Current Report Filing (8-k)

April 29 2015 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 28, 2015

Crown Castle International Corp.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-16441 |

|

76-0470458 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

1220 Augusta Drive

Suite 600

Houston, TX

77057

(Address of Principal Executive Office)

Registrant’s telephone number, including area code: (713) 570-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 7.01 – REGULATION FD DISCLOSURE

On April 28, 2015, the Company issued a press release announcing that certain of its indirect subsidiaries intend to offer, in a private transaction and

subject to market conditions, an amount to be determined of Senior Secured Tower Revenue Notes. The press release is furnished herewith as Exhibit 99.1 to this Form 8-K.

ITEM 9.01 – FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

As described in Item 7.01 of this Report, the

following exhibits are furnished as part of this Current Report on Form 8-K:

|

|

|

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release dated April 28, 2015 |

The information in Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the

Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| CROWN CASTLE INTERNATIONAL CORP. |

|

|

| By: |

|

/s/ E. Blake Hawk |

| Name: E. Blake Hawk |

| Title: Executive Vice President and General Counsel |

Date: April 28, 2015

2

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated April 28, 2015 |

3

Exhibit 99.1

|

|

|

|

|

|

|

|

|

NEWS RELEASE April 28,

2015 |

|

|

|

|

|

|

|

Contacts: |

|

Jay Brown, CFO |

|

|

|

|

Son Nguyen, VP – Corporate Finance |

| FOR IMMEDIATE RELEASE |

|

|

|

Crown Castle International Corp. |

|

|

|

|

713-570-3050 |

CROWN CASTLE ANNOUNCES

POTENTIAL SUBSIDIARY NOTES OFFERING

April 28, 2015 — HOUSTON, TEXAS — Crown Castle International Corp. (NYSE: CCI) (“Crown Castle”) announced today that

certain of its indirect subsidiaries intend to offer, in a private transaction and subject to market conditions, an amount to be determined of Senior Secured Tower Revenue Notes (“Offered Notes”), as additional debt securities under the

existing Indenture dated as of June 1, 2005, as amended and supplemented (“Indenture”), pursuant to which the Senior Secured Tower Revenue Notes, Series 2010-2, Series 2010-3, Series 2010-4, Series 2010-5 and Series 2010-6

(“Series 2010 Notes”), were issued. The subsidiaries expected to issue the Offered Notes are special purpose entities that are the current issuers under the Indenture and that hold over a quarter of the U.S., including Puerto Rico, towers

of Crown Castle. Crown Castle expects that any Offered Notes issued will be rated investment grade. The servicing and repayment of any such Offered Notes are expected to be made solely from the cash flow from the operation of the U.S. towers that

are part of the transaction.

Crown Castle expects to use the net proceeds received from such offering to retire the 2010-4 Notes, pay

fees and expenses related to the offering of the Offered Notes and the retirement of the 2010-4 Notes and for general corporate purposes.

This press release is not an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Offered Notes in any

jurisdiction in which any such offer, solicitation, or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. The Offered Notes will be offered to qualified institutional buyers under

Rule 144A, to persons outside of the U.S. under Regulation S and to institutional investors that are Accredited Investors under Rule 501. The Offered Notes will not be registered under the Securities Act of 1933, as amended (“Securities

Act”), or any state securities laws, and, unless so registered, may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws.

The Foundation for a

Wireless World.

CrownCastle.com

|

|

|

| News Release continued: |

|

Page 2 |

ABOUT CROWN CASTLE

Crown Castle provides wireless carriers with the infrastructure they need to keep people connected and businesses running. With approximately

40,000 towers and 14,000 small cell nodes supported by approximately 7,000 miles of fiber, Crown Castle is the nation’s largest provider of shared wireless infrastructure with a significant presence in the top 100 U.S. markets. In addition,

Crown Castle operates approximately 1,800 towers in Australia. For more information on Crown Castle, please visit www.crowncastle.com.

Cautionary Language Regarding Forward Looking Statements

This press release contains forward-looking statements that are based on Crown Castle management’s current expectations. Such statements

include plans, projections and estimates regarding (i) the proposed offering of the Offered Notes, (ii) the rating of the Offered Notes, (iii) the terms of the Offered Notes, including with respect to servicing and repayment and

(iv) the use of proceeds from the Offered Notes. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including prevailing market conditions and other factors. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. More information about potential risk factors that could affect Crown Castle’s results is included in our

filings with the Securities and Exchange Commission. The term “including”, and any variation thereof, means “including, without limitation”.

The Foundation for a

Wireless World.

CrownCastle.com

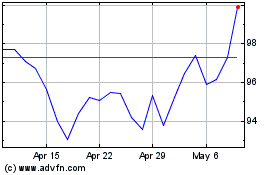

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

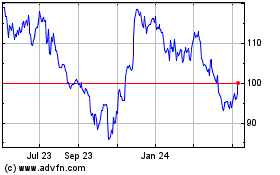

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024