The impact of CCAL discontinued operations on our previously issued guidance for the quarter ending June 30, 2015 is as follows:

|

| | | | | |

(in millions, except per share amount) | Midpoint as previously issued(a) | | CCAL Impact | | Midpoint as adjusted |

Site rental revenues | $770 | | $35 | | $735 |

Site rental gross margin | $526 | | $27 | | $499 |

Adjusted EBITDA | $534 | | $25 | | $509 |

AFFO | $351 | | $12 | | $339 |

AFFO per share(b) | $1.05 | | $0.03 | | $1.02 |

| |

(a) | As previously issued on April 22, 2015. |

| |

(b) | Based on diluted shares outstanding as of March 31, 2015. |

The impact of CCAL discontinued operations on our previously issued guidance for the year ending December 31, 2015 is as follows:

|

| | | | | |

(in millions, except per share amount) | Midpoint as previously issued(a) | | CCAL Impact | | Midpoint as adjusted |

Site rental revenues | $3,075 | | $142 | | $2,933 |

Site rental gross margin | $2,099 | | $107 | | $1,992 |

Adjusted EBITDA | $2,153 | | $99 | | $2,054 |

AFFO | $1,458 | | $59 | | $1,399 |

AFFO per share(b) | $4.37 | | $0.18 | | $4.19 |

| |

(a) | As previously issued on April 22, 2015. |

| |

(b) | Based on diluted shares outstanding as of March 31, 2015. |

The components of interest expense and amortization of deferred financing costs for the three months ended June 30, 2015 and 2014 are as follows:

|

| | | | | | | |

| For the Three Months Ended |

(in millions) | June 30, 2015 | | June 30, 2014 |

Interest expense on debt obligations | $ | 122.4 |

| | $ | 123.9 |

|

Amortization of deferred financing costs | 5.6 |

| | 5.5 |

|

Amortization of adjustments on long-term debt | (0.4 | ) | | (0.9 | ) |

Amortization of interest rate swaps(a) | 7.5 |

| | 16.2 |

|

Other, net | (0.6 | ) | | (0.2 | ) |

Interest expense and amortization of deferred financing costs | $ | 134.5 |

| | $ | 144.5 |

|

| |

(a) | Relates to the amortization of interest rate swaps; the swaps were cash settled in prior periods. |

The components of interest expense and amortization of deferred financing costs for the quarter ending September 30, 2015 and the year ending December 31, 2015 are forecasted as follows:

|

| | | |

| Q3 2015 | | Full Year 2015 |

(in millions) | Outlook | | Outlook |

Interest expense on debt obligations | $118 to $120 | | $478 to $488 |

Amortization of deferred financing costs | $4 to $6 | | $21 to $23 |

Amortization of adjustments on long-term debt | $0 to $1 | | $(2) to $0 |

Amortization of interest rate swaps(a) | $3 to $5 | | $16 to $21 |

Other, net | $0 to $0 | | $(3) to $(1) |

Interest expense and amortization of deferred financing costs | $125 to $130 | | $513 to $528 |

| |

(a) | Relates to the amortization of interest rate swaps, all of which has been cash settled in prior periods. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 15 |

Debt balances and maturity dates as of June 30, 2015 are as follows:

|

| | | | | |

(in millions) | | | |

| Face Value | | Final Maturity |

Revolver | $ | — |

| | Jan 2019 |

Term Loan A | 637.7 |

| | Jan 2019 |

Term Loan B | 2,258.5 |

| | Jan. 2021 |

4.875% Senior Notes | 850.0 |

| | Apr. 2022 |

5.25% Senior Notes | 1,650.0 |

| | Jan. 2023 |

2012 Secured Notes(a) | 1,500.0 |

| | Dec. 2017/Apr. 2023 |

Senior Secured Notes, Series 2009-1(b) | 151.2 |

| | Various(b) |

Senior Secured Tower Revenue Notes, Series 2010-2-2010-3(c) | 1,600.0 |

| | Various(c) |

Senior Secured Tower Revenue Notes, Series 2010-5-2010-6(d) | 1,300.0 |

| | Various(d) |

Senior Secured Tower Revenue Notes, Series 2015-1-2015-2(e) | 1,000.0 |

| | Various(e) |

Capital Leases and Other Obligations | 187.7 |

| | Various |

Total debt | $ | 11,135.0 |

| | |

Less: Cash and Cash Equivalents(f) | $ | 338.6 |

| | |

Net debt | $ | 10,796.4 |

| | |

| |

(a) | The 2012 Secured Notes consist of $500 million aggregate principal amount of 2.381% secured notes due 2017 and $1.0 billion aggregate principal amount of 3.849% secured notes due 2023. |

