By Ellie Ismailidou and Sara Sjolin, MarketWatch

Safety plays, like gold and yen, weaken as risk appetite

grows

U.S. stocks extended gains Friday, as a surge in oil futures

boosted the energy sector while a softening Japanese yen helped

calm investors' nerves after Thursday's selloff.

However, the main indexes were still on track to finish the week

with modest losses of up to 0.8%.

The S&P 500 climbed 15 points, or 0.7%, to 2,057, led by a

2.2% jump in the energy sector that was boosted by oil's surge.

Consumer-discretionary stocks were the only sector in the red, down

0.1%.

The Dow Jones Industrial Average gained 129 points, or 0.7%, to

17,671, led by a 2.2% gain in American Express Co. (AXP) and a 2.1%

rise in Boeing Co.(BA)

Meanwhile, the Nasdaq Composite advanced 34 points, or 0.7%, to

4,881.

Friday's strong gains came after a downbeat day on Thursday

(http://www.marketwatch.com/story/us-stocks-set-to-pause-dollar-crumbles-against-the-yen-2016-04-07),

in which stocks slumped as investors shunned assets perceived as

risky in favor of haven plays, such as the yen and gold.

Heightened volatility should continue to be the norm in the

short term, said Kate Warne, investment strategist at Edward Jones,

as Wall Street is torn between concerns about slower global growth

that are offset by hopes of a production-freeze agreement in the

Organization of the Petroleum Exporting Countries.

Oil prices rebounded strongly

(http://www.marketwatch.com/story/oil-rebounds-but-doha-meeting-remains-a-cloud-on-the-horizon-2016-04-08)

on Friday, boosting the stocks of energy companies like Chevron

Corp. (CVX), up 1.7%, Baker Hughes Inc. (BHI), up 2.8%, and

Marathon Oil Corp. (MRO) , up 4.4%.

At the meeting, planned for April 17 in Doha, Qatar, OPEC and

non-OPEC suppliers are set to discuss a production freeze to

salvage prices. But

Meanwhile, a weakening yen boosted equities on Friday, as the

Japanese currency was at the center of the stock selloff a day

earlier, after it jumped to the highest level against the dollar in

almost 18-months

(http://www.marketwatch.com/story/dollar-slides-to-fresh-18-month-low-vs-yen-as-market-bets-on-no-boj-intervention-2016-04-07)

on Thursday. The yen, typically viewed as a haven asset, gained as

fears that global central banks won't be able to fix the global

economy zapped investor sentiment and spurred a flight to

havens.

But the yen eased back on Friday

(http://www.marketwatch.com/story/dollar-recoups-some-losses-against-yen-after-jawboning-by-japan-2016-04-08)

after Japan's finance minister Taro Aso said he may act against

what he termed "one-sided" yen rises. Stocks bounced back and gold

prices inched lower, another sign that investors were warming up to

taking on more risk.

"Traders still remain on high alert amid fears that even though

Japanese government officials appear to be ruling out immediate

intervention to halt Yen aggressive appreciation, the Bank of Japan

may take action through monetary policy at its meeting on April

28," said Nawaz Ali, currency strategist at Western Union in a

note.

Other analysts expressed concerns about the financial sector,

which got hit particularly hard during Thursday's selloff, amid

worries about the effects of negative interest rates and energy

loan losses on banks' balance sheets. The sector looked set to log

a 2.2% loss for the week and was the worst performer on the S&P

year-to-date, down 7%.

"We can deal with a one-day gut check, but the group's

underperformance has been a bothersome phenomenon for a few weeks

now. With so many areas moving higher in unison for most of the

rally, the SPX's second biggest sector's trouble sticks out like a

sore thumb," said Frank Cappelleri, technical analyst at Instinet,

in emailed comments.

More Fed talk: Federal Reserve Chairwoman Janet Yellen said the

U.S. economy was "on a solid course, not a bubble economy" at a

gathering with former Fed leaders after U.S. markets had closed on

Thursday

(http://www.marketwatch.com/story/yellen-backs-gradual-rate-hikes-at-panel-of-fed-chiefs-2016-04-07).

And New York Fed president said Friday the central bank must

maintain a cautious and gradual approach to raising interest rates

(http://www.bloomberg.com/news/articles/2016-04-08/dudley-calls-for-cautious-and-gradual-fed-tightening-approach),

echoing views about the need for a go-slow approach to rate

increases that Yellen expressed last week.

But U.S. wholesale inventories declined for the fifth straight

month

(http://www.marketwatch.com/story/wholesale-inventories-fall-for-fifth-straight-month-2016-04-08),

offering more evidence that first-quarter growth will be weak.

Other movers and shakers: Under Armour Inc. (UA) underwent a

2-for-1 split Friday, after the athletic apparel company issued

Class C shares to existing shareholders.

Depomed Inc.(DEPO) surged 12% after Starboard Value disclosed

that the company and its affiliates own 9.8% of Depomed's shares

outstanding.

Intercept Pharmaceuticals Inc. (ICPT) tumbled 4.7% after a Food

and Drug Administration advisory committee recommended an

accelerated approval

(http://www.marketwatch.com/story/intercept-shares-rally-on-fda-panel-vote-for-liver-drug-2016-04-07)

of the biotech firm's liver treatment Ocaliva.

Gap Inc. (GPS) tumbled 12% after the retailer late Thursday said

sales fell in March

(http://www.marketwatch.com/story/gap-reports-drop-in-march-sales-high-inventory-2016-04-07).

Shares of Ruby Tuesday Inc. (RT) sank 13% after the restaurant

operator said its losses deepened in the latest quarter

(http://www.marketwatch.com/story/ruby-tuesday-cuts-forecast-as-losses-widen-2016-04-07-174851854),

leading to a sharp cut in its annual profit forecast.

Other markets: European stocks markets rose almost across the

board

(http://www.marketwatch.com/story/european-stocks-rise-on-rebounding-oil-upbeat-german-trade-data-2016-04-08),

getting a boost from the rally in oil prices and

stronger-than-expected German trade data.

Stocks in Asia ended mixed

(http://www.marketwatch.com/story/asian-shares-drop-as-investors-pare-risk-in-wake-of-yens-run-2016-04-08),

as investors digested the latest move in the yen.

(END) Dow Jones Newswires

April 08, 2016 11:16 ET (15:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

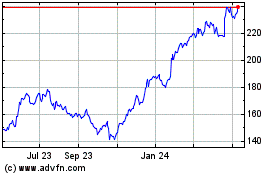

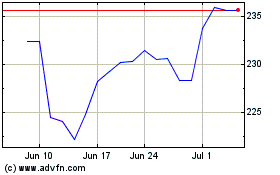

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024