Western Digital Posts a Loss

July 28 2016 - 5:30PM

Dow Jones News

Western Digital Corp. swung to a loss in its latest quarter as

the disk-drive maker folds in the recently acquired SanDisk

business.

The Irvine, Calif. company has been moving into flash-storage

technology as disk-drive sales dwindle. Western Digital recently

bought SanDisk, where sales of enterprise solutions, client SSDs

and removable products have been rising.

Chief Executive Steve Milligan called its fiscal 2016, which

ended in June, a transformative year. He said the combination of

SanDisk positions Western Digital to grab more share of the global

data center, client device and client solution markets.

While the addition of SanDisk helped push total sales up 9.5%

during the quarter, associated costs weighed on Western Digital's

bottom line. The company swung to a loss during the quarter;

without restructuring-related charges and other items, earnings

still nearly halved from a year earlier as operating expenses

climbed 48%.

Over all, Western Digital posted a loss of $351 million, or

$1.34 a share, down from a year-earlier profit of $220 million, or

94 cents a share. Excluding acquisition and restructuring-related

charges, among other items, earnings per share fell to 79 cents

from $1.51.

Revenue rose 9.5% to $3.50 billion.

Earlier this month, Western Digital had lifted its guidance for

the most recent quarter to 72 cents per adjusted share on $3.46

billion in revenue, to reflect the SanDisk addition. Analysts

polled by Thomson Reuters predicted 71 cents in adjusted earnings

per share and $3.44 billion in sales.

Shares were down 2.3% after hours.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

July 28, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

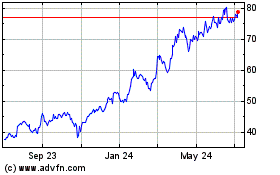

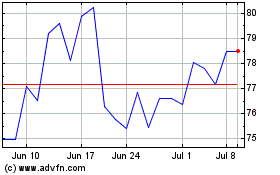

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Sep 2023 to Sep 2024