| |

(b) | The Senior Secured Notes, Series 2009-1 consist of $81.2 million of principal as of June 30, 2015 that amortizes during the period beginning January 2010 and ending in 2019, and $70.0 million of principal that amortizes during the period beginning in 2019 and ending in 2029. |

| |

(c) | The Senior Secured Tower Revenue Notes Series 2010-2 and 2010-3 have principal amounts of $350.0 million and $1.25 billion with anticipated repayment dates of 2017 and 2020, respectively. |

| |

(d) | The Senior Secured Tower Revenue Notes Series 2010-5 and 2010-6 have principal amounts of $300.0 million and $1.0 billion with anticipated repayment dates of 2017 and 2020, respectively. |

| |

(e) | The Senior Secured Tower Revenue Notes Series 2015-1 and 2015-2 have principal amounts of $300.0 million and $700.0 million with anticipated repayment dates of 2022 and 2025, respectively. |

| |

(f) | Excludes restricted cash. |

Net debt to Last Quarter Annualized Adjusted EBITDA is computed as follows:

|

| | | |

(in millions) | For the Three Months Ended June 30, 2015 |

Total face value of debt | $ | 11,135.0 |

|

Ending cash and cash equivalents | 338.6 |

|

Total net debt | $ | 10,796.4 |

|

| |

Adjusted EBITDA for the three months ended June 30, 2015 | $ | 520.9 |

|

Last quarter annualized adjusted EBITDA | 2,083.7 |

|

Net debt to Last Quarter Annualized Adjusted EBITDA | 5.2 | x |

Sustaining capital expenditures for the three months ended June 30, 2015 and 2014 is computed as follows:

|

| | | | | | | |

| For the Three Months Ended |

(in millions) | June 30, 2015 | | June 30, 2014 |

Capital Expenditures | $ | 219.2 |

| | $ | 160.5 |

|

Less: Land purchases | 28.3 |

| | 21.0 |

|

Less: Wireless infrastructure construction and improvements | 163.5 |

| | 127.7 |

|

Sustaining capital expenditures | $ | 27.4 |

| | $ | 11.8 |

|

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 16 |

Cautionary Language Regarding Forward-Looking Statements

This press release contains forward-looking statements and information that are based on our management's current expectations. Such statements include, but are not limited to, plans, projections, Outlook and estimates regarding (1) potential benefits, returns and shareholder value which may be derived from our business, assets, investments, dividends and acquisitions, (2) the pending Sunesys acquisition, including potential benefits and impact therefrom and the growth, financing and timing related thereto, (3) our strategy and strategic position, (4) the US wireless market, (5) wireless consumer demand, (6) demand for our wireless infrastructure and services, (7) carrier network investments and upgrades, and the benefits which may be derived therefrom, (8) our growth, (9) our dividends, including our dividend plans, the amount and growth of our dividends, the potential benefits therefrom and the tax characterization thereof, (10) leasing activity, including the impact of such leasing activity on our results and Outlook, (11) capital allocation, (12) net operating loss carryforward, including the utilization thereof, (13) our investments, including in small cells, and the potential benefits therefrom, (14) non-renewal of leases and decommissioning of networks, including timing, the impact thereof and decommissioning fees, (15) capital expenditures, including sustaining capital expenditures, (16) timing items, (17) general and administrative expense, (18) site rental revenues and Site Rental Revenues, as Adjusted, (19) site rental cost of operations, (20) site rental gross margin and network services gross margin, (21) Adjusted EBITDA, (22) interest expense and amortization of deferred financing costs, (23) FFO, including on a per share basis, (24) AFFO, including on a per share basis, (25) Organic Site Rental Revenues and Organic Site Rental Revenue growth, (26) net income (loss), including on a per share basis, (27) our common shares outstanding, including on a diluted basis, and (28) the utility of certain financial measures, including non-GAAP financial measures. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including but not limited to prevailing market conditions and the following:

