Bank of NY Mellon to Pay $14.8 Million to Settle FCPA Probe -- Update

August 18 2015 - 4:41PM

Dow Jones News

By Daniel Huang And Lisa Beilfuss

Bank of New York Mellon Corp. agreed to pay $14.8 million to

settle charges that it violated foreign-bribery laws by giving

internships to relatives of officials from a Middle Eastern

sovereign-wealth fund.

The settlement is the first enforcement action brought by the

Securities and Exchange Commission against a financial institution

under the Foreign Corrupt Practices Act, which bans U.S. companies

from giving anything of value to a foreign official to gain an

unfair advantage or business favors.

A number of U.S. banks are under investigation for similar

hiring practices.

One of the sovereign-wealth fund officials in 2010 told a BNY

Mellon employee that he could "secure internships for his family

members from a competitor of BNY Mellon if it did not satisfy his

personal request," according to court documents, and later became

"angry" when the internships were delayed.

The SEC didn't name the fund or the country it represents.

The interns were the sons of two officials and the nephew of one

of those officials, and they didn't meet the bank's standards for

interns, including minimum grade-point average, according to the

agency. The interns were recent college graduates.

In one email, a BNY Mellon employee wrote, "I want more money

for this. I expect more for this...we're doing [the official] a

favor."

Despite repeated absences and comments from managers belittling

their work ethic, the interns were able to extend their positions

to six months, significantly longer than the duration afforded

through the normal summer internship program, the SEC said.

With the settlement Tuesday, the SEC established that "valuable

student internships" are covered under the FCPA's effort to bar

improper exchanges of "anything of value."

When the violations took place in 2010 and 2011, BNY Mellon held

around $55 billion of the fund's assets in its servicing arm and

$711 million in assets under management. The bank earns fee revenue

from assets it services and manages.

In settling the charges, the bank didn't admit or deny

wrongdoing. Certain current and former BNY Mellon employees under

scrutiny for potential FCPA violations weren't charged, the SEC

said.

"We are pleased to reach an agreement with the SEC that allows

us to put this matter behind us," the bank said in a statement,

adding it had already taken steps to enhance internal controls and

procedures surrounding internship and hiring practices.

In a media call following the announcement, SEC enforcement

director Andrew Ceresney said the settlement with BNY Mellon is the

first action to arise from a broader examination of financial

institutions in recent years and their relationships with

sovereign-wealth funds.

Other banks under civil or criminal investigation for possible

FCPA violations include J.P. Morgan Chase & Co., Citigroup

Inc., Credit Suisse Group AG, Deutsche Bank AG, Goldman Sachs Group

Inc., Morgan Stanley and UBS Group AG, according to regulatory

filings.

Hiring the friend or family member of an official isn't

necessarily a violation of the FCPA but may be grounds for an

offense if the decision was made to induce a reward or business

deal.

Several Wall Street banks have banded together to push back

against regulators for what they call an "aggressive" campaign to

criminalize standard business practices in some countries, The Wall

Street Journal reported in April.

The probe into J.P. Morgan, arguably the most high profile in

the group, hasn't moved forward very much, people familiar with the

process said. Any settlement is unlikely to happen until 2016, and

the timing is still fluid, these people said.

The largest U.S. bank by assets is under investigation over its

hires in Asia. Earlier this summer, the Justice Department

indicated it will be initiating another round of interviews of

current and former J.P. Morgan employees as it seeks more

information on the bank's hiring in Asia, some of these people

said.

Emily Glazer contributed to this article.

Write to Daniel Huang at dan.huang@wsj.com and Lisa Beilfuss at

lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 18, 2015 16:26 ET (20:26 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

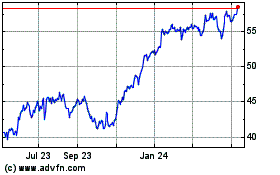

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

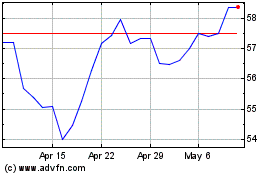

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024