Tenneco Sees Benefits From More Regulation of Auto Makers

April 26 2016 - 5:20PM

Dow Jones News

Tenneco Inc., an auto supplier initially expected to hit a

pothole in the wake of Volkswagen AG's diesel-emissions scandal,

said Tuesday that it expects to benefit from increased regulations

on auto makers.

The Illinois supplier of parts for new cars and replacement

components posted a 16% increase in its first-quarter profit, and

indicated the outlook will brighten.

Tenneco said it would now outgrow the wider market amid hot

demand for its products that help auto makers meet emissions

requirements. Tenneco expects its full-year revenue growth to

exceed industry production by 3%, including output for light

vehicles, commercial trucks and off-highway products.

The report contrasts the rough waters Tenneco encountered in

September when its shares were pummeled, along with other suppliers

of diesel-related technology, following Volkswagen's disclosure

that it cheated on U.S. diesel-emissions tests for several years.

Tenneco makes emissions systems and generated 8% of roughly $8

billion in annual revenue from Volkswagen at the time.

On Tuesday, Tenneco said an expected tightening of regulatory

pressure on auto makers will help the supplier thrive. The company

revised its full-year outlook saying it expects annual revenue

growth of 6%, excluding currency fluctuations.

"Looking beyond this year, we see our growth accelerating in

both 2017 and 2018 primarily due to new light vehicle emissions

regulations beginning to take effect in North America and Europe,"

Tenneco Chief Executive Gregg Sherrill said in a statement.

The bullish outlook sent Tenneco shares up more than 14% to

$57.49 Tuesday. The shares are now up 25% year-to-date.

BorgWarner Inc. and Delphi Automotive PLC were among other

emissions-related suppliers under pressure in the wake of

Volkswagen's disclosure. Both U.S. parts makers report earnings

over the next 10 days.

Tenneco reported a profit of $57 million, or 99 cents a share,

compared with $49 million, or 80 cents a share, for the same period

a year earlier. Revenue grew 6% to $2.14 billion.

Write to Jeff Bennett at jeff.bennett@wsj.com

(END) Dow Jones Newswires

April 26, 2016 17:05 ET (21:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

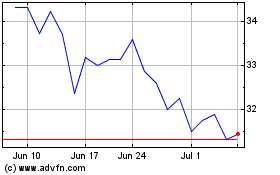

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Aug 2024 to Sep 2024

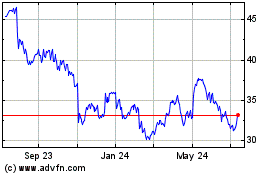

BorgWarner (NYSE:BWA)

Historical Stock Chart

From Sep 2023 to Sep 2024