| |

• | Our business depends on the demand for wireless communications and wireless infrastructure, and we may be adversely affected by any slowdown in such demand. Additionally, a reduction in carrier network investment may materially and adversely affect our business (including reducing demand for new tenant additions and network services). |

| |

• | A substantial portion of our revenues is derived from a small number of customers, and the loss, consolidation or financial instability of any of our limited number of customers may materially decrease revenues or reduce demand for our wireless infrastructure and network services. |

| |

• | Our substantial level of indebtedness could adversely affect our ability to react to changes in our business, and the terms of our debt instruments and 4.50% Mandatory Convertible Preferred Stock limit our ability to take a number of actions that our management might otherwise believe to be in our best interests. In addition, if we fail to comply with our covenants, our debt could be accelerated. |

| |

• | We have a substantial amount of indebtedness. In the event we do not repay or refinance such indebtedness, we could face substantial liquidity issues and might be required to issue equity securities or securities convertible into equity securities, or sell some of our assets to meet our debt payment obligations. |

| |

• | Sales or issuances of a substantial number of shares of our common stock may adversely affect the market price of our common stock. |

| |

• | As a result of competition in our industry, including from some competitors with significantly more resources or less debt than we have, we may find it more difficult to achieve favorable rental rates on our new or renewing customer contracts. |

| |

• | The business model for our small cell operations contains differences from our traditional site rental business, resulting in different operational risks. If we do not successfully operate that business model or identify or manage those operational risks, such operations may produce results that are less than anticipated. |

| |

• | New technologies may significantly reduce demand for our wireless infrastructure and negatively impact our revenues. |

| |

• | New wireless technologies may not deploy or be adopted by customers as rapidly or in the manner projected. |

| |

• | If we fail to retain rights to our wireless infrastructure, including the land under our sites, our business may be adversely affected. |

| |

• | Our network services business has historically experienced significant volatility in demand, which reduces the predictability of our results. |

| |

• | The expansion and development of our business, including through acquisitions, increased product offerings, or other strategic growth opportunities, may cause disruptions in our business, which may have an adverse effect on our business, operations or financial results. |

| |

• | If we fail to comply with laws and regulations which regulate our business and which may change at any time, we may be fined or even lose our right to conduct some of our business. |

| |

• | If radio frequency emissions from wireless handsets or equipment on our wireless infrastructure are demonstrated to cause negative health effects, potential future claims could adversely affect our operations, costs or revenues. |

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 17 |

| |

• | Certain provisions of our certificate of incorporation, bylaws and operative agreements, and domestic and international competition laws may make it more difficult for a third party to acquire control of us or for us to acquire control of a third party, even if such a change in control would be beneficial to our stockholders. |

| |

• | Future dividend payments to our stockholders will reduce the availability of our cash on hand available to fund future discretionary investments, and may result in a need to incur indebtedness or issue equity securities to fund growth opportunities. In such event, the then current economic, credit market or equity market conditions will impact the availability or cost of such financing, which may hinder our ability to grow our per share results of operations. |

| |

• | Remaining qualified to be taxed as a REIT involves highly technical and complex provisions of the US Internal Revenue Code. Failure to remain qualified as a REIT would result in our inability to deduct dividends to stockholders when computing our taxable income, which would reduce our available cash. |

| |

• | Complying with REIT requirements, including the 90% distribution requirement, may limit our flexibility or cause us to forgo otherwise attractive opportunities, including certain discretionary investments and potential financing alternatives. |

| |

• | If we fail to pay scheduled dividends on the 4.50% Mandatory Convertible Preferred Stock, in cash, common stock or any combination of cash and common stock, we will be prohibited from paying dividends on our common stock, which may jeopardize our status as a REIT. |

| |

• | We have limited experience operating as a REIT. Our failure to successfully operate as a REIT may adversely affect our financial condition, cash flow, the per share trading price of our common stock, or our ability to satisfy debt service obligations. |

| |

• | REIT ownership limitations and transfer restrictions may prevent or restrict certain transfers of our capital stock. |

Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. More information about potential risk factors which could affect our results is included in our filings with the SEC.

