UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 5, 2015

BRT REALTY TRUST

(Exact name of Registrant as specified in charter)

| Massachusetts |

|

001-07172 |

|

13-2755856 |

| (State or other jurisdiction |

|

(Commission file No.) |

|

(IRS Employer |

| of incorporation) |

|

|

|

I.D. No.) |

| 60 Cutter Mill Road, Suite 303, Great Neck, New York |

|

11021 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant's telephone number, including area

code 516-466-3100

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 5, 2015, we issued a press release

announcing our results of operations for the third quarter ended June 30, 2015. The press release is attached as an exhibit to

this Current Report on Form 8-K.

This information and the exhibit attached hereto

are being furnished pursuant to Item 2.02 of Form 8-K and are not to be considered "filed" under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any previous or future

filing by us under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

| |

99.1 |

Press release dated August 5, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BRT REALTY TRUST |

| |

|

|

| Date: August 5, 2015 |

By: |

/s/ George Zweier |

| |

|

George Zweier |

| |

|

Vice President and Chief Financial Officer |

3

Exhibit

99.1

BRT

REALTY TRUST REPORTS THIRD QUARTER 2015 RESULTS

Great

Neck, New York – August 5, 2015 – BRT REALTY TRUST (NYSE:BRT), today announced operating results for the three

months ended June 30, 2015.

Jeffrey

A. Gould, President and Chief Executive Officer stated: “The operations at our multi-family properties continue to improve,

as reflected by the higher rental rates many of these properties are generating. The strength of our multi-family underwriting

activities will be further highlighted in the fourth quarter when we will recognize an aggregate gain of $12.0 million from the

July 2015 sale of our Marietta, GA and Houston, TX multi-family properties, of which an aggregate of $3.9 million will be allocated

to the non-controlling partners. The operations and sales of the Marietta, GA and Houston, TX properties generated levered internal

rates of return of 31.7% and 14.8%, respectively, on these investments.”

Operating Results:

Total

revenues for the three months ended June 30, 2015 were approximately $21.2 million, an increase of $3.4 million, or 19.1%, from

$17.8 million in the corresponding quarter in the prior year. The increase is due to $2.4 million from multi-family properties

acquired since April 2014 and $1.2 million primarily from rental increases at many of the multi-family properties acquired before

April 2014.

Total

expenses for the three months ended June 30, 2015 were $24.7 million, an increase of $2.7 million, or 12.3%, from $22 million

in the quarter ended June 30, 2014. Contributing to the change were increases of $1.4 million in real estate operating expenses,

$1.2 million in depreciation and amortization and $595,000 of interest expense, due primarily to the multi-family properties acquired

since April 2014.

Net

loss attributable to common shareholders for the three months ended June 30, 2015 was $2.6 million, or $0.18 per share, compared

to net loss of $331,000, or $0.02 per share, for the three months ended June 30, 2014. Contributing to the change is the inclusion

in the 2014 period of a $2.6 million adjustment to non-controlling interest. The adjustment reflects the add back of the Newark

Joint Venture’s minority partner’s share of interest expense due to a non-recurring deferred interest payment to the

Trust by the Newark Joint Venture on debt eliminated in consolidation. Excluding the impact of this adjustment, net loss attributable

to common shareholders would have been $2.9 million, or $0.21 per share, in the three months ended June 30, 2014.

Funds from Operations;

Adjusted Funds from Operations:

Funds

from Operations, or FFO, was $1.3 million, or $0.09 per fully diluted share, in the current quarter, compared to $2.5 million,

or $0.18 per diluted share, in the third quarter of 2014. Adjusted Funds from Operations, or AFFO, was $1.7 million, or $0.13

per diluted share, in the current quarter, compared to $3.0 million, or $0.21 per diluted share, in the third quarter of 2014.

The decrease in FFO and AFFO is attributable primarily to the inclusion, in the third quarter of 2014, of the $2.6 million adjustment

to non-controlling interest. Excluding the effect of such adjustment, FFO and AFFO for the three months ended June 30, 2014 would

have been $(130,000), or $(0.07) per share, and $313,000, or $0.02 per share, respectively.

A

reconciliation of net income to FFO and AFFO, presented in accordance with GAAP, is provided with the financial information included

later in this release.

Balance Sheet:

At

June 30, 2015, the Trust had $16.2 million of cash and cash equivalents, assets of $766.5 million, debt of $564.2 million and

total BRT shareholders’ equity of $119.0 million.

At

July 31, 2015, the Trust has approximately $29.3 million of cash and cash equivalents. As further described in our Quarterly Report

on Form 10-Q for the period ended June 30, 2015, the Newark Joint Venture may require additional funds to complete the Teachers

Village project.

