UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

February 1, 2016

|

ConAgra Foods, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

1-7275

|

47-0248710

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

One ConAgra Drive, Omaha, Nebraska

|

|

68102

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

402-240-4000

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01 Completion of Acquisition or Disposition of Assets.

On February 1, 2016, pursuant to the Stock Purchase Agreement, dated as of November 1, 2015 (the "Agreement"), by and between ConAgra Foods, Inc. (the "Company") and TreeHouse Foods, Inc. ("TreeHouse"), the Company completed its previously announced disposition of its private label operations (the "Business") to TreeHouse (the "Transaction") for $2.7 billion in cash on a cash-free, debt-free basis, subject to working capital and other adjustments.

Concurrently with the closing of the Transaction, the Company and TreeHouse, and/or their respective affiliates, entered into a transition services agreement and certain other commercial arrangements.

The foregoing description of the Agreement does not purport to be complete, and is qualified in its entirety by reference to the full text of the Agreement, which was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on November 2, 2015, which is incorporated herein by reference.

A copy of the Agreement has been incorporated by reference to provide investors and stockholders with information regarding its terms and is not intended to provide any factual information about the Company or TreeHouse or any of their respective subsidiaries or affiliates. The representations, warranties and covenants contained in the Agreement have been made solely for the purposes of the Agreement and as of specific dates; were solely for the benefit of the parties to the Agreement; are not intended as statements of fact to be relied upon by the Company’s or TreeHouse’s investors or stockholders, but rather as a way of allocating contractual risk and governing the contractual rights and relationships between the parties to the Agreement; have been modified or qualified by certain confidential disclosures that were made between the parties in connection with the negotiation of the Agreement, which disclosures are not reflected in the Agreement itself; may no longer be true as of a given date; and may apply standards of materiality in a way that is different from what may be viewed as material by investors or stockholders. Investors and stockholders are not third party beneficiaries under the Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company, TreeHouse or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Agreement, which subsequent information may or may not be fully reflected in the Company’s or TreeHouse’s public disclosures. The Company acknowledges that, notwithstanding the inclusion of the foregoing cautionary statements, it is responsible for considering whether additional specific disclosures of material information regarding material contractual provisions are required to make the statements in this Form 8-K not misleading.

Item 7.01 Regulation FD Disclosure.

On February 1, 2016, the Company issued a press release announcing that the Company had completed its sale of the Business, a copy of which is attached as Exhibit 99.1 and incorporated by reference into this Item 7.01.

In accordance with General Instructions B.2 of Form 8-K, the information in this Item 7.01 and the press release attached hereto as Exhibit 99.1 are being furnished to the SEC in satisfaction of the public disclosure requirements of Regulation FD and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release of ConAgra Foods, Inc., dated February 1, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ConAgra Foods, Inc.

|

|

|

|

|

|

|

|

February 1, 2016

|

|

By:

|

|

Lyneth Rhoten

|

|

|

|

|

|

|

|

|

|

|

|

Name: Lyneth Rhoten

|

|

|

|

|

|

Title: Vice President, Securities Counsel and Assistant Corporate Secretary

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release of ConAgra Foods, Inc., dated February 1, 2016.

|

Exhibit 99.1

News Release

For more information, please contact:

MEDIA: Jon Harris

630-857-1440

jon.harris@conagrafoods.com

INVESTORS: Chris Klinefelter

402-240-4154

Chris.Klinefelter@ConAgraFoods.com

FOR IMMEDIATE RELEASE

CONAGRA FOODS COMPLETES SALE OF PRIVATE LABEL OPERATIONS

TO TREEHOUSE FOODS

OMAHA, Neb., February 1, 2016 – ConAgra Foods, Inc. (NYSE: CAG) announced today the completion

of the sale of its private label operations to TreeHouse Foods for proceeds of $2.7 billion in

cash, excluding transaction-related expenses and subject to post-closing adjustments.

“The sale of the private label business to TreeHouse Foods is another important step for ConAgra

Foods as we continue to transform the company to drive sustainable growth, more consistent

performance and deliver enhanced shareholder value,” said Sean Connolly, president and chief

executive officer of ConAgra Foods. “We are confident the private label business will be

well-positioned as part of TreeHouse Foods and our companies are working closely together to ensure

a smooth transition for all stakeholders.”

