BlackRock CEO: Investors Are Retreating to Sidelines -- WSJ

July 15 2016 - 3:02AM

Dow Jones News

By Sarah Krouse

The head of the world's largest asset manager said investors no

longer know what to do with their money as they wrestle with

historically low interest rates, the U.K.'s decision to exit the

European Union and uncertainty surrounding the next U.S.

election.

"They are afraid and they are pulling back," BlackRock Chief

Executive Laurence Fink said as he discussed the company's

second-quarter results with analysts Thursday.

BlackRock stock was relatively flat Thursday, recently down

0.42%, while shares in other asset managers rose along with the

market.

BlackRock attracted $1.54 billion in net new money during the

second quarter, the company's weakest inflows since the second

quarter of last year. Most of the new money went to its large

exchange-traded fund business, where fixed-income products were

particularly popular during the period. Clients pulled $2.2 billion

from equity products.

BlackRock reported a profit during the quarter of $789 million,

down from $819 million a year prior. Revenue fell 3.5% to $2.8

billion. The results met Wall Street expectations.

BlackRock is considered a bellwether for the money-management

industry because of its size and diversity of products and clients.

One analyst said BlackRock's performance wasn't a good sign for

rivals.

"We're used to seeing really big inflows at BlackRock and they

barely were positive," said Kyle Sanders, an analyst at Edward

Jones. "Outside of BlackRock and Invesco Ltd. I don't think any

other asset managers are going to have inflows," for the second

quarter, he added.

Individual savers and institutional investors are grappling with

a low-return environment that is forcing them to save more, revise

their targets or take greater risks to meet their goals.

"Clients are worried about how much cash they have and how they

reinvest it to meet their liability needs," Mr. Fink said in an

interview. "It's a push and pull: you can't make a return in cash

and yet where should they invest to make some return?"

Mr. Fink said more than $55 trillion held in bank deposits in

the U.S., Japan and China was evidence of investor concern

globally.

Some are retreating from equities in favor of bonds. In the

U.S., investors pulled more than $11 billion from mutual funds in

the second quarter, according to fund-research firm Morningstar

Inc., with the majority of those redemptions coming from stock

funds.

Mr. Fink told analysts that many clients who sat on the

sidelines as equity markets rallied recently "find themselves

feeling even further behind." The U.S. stock market reached new

highs this week after global markets slumped in the wake of the

U.K.'s surprise vote to leave the EU.

Stock and fixed-income markets have continued to diverge since

the vote, with bond yields falling and equities climbing.

BlackRock benefited from a rush to fixed-income investments

during the second quarter as its iShares unit attracted $15.7

billion in new money, $10 billion of which went into bond ETFs. In

the ETF business, which makes up about a quarter of BlackRock's

assets under management, the firm offers funds that trade like

stocks on an exchange and typically track an index or other basket

of assets.

The New York firm reported net outflows from equity products and

net inflows to fixed-income strategies, leading to higher fee

revenue in fixed income and lower fee revenue in equity offerings.

Performance fees also decreased due to lower fees from alternative

and equity products.

Its assets under management reached a record $4.89 trillion.

Several analysts said they remain bullish on BlackRock's

prospects. Erik Oja, an analyst at S&P Capital Global Market

Intelligence, raised his 12-month price target for the firm to $390

per share, up from $370, and said he expects the money manager to

further increase its market share. Still, Mr. Oja expects lower

assets under management growth for the firm and, as a result,

trimmed his 2016 and 2017 earnings per share estimates.

--Austen Hufford contributed to this article.

Write to Sarah Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

July 15, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

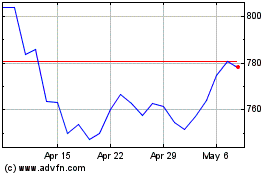

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

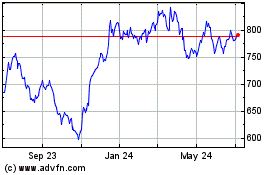

BlackRock (NYSE:BLK)

Historical Stock Chart

From Apr 2023 to Apr 2024