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 18 |

|

| |

| CROWN CASTLE INTERNATIONAL CORP. CONDENSED CONSOLIDATED BALANCE SHEET (UNAUDITED) (in thousands, except share amounts) |

|

| | | | | | | |

| June 30,

2015 | | December 31,

2014 |

| | | |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 338,609 |

| | $ | 151,312 |

|

Restricted cash | 143,016 |

| | 147,411 |

|

Receivables, net | 253,342 |

| | 313,308 |

|

Prepaid expenses | 138,355 |

| | 138,873 |

|

Deferred income tax assets | 29,842 |

| | 24,806 |

|

Other current assets | 214,396 |

| | 94,503 |

|

Assets from discontinued operations | — |

| | 412,783 |

|

Total current assets | 1,117,560 |

| | 1,282,996 |

|

Deferred site rental receivables | 1,256,517 |

| | 1,202,058 |

|

Property and equipment, net | 9,042,284 |

| | 8,982,783 |

|

Goodwill | 5,160,106 |

| | 5,196,485 |

|

Other intangible assets, net | 3,631,987 |

| | 3,681,551 |

|

Long-term prepaid rent, deferred financing costs and other assets, net | 803,175 |

| | 797,403 |

|

Total assets | $ | 21,011,629 |

| | $ | 21,143,276 |

|

| | | |

LIABILITIES AND EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 153,909 |

| | $ | 162,397 |

|

Accrued interest | 67,067 |

| | 66,943 |

|

Deferred revenues | 313,355 |

| | 279,882 |

|

Other accrued liabilities | 151,211 |

| | 182,081 |

|

Current maturities of debt and other obligations | 94,702 |

| | 113,335 |

|

Liabilities from discontinued operations | — |

| | 127,493 |

|

Total current liabilities | 780,244 |

| | 932,131 |

|

Debt and other long-term obligations | 11,036,602 |

| | 11,807,526 |

|

Deferred income tax liabilities | 35,117 |

| | 39,889 |

|

Other long-term liabilities | 1,755,430 |

| | 1,626,502 |

|

Total liabilities | 13,607,393 |

| | 14,406,048 |

|

Commitments and contingencies |

| |

|

CCIC stockholders' equity: | | | |

Common stock, $.01 par value; 600,000,000 shares authorized; shares issued and outstanding: June 30, 2015—333,762,344 and December 31, 2014—333,856,632 | 3,339 |

| | 3,339 |

|

4.50% Mandatory Convertible Preferred Stock, Series A, $.01 par value; 20,000,000 shares authorized; shares issued and outstanding: June 30, 2015 and December 31, 2014—9,775,000; aggregate liquidation value: June 30, 2015 and December 31, 2014—$977,500 | 98 |

| | 98 |

|

Additional paid-in capital | 9,518,103 |

| | 9,512,396 |

|

Accumulated other comprehensive income (loss) | (6,866 | ) | | 15,820 |

|

Dividends/distributions in excess of earnings | (2,110,438 | ) | | (2,815,428 | ) |

Total CCIC stockholders' equity | 7,404,236 |

| | 6,716,225 |

|

Noncontrolling interest from discontinued operations | — |

| | 21,003 |

|

Total equity | 7,404,236 |

| | 6,737,228 |

|

Total liabilities and equity | $ | 21,011,629 |

| | $ | 21,143,276 |

|

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 19 |

|

| |

| CROWN CASTLE INTERNATIONAL CORP. CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED) (in thousands, except share and per share amounts) |

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Net revenues: | | | | | | | |

Site rental | $ | 737,091 |

| | $ | 710,783 |

| | $ | 1,468,471 |

| | $ | 1,425,575 |

|

Network services and other | 162,346 |

| | 167,459 |

| | 331,437 |

| | 294,430 |

|

Net revenues | 899,437 |

| | 878,242 |

| | 1,799,908 |

| | 1,720,005 |

|

Operating expenses: | | | | | | | |

Costs of operations (exclusive of depreciation, amortization and accretion): | | | | | | | |

