Archer Daniels Midland Results Top Views -- Update

November 01 2016 - 11:23AM

Dow Jones News

By Jacob Bunge

A projected record U.S. harvest is set to boost Archer Daniels

Midland Co.'s grain trading business for the remainder of the year

and extend a crop-export surge, the company's chief executive said

Tuesday.

ADM's network of grain terminals, railcars and barges, already

laboring to direct a heavy flow of U.S. crops to overseas buyers,

will continue to move heavy volumes of corn, soybeans and wheat

into the beginning of 2017, lifting profit margins in one of the

company's largest segments.

"There is a big crop coming," said Juan Luciano, ADM's chief

executive, on a conference call discussing the company's

third-quarter results. "That is good for ADM."

Commodity traders and processors like Chicago-based ADM, along

with rivals like Cargill Inc. and Bunge Ltd., stand to benefit from

what U.S. government forecasters have pegged as a record-breaking

haul of corn and soybeans now being reaped by U.S. farmers. A

string of four consecutive bumper crops in North America has pushed

crop prices to low levels, translating to painfully low profits for

farmers, but lower costs for the companies that buy grain from

farmers to ship and process into flour, corn syrup and vegetable

oil.

ADM's third-quarter profits, boosted by strength in U.S. crop

exports that offset a drop in its oilseeds business, topped

analysts' expectations Tuesday. Shares soared 7% on the upbeat

outlook.

Mr. Luciano said that the availability and relative

competitiveness of U.S. grain on global markets made it likely that

North American exports would continue to do brisk business into the

first quarter of 2017, even as South American grain begins filling

bins and ships in Brazil and Argentina. The trend benefits ADM,

which maintains more grain-trading infrastructure in North America

than south of the equator.

Profit margins in the business, however, were unlikely to match

those ADM saw nearly three years ago, when a capacity crunch on

U.S. rail lines brought on by high traffic and a harsh winter

pushed grain-trading profits to very lofty levels, Mr. Luciano

said.

ADM is moving ahead with potential deals involving its corn dry

mills, which grind, crush and roll corn to produce ethanol fuel and

animal feed. Mr. Luciano told analysts that the company expects

final proposals from a "short list" of interested parties by the

end of 2016, after narrowing down proposals received in recent

months from seven interested parties.

"We are waiting for the second round of bids," he said. ADM has

been looking for ways to reduce invested capital in its business by

at least $1 billion over time and in some cases has brought in

partners to existing ventures, such as a 50% stake in a Brazilian

port sold last year to Glencore PLC.

In the third quarter, ADM earned $341 million, or 58 cents a

share, up from $252 million, or 41 cents a share, a year prior.

Results were boosted by gains in ADM's agricultural services and

corn-processing divisions, though oilseed profits fell by more than

half, mainly due to a quarterly loss reported by Wilmar

International Ltd., a Singapore-based commodity trader in which ADM

maintains a roughly 22% stake.

Excluding losses on sales and other special items, per-share

earnings fell a penny to 59 cents a share from 60 cents a year

before. Analysts surveyed by Thomson Reuters had expected 46 cents

a share.

Revenue slid 4.4% to $15.83 billion.

Joshua Jamerson contributed to this article.

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

November 01, 2016 11:08 ET (15:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

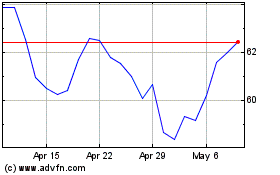

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Aug 2024 to Sep 2024

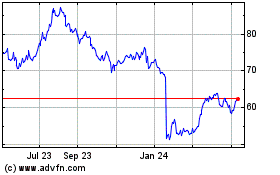

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Sep 2023 to Sep 2024