TIDMZTF

RNS Number : 4960V

Zotefoams PLC

18 April 2016

Zotefoams plc

2015 Annual Report and Accounts and Notice of the 2016 Annual

General Meeting

In compliance with Listing Rule 9.6.1, the following documents

have been submitted to the National Storage Mechanism and will

shortly be available for inspection at:

http://www.morningstar.co.uk/uk/NSM

1 Annual Report and Accounts for the year ended 31 December

2015, incorporating the Notice of the 2016 Annual General Meeting;

and

2 Form of Proxy for the 2016 Annual General Meeting.

Copies of the 2015 Annual Report and Accounts and the Notice of

the 2016 Annual General Meeting are available on our website,

www.zotefoams.com under the Investor Relations tab.

A condensed set of the financial statements, the Chairman's

statement, Strategic report and responsibility statement of the

Directors in respect of the annual financial report were included

in the preliminary results announcement issued on 15 March 2016.

This announcement contains additional information for the purposes

of compliance with the Disclosure and Transparency Rules, including

principal risks and uncertainties and details of related party

transactions. This information is extracted from the 2015 Annual

Report and Accounts in full unedited text. This announcement is not

a substitute for reading the full Annual Report and Accounts. Page

and note references in the text below refer to page numbers and

notes in the 2015 Annual Report and Accounts.

Principal risks and uncertainties

The Board of Directors believes that the Principal Risks and

Uncertainties that the Group currently faces are as stated below.

Regular risk reviews are undertaken to ensure that the major risks

in the business, that could affect the Group's operations and

financial performance, have been identified and that, where

possible, mitigating actions and controls are put in place.

Significant risks are reviewed by the Board and the Audit

Committee. It is not possible to identify every risk that could

affect the Group's business, and the mitigating actions and

controls that have been put in place may not provide absolute

assurance that the risk will neither occur nor materially affect

the Group's operations or financial performance.

Risk and potential Mitigation actions

impact

--------------------------------- ---------------------------------

Operational The Group has extensive

As the Group's operations SHE policies and procedures

are currently mainly in place, which are

on one site, a significant in line with best practice.

operational disruption In the UK the Company

or Safety, Health and is certified to accredited

Environmental ('SHE') standards OHSAS 18001

incident could impact on Health and Safety

the ability to manufacture and ISO 14001, the

and supply products, International Standard

which could have reputational for Environment Management

issues and, in certain Systems.

defined circumstances,

have contractual commercial Regular training is

consequences which provided on SHE matters

may result in customer to the staff.

claims.

Pressure equipment

used is operated under

the Pressure Systems

Safety Regulations

2000 and is subject

to systematic internal

and frequent external

inspections in accordance

with the Safety Assessment

Federation.

The Group has extensive

fire prevention systems

in place and also has

appropriate contingency

plans in place in the

event of the failure

of certain major pieces

of equipment.

Reporting of incidents,

including 'near misses'

and damage to plant

or equipment not resulting

in personal injury,

is mandatory in order

to track issues and

to prevent reoccurrences.

Insurance is in place

to cover capital restatement

and loss of profits

in the event of operational

disruption caused by

certain events.

The Group is investing

in its Kentucky, USA,

site which, when completed,

will give multi-site

capability, subject

to capacity, on many

polyolefin products.

--------------------------------- ---------------------------------

Operational The extension of our

The Group is extending facilities in Kentucky

its operations in Kentucky will replicate, where

to cover the full block appropriate, machinery

foam manufacturing and processes already

process stages. This in operation in the

is a significant capital UK. Existing managerial

project, which is reliant and engineering support

on some specialist in North America will

suppliers, and needs be supplemented by

to be managed to time external project expertise

and budget. and resource from the

Group's Croydon operations.

Alternative suppliers

were considered. Raw

materials will be trialled

in the UK first to

reduce the commissioning

risk.

--------------------------------- ---------------------------------

Supply chain Wherever possible,

Certain of the Group's supplies are sourced

raw materials and engineering from more than one

components are sourced supplier or location.

from single suppliers. However, this is not

Disruption in those always possible, due

supplies, either on to the special nature

a temporary or more of the raw materials

permanent basis, could and machines used.

affect production and

supply to the Group's

customers and in certain

defined circumstances

have contractual commercial

consequences which

may result in customer

claims.