Site rental | 237,031 |

| | 227,032 |

| | 469,244 |

| | 445,676 |

|

Network services and other | 89,400 |

| | 101,901 |

| | 176,318 |

| | 173,701 |

|

General and administrative | 73,125 |

| | 63,318 |

| | 147,181 |

| | 121,959 |

|

Asset write-down charges | 3,620 |

| | 3,105 |

| | 12,175 |

| | 5,741 |

|

Acquisition and integration costs | 2,377 |

| | 19,125 |

| | 4,393 |

| | 24,784 |

|

Depreciation, amortization and accretion | 253,153 |

| | 246,583 |

| | 504,959 |

| | 491,759 |

|

Total operating expenses | 658,706 |

| | 661,064 |

| | 1,314,270 |

| | 1,263,620 |

|

Operating income (loss) | 240,731 |

| | 217,178 |

| | 485,638 |

| | 456,385 |

|

Interest expense and amortization of deferred financing costs | (134,466 | ) | | (144,534 | ) | | (268,905 | ) | | (290,934 | ) |

Gains (losses) on retirement of long-term obligations | (4,181 | ) | | (44,629 | ) | | (4,157 | ) | | (44,629 | ) |

Gains (losses) on foreign currency swaps | 59,779 |

| | — |

| | 59,779 |

| | — |

|

Interest income | 325 |

| | 108 |

| | 381 |

| | 222 |

|

Other income (expense) | 194 |

| | (5,920 | ) | | (55 | ) | | (8,656 | ) |

Income (loss) from continuing operations before income taxes | 162,382 |

| | 22,203 |

| | 272,681 |

| | 112,388 |

|

Benefit (provision) for income taxes | 4,144 |

| | 3,101 |

| | 5,579 |

| | 6,141 |

|

Income (loss) from continuing operations | 166,526 |

| | 25,304 |

| | 278,260 |

| | 118,529 |

|

Discontinued operations: | | | | | | | |

Income (loss) from discontinued operations, net of tax | 6,312 |

| | 10,053 |

| | 19,690 |

| | 19,621 |

|

Net gain (loss) from disposal of discontinued operations, net of tax | 981,540 |

| | — |

| | 981,540 |

| | — |

|

Income (loss) from discontinued operations, net of tax | 987,852 |

| | 10,053 |

| | 1,001,230 |

| | 19,621 |

|

Net income (loss) | 1,154,378 |

| | 35,357 |

| | 1,279,490 |

| | 138,150 |

|

Less: Net income (loss) attributable to the noncontrolling interest | 1,018 |

| | 1,348 |

| | 3,343 |

| | 2,644 |

|

Net income (loss) attributable to CCIC stockholders | 1,153,360 |

| | 34,009 |

| | 1,276,147 |

| | 135,506 |

|

Dividends on preferred stock | (10,997 | ) | | (10,997 | ) | | (21,994 | ) | | (21,994 | ) |

Net income (loss) attributable to CCIC common stockholders | $ | 1,142,363 |

| | $ | 23,012 |

| | $ | 1,254,153 |

| | $ | 113,512 |

|

| | | | | | | |

Net income (loss) attributable to CCIC common stockholders, per common share: | | | | | | | |

Income (loss) from continuing operations, basic | $ | 0.47 |

| | $ | 0.04 |

| | $ | 0.77 |

| | $ | 0.29 |

|

Income (loss) from discontinued operations, basic | $ | 2.96 |

| | $ | 0.03 |

| | $ | 3.00 |

| | $ | 0.05 |

|

Net income (loss) attributable to CCIC common stockholders, basic | $ | 3.43 |

| | $ | 0.07 |

| | $ | 3.77 |

| | $ | 0.34 |

|

Income (loss) from continuing operations, diluted | $ | 0.47 |

| | $ | 0.04 |

| | $ | 0.77 |

| | $ | 0.29 |

|

Income (loss) from discontinued operations, diluted | $ | 2.95 |

| | $ | 0.03 |

| | $ | 2.99 |

| | $ | 0.05 |

|

Net income (loss) attributable to CCIC common stockholders, diluted | $ | 3.42 |

| | $ | 0.07 |

| | $ | 3.76 |

| | $ | 0.34 |

|

| | | | | | | |

Weighted-average common shares outstanding (in thousands): | | | | | | | |

Basic | 333,091 |

| | 332,344 |

| | 332,902 |

| | 332,189 |

|

Diluted | 333,733 |

| | 333,081 |

| | 333,665 |

| | 333,034 |

|

The Foundation for a Wireless World.