Subsequent Events:

On

July 7, 2015, the Trust sold a 207 unit multi-family property in Marietta, GA, for $17.6 million. The Trust estimates it will

record a gain on the sale of approximately $8.0 million, of which $3.1 million will be allocated to the non-controlling partner.

On

July 21, 2015, the Trust sold a 798 unit multi-family property in Houston, TX, for $39.9 million, including the purchaser’s

assumption of mortgage debt of $24.1 million. The Trust estimates it will record a gain on the sale of approximately $4.0 million,

of which $800,000 will be allocated to the non-controlling partner.

On

July 27, 2015, the Trust acquired, through a consolidated joint venture in which it has an approximate 61% equity interest, a

618 unit multi-family property in Valley, AL for $44.0 million, including mortgage debt financing of $30 million. The mortgage

debt has an annual interest rate of 4.49%, is interest only until maturity and matures in 2025.

Non-GAAP Financial

Measures:

In

view of BRT’s equity investments in joint ventures which have acquired multi- family properties, it discloses FFO and AFFO

because management believes that such metrics are a widely recognized and appropriate measure of the performance of an equity

REIT.

BRT

computes FFO in accordance with the “White Paper on Funds From Operations” issued by the National Association of Real

Estate Investment Trusts (“NAREIT”) and NAREIT’s related guidance. FFO is defined in the White Paper as net

income (computed in accordance with generally accepting accounting principles), excluding gains (or losses) from sales of property,

plus depreciation and amortization, plus impairment write-downs of depreciable real estate and after adjustments for unconsolidated

partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect

funds from operations on the same basis. In computing FFO, BRT does not add back to net income the amortization of costs in connection

with its financing activities or depreciation of non-real estate assets. Since the NAREIT White Paper only provides guidelines

for computing FFO, the computation of FFO may vary from one REIT to another. BRT computes AFFO by deducting from FFO, straight

line rent accruals and deferrals, adding back amortization of restricted stock compensation and amortization of costs in connection

with financing activities, and adjusting for non-controlling interests.

Management

believes that FFO and AFFO are useful and standard supplemental measures of the operating performance for equity REITs and are

used frequently by securities analysts, investors and other interested parties in evaluating equity REITs, many of which present

FFO and AFFO when reporting their operating results. FFO and AFFO are intended to exclude GAAP historical cost depreciation and

amortization of real estate assets, which assumes that the value of real estate assets diminish predictability over time. In fact,

real estate values have historically risen and fallen with market conditions. As a result, management believes that FFO and AFFO

provide a performance measure that when compared year over year, should reflect the impact to operations from trends in occupancy

rates, rental rates, operating costs, interest costs and other matters without the inclusion of depreciation and amortization,

providing a perspective that may not be necessarily apparent from net income. Management also considers FFO and AFFO to be useful

in evaluating potential property acquisitions.

FFO

and AFFO do not represent net income or cash flows from operations as defined by GAAP. FFO and AFFO should not be considered to

be an alternative to net income as a reliable measure of our operating performance; nor should FFO and AFFO be considered an alternative

to cash flows from operating, investing or financing activities (as defined by GAAP) as measures of liquidity.

FFO

and AFFO do not measure whether cash flow is sufficient to fund all of BRT’s cash needs, including principal amortization

and capital improvements. FFO and AFFO do not represent cash flows from operating, investing or financing activities as defined

by GAAP.

Management

recognizes that there are limitations in the use of FFO and AFFO. In evaluating BRT’s performance, management examines GAAP

measures such as net income and cash flows from operating, investing and financing activities. Management also reviews the reconciliation

of net income to FFO and AFFO.

Forward Looking

Statements:

Certain

information contained herein is forward looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding lending activities and other positive

business activities. BRT intends such forward looking statements to be covered by the safe harbor provisions for forward looking

statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying

with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe our future

plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “believe,”

“expect,” “intend,” “anticipate,” “estimate,” “project,” or similar

expressions or variations thereof. Forward looking statements, including our loan origination and property acquisition activities,

involve known and unknown risks, uncertainties and other factors, which, in some cases, are beyond BRT’s control and could

materially affect actual results, performance or achievements. Investors are cautioned not to place undue reliance on any forward-looking

statements and to carefully review the section entitled “Item 1A. Risk Factors” in BRT’s Annual Report on Form

10-K for the year ended September 30, 2014.

About BRT Realty

Trust:

BRT

is a real estate investment trust that participates as an equity investor in joint ventures which own and operate multi-family

properties, owns and operates and develops commercial, mixed use and other real estate assets. Additional financial and descriptive

information on BRT, its operations and its portfolio, is available at BRT’s website at: www.BRTRealty.com. Interested

parties are encouraged to review the Form 10-Q for the quarter ended June 30, 2015 to be filed with the Securities and Exchange

Commission for additional information.

