Caterpillar Gives Strong Profit Outlook Despite Revenue Weakness--Update

January 28 2016 - 8:30AM

Dow Jones News

By Chelsey Dulaney

Caterpillar Inc. on Thursday gave a strong profit outlook for

2016, even as the company cut its sales guidance as it struggles

with weak demand for its equipment used in mining and oil

drilling.

The Peoria, Ill., maker of heavy equipment and engines also

reported better-than-expected adjusted earnings for its fourth

quarter, though its revenue missed expectations.

Shares rose 6.5% to $62.10 a share in premarket trading.

Caterpillar said it now expects its revenue to fall by about 10%

to a range of $40 billion to $44 billion. In October, the company

had forecast a 5% sales decline for 2016, with lower sales of

mining equipment accounting for two-thirds of the damage. The

decline would mark its fourth straight year of lower sales, a

record for the company.

The company, which is already planning to cut thousands of jobs

in the coming years, said it will book $400 million in

restructuring charges in 2016 to lower its cost structure.

Still, Caterpillar forecast earnings of $4 a share for 2016

excluding those restructuring charges. Analysts polled by Thomson

Reuters had forecast $3.48 a share in adjusted earnings. Lower

pension and post-employment benefit costs, due to an accounting

change, are expected to boost profit.

Chief Executive Doug Oberhelman, in prepared remarks, gave a

tempered take on the company's outlook, saying it "reflects

struggling oil and other commodity markets, and continued economic

weakness in developing countries....While the U.S. and European

economies are showing signs of stability, the global economy

remains under pressure."

Caterpillar is facing tough conditions across a number of its

markets. Weakening economic growth in the U.S. is driving down

construction activity, while lower gas and oil prices have pulled

down sales of Caterpillar machinery and engines used at frack well

sites in North America.

A dismal economy in Brazil and weaker economic growth in China

have choked sales in two of Caterpillar's key overseas markets.

For the fourth quarter ended Dec. 31, Caterpillar swung to a

loss of $87 million, or 15 cents a share, compared with a

prior-year profit of $757 million, or $1.23 a share.

Excluding restructuring costs, which totaled about 89 cents a

share, the company reported earnings of 74 cents a share. Analysts

polled by Thomson Reuters had forecast 69 cents a share in

earnings.

Revenue, including revenue from financing, tumbled 23% to $11.03

billion. Analysts had forecast $11.43 billion in revenue.

Caterpillar said sales in the quarter declined across all of its

regions and segments. North American sales fell 26% amid declines

in energy & transportation. In its Europe, Africa and Middle

East division, sales fell 20%, hurt in part by currency impacts.

Latin America posted the largest sales decline, with weakness in

Brazil contributing to a 36% year-over-year decline for the

region.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 28, 2016 08:15 ET (13:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

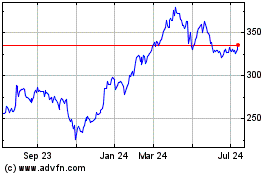

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

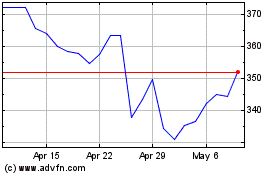

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024