--------------------------------- ---------------------------------

Technology There are high barriers

The Group's processes of entry to the market.

for the manufacture Significant capital

of its products are investment is required

substantially unique for the autoclaves

to the and related infrastructure.

Group. Whilst the principles

behind the processes The Group actively

are not confidential, maintains its intellectual

the precise know-how property. It patents

is. A competitor could its technology wherever

match or improve upon it believes it is appropriate

the properties and to do so. Where technology

economics of the Group's is not subject to patent,

products. Key to the patents are no longer

success of the business applicable or the technology

of MuCell Extrusion is incapable of being

LLC ('MEL') is the patented, the Group

strength of its intellectual guards its know-how.

property and, on the

back of that, its ability The Group reduces its

to grant commercial technology risk by

licences. The risks entering into new markets.

to MEL are that its For example, the development

intellectual property of High-Performance

becomes dated or its Products ('HPP') and

patents expire or are MEL, where the product

successfully challenged. offerings are unique

and protected by patents

and/or process know-how

and capability, opens

up new markets for

the Group with potential

significant and lasting

differential advantages.

MEL actively maintains

and updates its intellectual

property portfolio.

This is done by undertaking

(MORE TO FOLLOW) Dow Jones Newswires

April 18, 2016 05:18 ET (09:18 GMT)

research and development

to add new patents

to the portfolio, further

developing its know-how

and obtaining licences

of key third-party

patents, which are

complementary to the

existing portfolio.

MEL licences typically

include a bundle of

patents and know-how

and therefore are not

completely dependent

on any particular patent.

--------------------------------- ---------------------------------

Pension To minimise the risk

The Company has a Defined to the Company of meeting

Benefit Pension Scheme the obligations under

('Scheme') and any the Scheme, the Company

inability of the closed the Scheme to

Scheme to meet its new members in 2001

liabilities to its and closed it to future

members could, ultimately, accrual of benefits

be the responsibility in 2005. The Company

of the Company. is currently working

together with the Trustees

to undertake de-risking

activities to the Scheme.

The Company has concluded

discussions with the

Trustees of the Scheme

on the triennial actuarial

valuation of the Scheme

as at 5 April 2014,

and the associated

recovery plan for the

Scheme. The Company

has agreed to make

a contribution to the

Scheme of GBP41k per

month until April 2020

to reduce the deficit.

--------------------------------- ---------------------------------

Foreign exchange The Group reduces its

The Group's operations foreign exposure for

are substantially based transactional items

in the UK and, therefore, by making purchases

most of its manufacturing either in euros or

assets and costs are US dollars where possible.

sterling denominated. For example, there

are US dollar costs

The Group has significant associated with the

exposure to foreign Group's operations

exchange fluctuations. in Kentucky, USA and

This is both transactional with MEL. In addition,

and on the translation the majority of the

of foreign currency Group's raw materials

balances and the consolidation are purchased in euros.

of its foreign subsidiaries.

The Group is currently

The Group's customers undertaking a circa

are normally invoiced $22m capital investment

in their local currencies. in North America which

In 2015, approximately will reduce exposure

80% of the Group's for transactional items

revenue was in currencies on the US dollar significantly.

other than sterling.

The Group, therefore, The Group has a hedging

generates surpluses policy, which is approved

in US dollars and euros, by the Board. The Group

which are converted hedges a proportion

into sterling. of its exposure for

transactional items

to foreign exchange

by using forward exchange

contracts. The Company,

like most public companies,

does not hedge for

the translation of

its foreign subsidiaries'

assets or liabilities

in the consolidation

of its Group accounts.

--------------------------------- ---------------------------------

Macro economics Some of the Group's

Most of our markets markets can be cyclical.

are exposed to general However, this risk

economic conditions. is spread geographically

The Group is operationally and across a number

geared and a fall in of segments which are

demand for its products expected to diversify

could adversely impact further with the growth

the Group. of HPP, MEL and the

joint ventures. The

Group's experience

is that in these circumstances

operational labour

costs can be reduced,

polymer prices generally

fall with reduced economic

demand giving a cost

benefit and cash can

be generated from reducing

working capital and

slowing capital expenditure

projects to help offset

the effects of a downturn.

The Group targets a

low financial gearing

to give it operational

flexibility in a downturn.