Contact: Investor

Relations – (516) 466-3100

BRT REALTY TRUST

60 Cutter Mill Road

Suite 303

Great Neck, New

York 11021

Telephone (516)

466-3100

Telecopier (516)

466-3132

www.BRTRealty.com

| BRT

REALTY TRUST AND SUBSIDIARIES |

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Dollars

in thousands, except per share data) |

| | |

Three months ended | |

Nine months ended |

| | |

June 30, | |

June 30 |

| | |

2015 | |

2014 | |

2015 | |

2014 |

| | |

| |

| |

| |

|

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Rental and other revenues from real estate | |

$ | 20,945 | | |

$ | 17,449 | | |

$ | 60,612 | | |

$ | 46,133 | |

| Other income | |

| 280 | | |

| 319 | | |

| 862 | | |

| 870 | |

| Total revenues | |

| 21,225 | | |

| 17,768 | | |

| 61,474 | | |

| 47,003 | |

| | |

| | | |

| | | |

| | | |

| | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Real estate operating expenses | |

| 11,424 | | |

| 10,042 | | |

| 32,147 | | |

| 26,071 | |

| Interest expense | |

| 6,006 | | |

| 5,411 | | |

| 18,072 | | |

| 15,044 | |

| Advisor's fee, related party | |

| 612 | | |

| 475 | | |

| 1,801 | | |

| 1,251 | |

| Property acquisition costs | |

| — | | |

| 718 | | |

| 295 | | |

| 2,246 | |

| General and administrative expenses | |

| 1,654 | | |

| 1,512 | | |

| 5,047 | | |

| 4,682 | |

| Depreciation and amortization | |

| 5,037 | | |

| 3,801 | | |

| 14,310 | | |

| 10,375 | |

| Total expenses | |

| 24,733 | | |

| 21,959 | | |

| 71,672 | | |

| 59,669 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenues less total expenses | |

| (3,508 | ) | |

| (4,191 | ) | |

| (10,198 | ) | |

| (12,666 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gain on sale of real estate | |

| — | | |

| 3 | | |

| 2,777 | | |

| 3 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations | |

| (3,508 | ) | |

| (4,188 | ) | |

| (7,421 | ) | |

| (12,663 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Discontinued operations: | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

| — | | |

| 185 | | |

| — | | |

| 1,398 | |

| Net loss | |

| (3,508 | ) | |

| (4,003 | ) | |

| (7,421 | ) | |

| (11,265 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Plus: net loss attributable to non-controlling interests | |

| 930 | | |

| 3,672 | | |

| 1,597 | | |

| 5,609 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to common shareholders | |

$ | (2,578 | ) | |

$ | (331 | ) | |

$ | (5,824 | ) | |

$ | (5,656 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diltued per share amounts attributable to common shareholders: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from continuing operations | |

| (0.18 | ) | |

| (0.03 | ) | |

| (0.41 | ) | |

| (0.49 | ) |

| Discontinued operations | |

| — | | |

| 0.01 | | |

| — | | |

| 0.09 | |

| Basic and diluted (loss) per share | |

$ | (0.18 | ) | |

$ | (0.02 | ) | |

$ | (0.41 | ) | |

$ | (0.40 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Funds from operations - Note 1 | |

$ | 1,267 | | |

$ | 2,520 | | |

$ | 4,735 | | |

$ | 2,073 | |

| Funds from operations per common share - diluted - Note 2 | |

$ | 0.09 | | |

$ | 0.18 | | |

$ | 0.33 | | |

$ | 0.14 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted funds from operations - Note 1 | |

