Yen Rises On Japan FinMin Taro Aso Comments

July 25 2016 - 9:55PM

RTTF2

The Japanese yen strengthened against the other major currencies

in the Asian session on Tuesday, after Japanese finance minister

Taro Aso said that the government was yet to decide on the size of

economic stimulus package.

While speaking at a news conference in Tokyo, Japanese finance

minister Taro Aso said that he expect the BOJ to continue its

utmost efforts toward price target of 2 percent.

"Govt leaves actual policy measures in hands of BOJ", Aso

said.

The Bank of Japan will announce its interest rate decision this

Friday. Speculations are rife that the BOJ is likely to take

additional easing steps at the monetary policy meeting.

Meanwhile, Asian stocks fell following the overnight losses on

Wall Street and the slide in crude oil prices to its lowest in

almost three months. Investors also turned cautious ahead of

central bank meetings in the U.S. and Japan this week.

The U.S. Federal Reserve is scheduled to begin a two-day

monetary policy meeting later today. The central bank is widely

expected to leave interest rates unchanged, but the bank's

accompanying statement is likely to be in focus, as investors

attempt to gauge the outlook for the next rate hike.

Crude oil prices tumbled to the lowest in almost three months on

Monday amid worries that supplies will outpace demand.

Monday, the yen showed mixed trading against its major rivals.

While the yen fell against the U.S. dollar and the Swiss franc, it

held steady against the euro and the pound.

In the Asian trading, the yen rose to more than a 2-week high of

73.19 against the NZ dollar, from yesterday's closing value of

74.01. The yen may test resistance around the 70.00 area.

Against the pound, the U.S. dollar and the Swiss franc, the yen

advanced to near 2-week highs of 114.67, 137.69, 104.27 and 105.80

from yesterday's closing quotes of , 138.95, 105.79 and 107.29,

respectively. If the yen extends its uptrend, it is likely to find

resistance around 128.00 against the pound, 101.00 against the

greenback and 102.00 against the franc.

Against the Australian and the Canadian dollars and the euro,

the yen climbed to 2-week highs of 78.21, 79.02 and 114.67 from

yesterday's closing quotes of 79.02, 80.05 and 116.30,

respectively. On the upside, 74.00 against the aussie, 76.00

against the loonie and 110.00 against the euro are seen as the next

resistance level for the yen.

Looking ahead, U.K. BBA mortgage approvals for June is due to be

released at 4:30 am ET.

In the New York session, flash estimate of Markit's U.S. service

sector PMI for July, U.S. consumer confidence index for July, new

home sales data for June, U.S. S&P Case-Shiller home price

index for May and U.S. Richmond Fed manufacturing index for July

are slated for release.

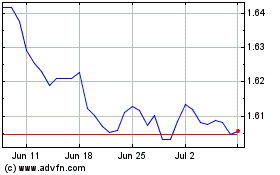

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

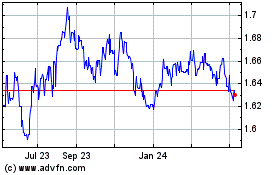

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024