FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

Date: February 4,

2016

Commission File Number 001-16125

Advanced

Semiconductor Engineering, Inc.

( Exact name

of Registrant as specified in its charter)

26 Chin

Third Road

Nantze

Export Processing Zone

Kaoshiung,

Taiwan

Republic

of China

(Address

of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X Form 40-F ___

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

____

Note: Regulation S-T Rule

101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security

holders.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

____

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign

private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled

or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the

registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and

has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject

of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether

by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If "Yes" is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

|

ADVANCED

SEMICONDUCTOR

ENGINEERING, INC. |

|

| |

|

|

|

|

| |

|

|

|

|

| Date: February 4,

2016 |

By: |

|

/s/

Joseph Tung |

|

| |

Name: |

|

Joseph Tung |

|

| |

Title: |

|

Chief Financial Officer |

|

Advanced Semiconductor Engineering, Inc.

Below

is the English version of our MOPS filings on February 4, 2016 Regulation: Published pursuant to Article 4 Paragraph 38 of the

Taiwan Stock Exchange’s Operating Procedures for the Publication of Material Information by Listed Companies

SEQ_NO:

1

Date

of announcement: 2016/02/04

Time

of announcement: 19:00:39

Subject:

ASE announces to extend the period of public tender offer of SPIL's common shares

Date

of events: 2016/02/04

To

which item it meets: paragraph 38

Statement:

1.

Date of receipt of the SFB approval letter: 2015/12/22

2.

Name of the public companies whose securities were originally to be acquired: Siliconware

Precision Industries Co., Ltd.

3.

Type of securities that were originally to be acquired: Common shares

4.

Volume of securities originally to be acquired: Intended amount of acquisition is 770,000,000 shares (including issued and outstanding

common shares represented by the American depositary shares), accounting for approximately 24.71% of total amount of the issued

common shares by the acquired company, as listed on the Ministry of Economic Affairs of Business Registration Publicity and Inquiry

System on the last date of change.

In

order to comply with Rule 14e-1(d) of the Securities Exchange Act of 1934, the Company hereby announces that as of February 3,

2016, the amount of common shares that have been validly tendered and not withdrawn is 89,774,676 shares (including those are

represented by the American depositary shares), which represents approximately 2.9% of the issued and outstanding share capital

of SPIL.

5.

Price of the securities originally to be acquired: NT$ 55 (cash)/share

6.

Originally scheduled public tender offer period: 9:00 a.m. to 3:30 p.m. on business day (TW time), December 29th, 2015 to February

16th, 2016.

7.

Reason for the SFB approval of suspension of the public tender offer: As noted in the Public Tender Offer Prospectus, one of the

conditions for this public tender offer is that the Fair Trade Commission (the ”FTC”) does not prohibit the combination

between the public purchaser and Siliconware Precision Industries Co., Ltd. (”SPIL”). The public purchaser has reported

to the FTC regarding the business combination related

to this public tender offer on December 25th, 2015 (the same hereinafter), and informed by the letter of notice from the FTC:”Regarding

the application filed for combination between ASE and SPIL, the application has been filed with the FTC completely on February

2, 2016, Unless receiving written notice from the FTC requiring correction, shortening or extension, prohibition of combination

or rejection, the combination shall be conducted in accordance with reported issues as of March 3, 2016”, therefore the

public purchaser reasonably anticipates that the FTC may allow the combination between the public purchaser and SPIL on March

3, 2016 as the earliest date.The public purchaser hereby reported to the Financial Supervisory Commission to extend the period

of public tender offer for 30 days on February 4, 2016, pursuant to relevant regulation. Upon extension, the period of this public

tender offer shall end at 3:30 p.m. on March 17th, 2016. Whereas, other conditions of this public tender offer remain unchanged,

and the settlement day is still within 5 business days after the expiration of the extended period (including the 5th business

day). Hereby certify.

8.

Any other matters that need to be specified: The FTC is still reviewing the combination between the public purchaser and SPIL

currently, and has not determined whether to prohibit such combination. Provided that the public purchaser receives the written

notification from the FTC requiring correction, extension, prohibition of combination or rejection prior to the expiration of

the period of public tender offer, which leads to the failure to receive the confirmation from the FTC of non-prohibition on the

combination prior to and including March 17th, 2016, this public tender offer hereby fails with conditions uncompleted. The public

purchaser shall release relevant announcement regarding the completion or incompletion of the conditions of this public tender

offer in accordance with relevant law.

All

of the other terms and conditions of the tender offers remain unchanged. The tender offers are conditioned upon (i) there being

validly tendered in accordance with the terms of the ROC Offer, and not withdrawn prior to the expiration of the ROC Offer, 155,818,056

Common Shares, not including those tendered into the U.S. Offer or those represented by ADSs (representing approximately least

5% of the issued and outstanding share capital of SPIL) and (ii) the receipt of antitrust approval from the Taiwan Fair Trade

Commission. Upon the satisfaction of the aforementioned two conditions, ASE will purchase the 770,000,000 Common Shares at NT$55

per Common Share and NT$275 per ADS cash consideration payable in the tender offers in accordance with the relevant laws and regulations.

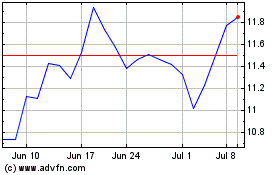

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

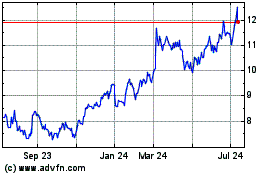

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024