$ | 1,747 | | |

$ | 2,963 | | |

$ | 6,267 | | |

$ | 3,308 | |

| Adjusted funds from operations per common share - diluted -Note 2 | |

$ | 0.13 | | |

$ | 0.21 | | |

$ | 0.44 | | |

$ | 0.23 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 14,101,056 | | |

| 14,303,237 | | |

| 14,144,236 | | |

| 14,252,902 | |

| | |

| | | |

| | | |

| | | |

| | |

| Note 1: | |

| | | |

| | | |

| | | |

| | |

| Funds from operations is summarized in the following table: | |

| | | |

| | | |

| | | |

| | |

| GAAP Net (loss) attributable to common shareholders | |

$ | (2,578 | ) | |

$ | (331 | ) | |

$ | (5,824 | ) | |

$ | (5,656 | ) |

| Add: depreciation of properties | |

| 5,033 | | |

| 3,799 | | |

| 14,299 | | |

| 10,365 | |

| Add: our share of depreciation in unconsolidated joint ventures | |

| 5 | | |

| 5 | | |

| 15 | | |

| 15 | |

| Add: amortization of deferred leasing costs | |

| 16 | | |

| 16 | | |

| 47 | | |

| 46 | |

| Deduct: gain on sale of real estate assets | |

| — | | |

| (3 | ) | |

| (2,777 | ) | |

| (3 | ) |

| Adjustments for non-controlling interests - depreciation of properties | |

| (1,208 | ) | |

| (960 | ) | |

| (2,260 | ) | |

| (2,675 | ) |

| Adjustments for non-controlling interests - deferred leasing costs | |

| (1 | ) | |

| (6 | ) | |

| (14 | ) | |

| (19 | ) |

| Adjustments for non-controlling interests - gain on sale of real estate | |

| — | | |

| — | | |

| 1,249 | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Funds from operations attributable to common shareholders | |

$ | 1,267 | | |

$ | 2,520 | | |

$ | 4,735 | | |

$ | 2,073 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjust for straight line rents | |

| (117 | ) | |

| (136 | ) | |

| (318 | ) | |

| (404 | ) |

| Add: amortization of restricted stock compensation | |

| 232 | | |

| 206 | | |

| 676 | | |

| 599 | |

| Add: amortization of deferred financing costs | |

| 514 | | |

| 492 | | |

| 1,723 | | |

| 1,362 | |

| Adjustments for non-controlling interests - straight line rents | |

| 68 | | |

| 77 | | |

| 186 | | |

| 229 | |

| Adjustments for non-controlling interests - deferred financing costs | |

| (217 | ) | |

| (196 | ) | |

| (735 | ) | |

| (551 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted funds from operations attributable to common shareholders | |

$ | 1,747 | | |

$ | 2,963 | | |

$ | 6,267 | | |

$ | 3,308 | |

| | |

| | | |

| | | |

| | | |

| | |

| Note 2: | |

| | | |

| | | |

| | | |

| | |

| Funds from operations per share is summarized in the following table: | |

| | | |

| | | |

| | | |

| | |

| GAAP Net (loss) income attributable to common shareholders | |

$ | (0.18 | ) | |

$ | (0.02 | ) | |

$ | (0.41 | ) | |

$ | (0.40 | ) |

| Add: depreciation of properties | |

| 0.36 | | |

| 0.27 | | |

| 1.01 | | |

| 0.73 | |

| Add: our share of depreciation in unconsolidated joint ventures | |

| — | | |

| — | | |

| — | | |

| — | |

| Add: amortization of deferred leasing costs | |

| — | | |

| — | | |

| — | | |

| — | |

| Deduct: gain on sale of real estate asset | |

| — | | |

| — | | |

| (0.20 | ) | |

| — | |

| Adjustments for non-controlling interests - depreciation of properties | |

| (0.09 | ) | |

| (0.07 | ) | |

| (0.16 | ) | |

| (0.19 | ) |

| Adjustments for non-controlling interests - deferred leasing costs | |

| — | | |

| — | | |

| — | | |

| — | |

| Adjustment for non-controlling interest - gain on sale of real estate | |

| — | | |

| — | | |

| 0.09 | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Funds from operations per common share basic and diluted | |

| 0.09 | | |

| 0.18 | | |

| 0.33 | | |

| 0.14 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjust for straight line rents | |

| (0.01 | ) | |

| (0.01 | ) | |

| (0.02 | ) | |

| (0.03 | ) |

| Add: amortization of restricted stock compensation | |

| 0.02 | | |

| 0.01 | | |

| 0.05 | | |

| 0.04 | |

| Add: amortization of deferred financing costs | |

| 0.04 | | |

| 0.03 | | |

| 0.12 | | |

| 0.10 | |

| Adjustments for non-controlling interests - straight line rents | |

| — | | |

| 0.01 | | |

| 0.01 | | |

| 0.02 | |

| Adjustments for non-controlling interests - deferred financing costs | |

| (0.01 | ) | |

| (0.01 | ) | |

| (0.05 | ) | |

| (0.04 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted funds from operations per common share basic and diluted | |

$ | 0.13 | | |

$ | 0.21 | | |

$ | 0.44 | | |

$ | 0.23 | |

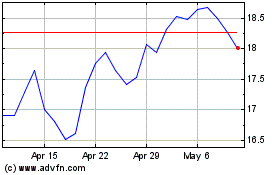

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

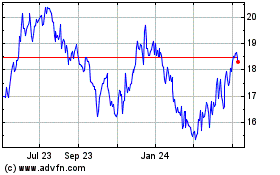

BRT Apartments (NYSE:BRT)

Historical Stock Chart

From Apr 2023 to Apr 2024