By Rick Carew

After a year when Chinese companies bought record numbers of

American firms, a U.S. company is getting a rare shot at a big

takeover in China.

Allentown, Penn.-based Air Products & Chemicals Inc., a

maker of industrial gases, is looking for a bigger foothold in the

Chinese market. In December, it got an unexpected opening , after a

boardroom battle at China's biggest industrial-gas maker, Yingde

Gases Group Co., effectively put the company on the block.

Air Products is offering up to $1.5 billion for Hong Kong-listed

Yingde, a price that would make the deal the largest takeover of a

Chinese firm by an American buyer. People familiar with Air

Products' bid say it could raise that offer to fend off a rival bid

formalized Tuesday by a Hong Kong-based private-equity firm PAG

Asia Capital.

An important twist would come Wednesday, when shareholders vote

which of the warring board factions get to run the company, and

thus handle the sale. The leadership is being contested between

Yingde's chairman -- under whom Yingde has been slow to open its

books, according to Air Products -- and a pair of ousted former

executives who say they want to speed up a sale.

A spokesman for Yingde said the company is "focused on the

auction process," but declined to comment further. It has said in

the past that it is working to provide prospective bidders with

access to financial data.

Air Products has said it is open to working with either party to

strike a deal. "We believe that the combination of Yingde and Air

Products makes significant strategic and financial sense," the

company said Tuesday in a statement, adding that it continues to

participate in the sale process.

The fight over Yingde, which accounts for around 14% of China's

industrial-gas market by revenue, presents an unusual opportunity

for a U.S. buyer to buy a big Chinese company. Chinese regulators

restrict foreign investment in many sensitive industries, and have

nixed high-profile bids for prominent local companies in the past,

including Coca-Cola Co.'s $2.4 billion attempted takeover of China

Huiyuan Juice Group Ltd. in 2009 on antitrust grounds. That has

discouraged other U.S. firms from trying splashy acquisitions.

The biggest U.S. acquisition of a Chinese company was Joy Global

Inc.'s $1.4 billion purchase of International Mining Machinery

Holdings Ltd. in 2011, according to Dealogic data. U.S.

politicians, including President Donald Trump, have lambasted China

for not giving U.S. firms equal access to Chinese markets, even as

Chinese investors cut a record $69 billion worth of deals last year

for American firms.

Lawyers in China say regulators there may allow a takeover of

Yingde, since it trades publicly and already has many foreign

investors. There are already many foreign participants in the

industrial-gas business, where companies create mixtures of gases

such as oxygen and nitrogen, which are used in manufacturing

products such as steel and semiconductors.

An Air Products deal would require approval from China's

Ministry of Commerce.

Air Products' pursuit of Yingde followed a split in the

company's management team in November, when Yingde Chairman Zhao

Xiangti called a hasty board meeting to remove then-Chief Executive

Sun Zhongguo and his chief operating officer, as well as the issue

of a big chunk of shares to a Beijing investor picked by Mr. Zhao.

Mr. Sun protested the share sale and asked for the entire company

be put up for sale. Yingde subsequently nixed the deal with the

Beijing investor after its share price rose significantly.

The U.S. company, which has a market value of about $30 billion,

made its initial offer in December. In February, Yingde hired

Morgan Stanley to shop the company to potential buyers.

Air Products' chief executive, Seifi Ghasemi, has taken a deep

personal interest in the deal, leading calls and peppering

executives and advisers with questions, according to participants.

Mr. Ghasemi flew to Shanghai to pitch Yingde executives on its

offer in February, and is scheduled to go again later this week to

learn more about the company's operations, according to people

familiar with the situation.

There are still plenty of obstacles to an Air Products takeover.

Last week, Yingde's feuding board members separately cut deals with

PAG to sell their combined 42% stake for HK$6 a share -- the same

price Air Products offered, but without requiring the due diligence

that the U.S. company has said it needs.

PAG is planning to make the same HK$6 offer to the rest of

Yingde's shareholders, and the deal would become effective if it is

accepted by more than half.

PAG declined to elaborate beyond its Tuesday official offer

statement. PAG says its offer isn't conditioned on Ministry of

Commerce approval.

Mr. Sun said in an interview he believes the PAG deal "puts a

floor" on the price bidders must pay to buy the company and that he

welcomes higher competing offers from Air Products and others.

Yingde suspended trading in its shares Monday, but closed at

HK$6.22 Friday after news of PAG deal, meaning investors are

betting the takeover battle will heat up and produce a higher

offer.

"We want a fair deal for all shareholders," says Seth Fischer,

who runs hedge fund Oasis Management Co., which owns a 4.5% stake

in Yingde. "Now is the time for buyers to finish sharpening their

pencils and put in their best offer."

Write to Rick Carew at rick.carew@wsj.com

(END) Dow Jones Newswires

March 07, 2017 10:12 ET (15:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

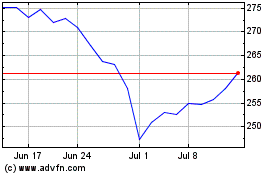

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

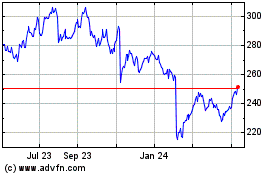

From Mar 2024 to Apr 2024

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Apr 2023 to Apr 2024