--------------------------------- ---------------------------------

Financing The Group has strong

The Group needs to cash generation from

have sufficient cash, its operations.

or be able to draw

on loan facilities, The Group:

to finance its operations -- has at 31.12.15

and growth. a $8m loan and GBP1.5m

of a GBP3.5m loan outstanding;

and

-- from 1 March 2016

a GBP8m multi-currency

revolving credit facility

('RCF') and a GBP2m

overdraft facility.

The loans and RCF facility

are secured against

certain Group assets

and are subject to

covenants as described

in note 21 and 27 of

the Annual Report.

When considering investment

projects the Group

has regard to its ability

to raise finance for

the project and will

not commit to a project

until acceptable and

appropriate finance

is in place, or believed

to be available.

--------------------------------- ---------------------------------

Commercial The Group's largest

Loss, poor performance customers are distributors

or insolvency of a and converters of foam.

major customer or joint-venture The Group has good

partner. knowledge of the end-customers

of its major customers

and, with some additional

short-term work, would

be able to bring or

identify additional

converter capacity

to service these markets.

The risks associated

with implementation

of joint ventures in

Asia have been mitigated

by partnering with

the JVs' major customers.

The joint venture agreements

contain clauses to

address performance

and insolvency issues.

--------------------------------- ---------------------------------

People The Group keeps under

The failure to attract, review its skill needs

(MORE TO FOLLOW) Dow Jones Newswires

April 18, 2016 05:18 ET (09:18 GMT)

develop or retain the and labour requirements.

right calibre of staff The Group aims to provide

to deliver growing its employees with

opportunities by product varied and interesting

and geographic reach. work and to incentivise

them appropriately.

The Group has appointed

a Global Talent Manager,

whose remit is to ensure

senior and emerging

talent is appropriate

for the Group's current

and future needs.

--------------------------------- ---------------------------------

Related parties

Directors

The Directors of the Company as at 31 December 2015 and their

immediate relatives control approximately 1.9% of the voting shares

of the Company. Details of Directors' pay and remuneration are

given in the Remuneration Report on pages 48 to 55. The Executive

Directors are considered to be the only key management

personnel.

Transactions with key management personnel

The compensation of key management personnel is as follows:

Group Company

2015 2014 2015 2014

GBP000 GBP000 GBP000 GBP000

Key management emoluments 505 488 505 488

Company contributions to money purchase pension plan 73 71

73

71

Share related awards 140 78 140 78

718 637 718 637

Subsidiaries

Details of the subsidiaries of the Company are set out in note

13. These companies are considered to be related parties.

In addition the Company has a 50% interest in associate

companies Azote Asia Limited (incorporated in Hong Kong) and Inoac

Zotefoams Korea Limited (incorporated in South Korea).

Common control exists between the Company and Zotefoams Employee

Benefit Trust (EBT) and Zotefoams EBT has therefore been

consolidated as described in note 1b.

Zotefoams Inc. owns 100% of the ownership units of MuCell

Extrusion LLC, which is incorporated in the USA.

Balances between the Company and its active subsidiaries and

associates are as follows:

Receivables owed by/(to) Investments in

2015 2014 2015 2014

GBP000 GBP000 GBP000 GBP000

Zotefoams Inc 4,747 1,604 - -

KZ Trading and Investment Ltd 125 - - -

Azote Asia Limited 1,817 995 - -

MuCell Extrusion LLC (67) - - -

Zotefoams International Limited - - 13,265 10,172

In addition there is a net payable balance of GBP2,166,000 owed

by MuCell Extrusion LLC to Zotefoams Inc.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCAKFDDCBKKAQD

(END) Dow Jones Newswires

April 18, 2016 05:18 ET (09:18 GMT)

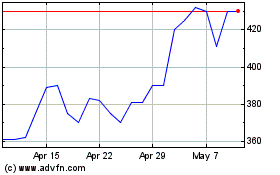

Zotefoams (LSE:ZTF)

Historical Stock Chart

From Apr 2024 to May 2024

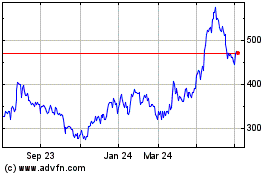

Zotefoams (LSE:ZTF)

Historical Stock Chart

From May 2023 to May 2024