Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

March 10 2015 - 6:03AM

Edgar (US Regulatory)

|

|

|

| Supplementing the Preliminary Prospectus

Supplement dated March 9, 2015 (To Prospectus dated

December 10, 2014) |

|

Filed Pursuant to Rule 433 Registration

Statement No. 333-200838 and 333-200838-03 March 9,

2015 |

ACE INA Holdings Inc.

3.150% Senior Notes due 2025

Fully and Unconditionally Guaranteed by

ACE Limited

Pricing

Term Sheet

March 9, 2015

|

|

|

| Issuer: |

|

ACE INA Holdings Inc. |

|

|

| Guarantor: |

|

ACE Limited |

|

|

| Ratings (Moody’s / S&P / Fitch):* |

|

A3 (stable) / A+ (stable) / A+ (stable) |

|

|

| Security Type: |

|

Senior Unsecured Notes |

|

|

| Pricing Date: |

|

March 9, 2015 |

|

|

| Settlement Date: |

|

March 16, 2015 (T+5) |

|

|

| Maturity Date: |

|

March 15, 2025 |

|

|

| Principal Amount: |

|

$800,000,000 |

|

|

| Public Offering Price: |

|

99.983% |

|

|

| Coupon (Interest Rate): |

|

3.150% per year |

|

|

| Interest Payment Dates: |

|

March 15 and September 15, commencing September 15, 2015 (Short first coupon) |

|

|

| Benchmark Treasury: |

|

UST 2.000% due February 15, 2025 |

|

|

| Benchmark Treasury Price / Yield: |

|

98-06+ / 2.202% |

|

|

| Spread to Benchmark Treasury: |

|

+ 95 bps |

|

|

| Yield to Maturity: |

|

3.152% |

|

|

| Make-Whole Call (Optional Redemption): |

|

T + 15 bps |

|

|

| CUSIP / ISIN: |

|

00440EAS6/ US00440EAS63 |

|

|

| Joint Book-Running Managers: |

|

Citigroup Global Markets Inc. Morgan Stanley

& Co. LLC J.P. Morgan Securities LLC Wells Fargo

Securities, LLC |

|

|

| Senior Co-Managers: |

|

ANZ Securities, Inc. Deutsche Bank Securities

Inc. Goldman, Sachs & Co. HSBC Securities (USA) Inc.

Mitsubishi UFJ Securities (USA), Inc. |

|

|

| Co-Managers: |

|

Barclays Capital Inc. BNY Mellon Capital

Markets, LLC ING Financial Markets LLC Lloyds Securities

Inc. Merrill Lynch, Pierce, Fenner & Smith

Incorporated

RBC Capital Markets, LLC RBS Securities Inc.

Standard Chartered Bank |

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time.

The issuer and the guarantor have filed a registration statement (including a prospectus) with the SEC for the offering to

which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer or the guarantor has filed with the SEC for more complete information about the issuer, the guarantor

and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in this offering will arrange to send you the prospectus if you

request it by calling Citigroup Global Markets Inc. at 1-800-831-9146 or Morgan Stanley & Co. LLC at 1-866-718-1649.

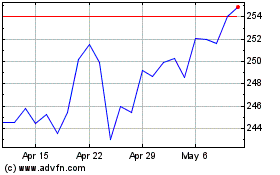

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Mar 2024 to Apr 2024

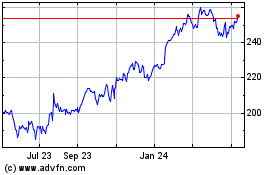

DBA Chubb (NYSE:CB)

Historical Stock Chart

From Apr 2023 to Apr 2024