Under the terms of the agreement, ConAgra Foods sold the vast majority of its private label

operations, which are classified as discontinued operations. Among other assets, this includes a

network of 32 manufacturing facilities in the U.S., Canada and Italy.

Additional details of the completed transaction include:

Effective today, a total of approximately 9,500 employees transitioned to TreeHouse Foods,

including plant employees and those supporting the private label business located at the St.

Louis, Mo., Downers Grove, Ill., and Omaha, Neb., office locations.

Certain private label operations with a strong connection to ConAgra Foods’ existing

Consumer Foods business were not part of the sale, specifically canned pasta, cooking spray,

peanut butter, pudding/gels, Gelit frozen pasta product offerings, as well as the HK

Anderson and Kangaroo brand equities, trademarks and business portfolios. Results for these

operations, which were not material, were moved to the Consumer Foods reporting segment in

the first quarter of fiscal 2016.

ConAgra Foods generated approximately $2.7 billion in cash proceeds from the sale, less

transaction expenses, and intends to utilize the net proceeds primarily for debt reduction.

The company expects the transaction to result in a tax asset of approximately $1.6 billion,

which can be used to offset potential future capital gains over the next five years.

Goldman Sachs and Centerview Partners acted as financial advisors to ConAgra Foods on the

transaction. Davis Polk & Wardwell LLP served as legal advisor.

About ConAgra Foods

ConAgra Foods, Inc., (NYSE: CAG), is one of North America’s leading packaged food companies with

recognized brands such as Marie Callender’s®, Healthy Choice®, Slim Jim®, Hebrew National®, Orville

Redenbacher’s®, Peter Pan®, Reddi-wip®, PAM®, Snack Pack®, Banquet®, Chef Boyardee®, Egg Beaters®,

Hunt’s® and many other ConAgra Foods brands found in grocery, convenience, mass merchandise and

club stores. ConAgra Foods also has a strong business-to-business presence, supplying frozen potato

and sweet potato products as well as other vegetable, spice and grain products to a variety of

well-known restaurants, foodservice operators and commercial customers. For more information,

please visit us at www.conagrafoods.com.

Note on Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are based on management’s current

expectations and are subject to uncertainty and changes in circumstances. These risks and

uncertainties include, among other things: ConAgra Foods’ ability to successfully complete the

spinoff of its Lamb Weston business on a tax-free basis within the expected time frame or at all;

ConAgra Foods’ ability to execute its operating and restructuring plans and achieve its targeted

operating efficiencies, cost-saving initiatives, and trade optimization programs; ConAgra Foods’

ability to successfully execute its long-term value creation strategy; ConAgra Foods’ ability to

realize the synergies and benefits contemplated by the Ardent Mills joint venture; risks and

uncertainties associated with intangible assets, including any future goodwill or intangible assets

impairment charges; the availability and prices of raw materials, including any negative effects

caused by inflation or weather conditions; the effectiveness of ConAgra Foods’ product pricing

efforts, whether through pricing actions or changes in promotional strategies; the ultimate outcome

of litigation, including litigation related to the lead paint and pigment matters; future economic

circumstances; industry conditions; the effectiveness of ConAgra Foods’ hedging activities,

including volatility in commodities that could negatively impact ConAgra Foods’ derivative

positions and, in turn, ConAgra Foods’ earnings; the success of ConAgra Foods’ innovation and

marketing investments; the competitive environment and related market conditions; the ultimate

impact of any ConAgra Foods’ product recalls; access to capital; actions of governments and

regulatory factors affecting ConAgra Foods’ businesses, including the Patient Protection and

Affordable Care Act; the amount and timing of repurchases of ConAgra Foods’ common stock and debt,

if any; the costs, disruption and diversion of management’s attention associated with campaigns

commenced by activist investors; and other risks described in ConAgra Foods’ reports filed with the

Securities and Exchange Commission, including its most recent annual report on Form 10-K and

subsequent reports on Forms 10-Q and 8-K. Investors and security holders are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of the date they are made.

ConAgra Foods disclaims any obligation to update or revise statements contained in this press

release to reflect future events or circumstances or otherwise.

# # #

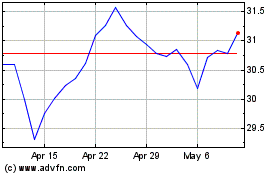

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024