CrownCastle.com

|

| | |

News Release continued: | | Page 20 |

|

| |

| CROWN CASTLE INTERNATIONAL CORP. CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED) (in thousands) |

|

| | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

Cash flows from operating activities: | | | |

Net income (loss) from continuing operations | $ | 278,260 |

| | $ | 118,529 |

|

Adjustments to reconcile net income (loss) from continuing operations to net cash provided by (used for) operating activities: | | | |

Depreciation, amortization and accretion | 504,959 |

| | 491,759 |

|

Gains (losses) on retirement of long-term obligations | 4,157 |

| | 44,629 |

|

Gains (losses) on foreign currency swaps | (59,779 | ) | | — |

|

Amortization of deferred financing costs and other non-cash interest | 23,804 |

| | 41,485 |

|

Stock-based compensation expense | 30,131 |

| | 27,373 |

|

Asset write-down charges | 12,175 |

| | 5,741 |

|

Deferred income tax benefit (provision) | (10,170 | ) | | (9,882 | ) |

Other non-cash adjustments, net | (1,024 | ) | | (1,468 | ) |

Changes in assets and liabilities, excluding the effects of acquisitions: | | | |

Increase (decrease) in liabilities | 131,661 |

| | 160,585 |

|

Decrease (increase) in assets | 4,704 |

| | (155,815 | ) |

Net cash provided by (used for) operating activities | 918,878 |

| | 722,936 |

|

Cash flows from investing activities: | | | |

Payments for acquisition of businesses, net of cash acquired | (64,725 | ) | | (85,788 | ) |

Capital expenditures | (420,883 | ) | | (299,298 | ) |

Receipts from foreign currency swaps | 54,475 |

| | — |

|

Other investing activities, net | (8,080 | ) | | 2,378 |

|

Net cash provided by (used for) investing activities | (439,213 | ) | | (382,708 | ) |

Cash flows from financing activities: | | | |

Proceeds from issuance of long-term debt | 1,000,000 |

| | 845,750 |

|

Principal payments on debt and other long-term obligations | (53,718 | ) | | (55,385 | ) |

Purchases and redemptions of long-term debt | (1,069,337 | ) | | (836,899 | ) |

Purchases of capital stock | (29,490 | ) | | (21,730 | ) |

Borrowings under revolving credit facility | 450,000 |

| | 494,000 |

|

Payments under revolving credit facility | (1,145,000 | ) | | (534,000 | ) |

Payments for financing costs | (16,348 | ) | | (15,834 | ) |

Net decrease (increase) in restricted cash | 9,093 |

| | 24,386 |

|

Dividends/distributions paid on common stock | (547,371 | ) | | (233,684 | ) |

Dividends paid on preferred stock | (21,994 | ) | | (22,360 | ) |

Net cash provided by (used for) financing activities | (1,424,165 | ) | | (355,756 | ) |

Net increase (decrease) in cash and cash equivalents - continuing operations | (944,500 | ) | | (15,528 | ) |

Discontinued operations: | | | |

Net cash provided by (used for) operating activities | 4,881 |

| | 40,740 |

|

Net cash provided by (used for) investing activities | 1,103,577 |

| | (15,096 | ) |

Net increase (decrease) in cash and cash equivalents - discontinued operations | 1,108,458 |

| | 25,644 |

|

Effect of exchange rate changes | (969 | ) | | (6,031 | ) |

Cash and cash equivalents at beginning of period(a) | 175,620 |

| | 223,394 |

|

Cash and cash equivalents at end of period | $ | 338,609 |

| | $ | 227,479 |

|

Supplemental disclosure of cash flow information: | | | |

Interest paid | 244,977 |

| | 248,183 |

|

Income taxes paid | 8,489 |

| | 12,690 |

|

________________

| |

(a) | Inclusive of cash and cash equivalents included in discontinued operations. |

The Foundation for a Wireless World.

CrownCastle.com

Supplemental Information Package

and Non-GAAP Reconciliations

Second Quarter • June 30, 2015

The Foundation for a Wireless World.

CrownCastle.com

Crown Castle International Corp

Second Quarter 2015

|

| |

TABLE OF CONTENTS |

| Page |

Company Overview | |

Company Profile | |

Strategy | |

Historical Dividend and AFFO per Share | |

Portfolio Footprint | |

Corporate Information | |

Research Coverage | |

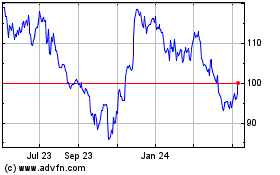

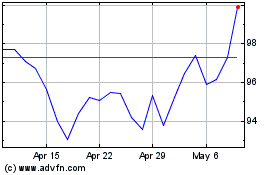

Historical Common Stock Data | |

Portfolio and Financial Highlights | 7 |

Outlook | |

Financials & Metrics | |

Consolidated Balance Sheet | |

Consolidated Statement of Operations | |

FFO and AFFO Reconciliations | |

Consolidated Statement of Cash Flows | |

Site Rental Revenue Growth | |

Site Rental Gross Margin Growth | |

Summary of Straight-Line, Prepaid Rent Activity, and Capital Expenditures | |

Lease Renewal and Lease Distribution | |

Customer Overview | |

Asset Portfolio Overview | |

Summary of Tower Portfolio by Vintage | |

Portfolio Overview | |

Ground Interest Overview | |

Ground Interest Activity | |

Small Cell Network Overview | |

Capitalization Overview | |

Capitalization Overview | |

Debt Maturity Overview | |

Liquidity Overview | |

Maintenance and Financial Covenants | |

Interest Rate Sensitivity | |

Appendix | |

Cautionary Language Regarding Forward-Looking Statements

This supplemental information package ("Supplement") contains forward-looking statements and information that are based on our management's current expectations as of the date of this Supplement. Statements that are not historical facts are hereby identified as forward-looking statements. Words such as "Outlook", "guide", "forecast", "estimate", "anticipate", "project", "plan", "intend", "believe", "expect", "likely", "predicted", and any variations of these words and similar expressions are intended to identify such forward looking statements. Such statements include, but are not limited to, our Outlook for the third quarter 2015 and full year 2015 .

Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including, but not limited to, prevailing market conditions. Should one or more of these or other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. More information about potential risk factors which could affect our results is included in our filings with the Securities and Exchange Commission. Crown Castle assumes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

The components of financial information presented herein, both historical and forward looking, may not sum due to rounding. Definitions and reconciliations of non-GAAP measures, including FFO and AFFO, are provided in the Appendix to this Supplement.

As used herein, the term "including" and any variation thereof, means "including without limitation." The use of the word "or" herein is not exclusive.

Crown Castle International Corp.

Second Quarter 2015

|

| | | | |

COMPANY OVERVIEW | FINANCIALS & METRICS | ASSET PORTFOLIO OVERVIEW | CAPITALIZATION OVERVIEW | APPENDIX |

Crown Castle International Corp. (to which the terms "Crown Castle," "CCIC," "we," "our," "our Company," "the Company" or "us" as used herein refer) owns, operates and leases shared wireless infrastructure, including: (1) towers and other structures, such as rooftops (collectively, "towers"), and to a lesser extent, (2) distributed antenna systems, a type of small cell network ("small cells"), and (3) interests in land under third party towers in various forms ("third party land interests") (collectively, "wireless infrastructure"). Crown Castle offers significant wireless communications coverage in each of the top 100 US markets. Crown Castle owns, operates and manages approximately 40,000 towers in the US.

Our core business is providing access, including space or capacity, to our wireless infrastructure via long-term contracts in various forms, including license, sublease and lease agreements (collectively, "leases"). Our wireless infrastructure can accommodate multiple customers for antennas or other equipment necessary for the transmission of signals for wireless communication devices. We seek to increase our site rental revenues by adding more tenants on our wireless infrastructure, which we expect to result in significant incremental cash flows due to our relatively fixed operating costs.

Effective January 1, 2014, Crown Castle commenced operating as a Real Estate Investment Trust ("REIT") for U.S. federal income tax purposes as it relates to our towers and third party land interests. In August 2014, we received a favorable private letter ruling from the IRS, which provides that the real property portion of our small cells and the related rents qualify as real property and rents from real property, respectively, under the rules governing REITs. We are evaluating the impact of this private letter ruling and, subject to board approval, we expect to take appropriate action to include at least some part of our small cells as part of the REIT during 2015.