TIDMVOD

RNS Number : 0396G

Vodafone Group Plc

24 May 2017

24 May 2017

MELITA LTD AND VODAFONE MALTA MERGER TO CREATE NEW FULLY

INTEGRATED COMMUNICATIONS PROVIDER IN MALTA

Apax Partners Midmarket SAS ("Apax"), Fortino Capital

("Fortino") and Vodafone Group Plc ("Vodafone") today announced an

agreement to combine Melita Ltd ("Melita") and Vodafone Malta Ltd

("Vodafone Malta") (together, the "Combined Company").

The transaction combines Vodafone Malta, the country's leading

mobile operator with the highest customer satisfaction scores and

an industry-leading 4G mobile network covering 99% of the Maltese

population, with Melita, Malta's leading cable, broadband and pay

TV provider, with a network covering 99% of Maltese households.

Melita offers a wide range of rich content and superfast broadband

download speeds of up to 250mbps.

The Combined Company's mobile and enterprise business will

operate under the Vodafone brand, distribute a wide range of

services including Vodafone's global portfolio of products and

services and benefit from access to Vodafone's extensive expertise

in mobile and fixed operations worldwide.

Transaction rationale

The combination will create a new fully integrated

communications company with the scale and resources required to

offer competitive 'quad play' bundled mobile, fixed broadband,

fixed telephony and TV services to Maltese consumers and a full

range of enterprise services for businesses and the public

sector.

In a market where demand for converged services is accelerating

rapidly(1) , the Combined Company will be in a stronger position to

compete with the fully integrated incumbent, GO, ensuring

sustainable consumer choice over the long term.

The Combined Company is expected to be able to generate cost

synergies through the rationalisation of overlapping activities and

greater network investment efficiency as the Combined Company

introduces 4.5G, and subsequently 5G, mobile networks and

gigabit-capable fixed networks.

Transaction details

At completion, the current shareholders of Melita will own 51%

of the Combined Company and Vodafone Europe B.V. ("VEBV"), the

current shareholder of Vodafone Malta, will own the remaining

49%(2) .

The transaction values Vodafone Malta at an enterprise value of

EUR208 million, equivalent to multiples of 6.8x EV/2016 EBITDA and

15.1x EV/2016 OpFCF. The transaction values Melita at an enterprise

value of EUR298 million, equivalent to multiples of 8.9x EV/2016

EBITDA and 15.3x EV/ 2016 OpFCF(3) .

At completion, the Combined Company's net debt is expected to be

approximately EUR345 million and Vodafone will receive an estimated

cash payment of EUR120 million which will be used for general

corporate purposes. Melita's shareholders will receive an estimated

cash payment of EUR33 million.

The Combined Company will not be consolidated in Vodafone's

accounts and will be reported on an equity accounting basis after

completion of the transaction. The transaction is not expected to

have a material impact on Vodafone Group's free cash flow or

earnings.

The Melita shareholders intend to appoint the current CEO of

Melita, Harald Rösch, as CEO of the Combined Company and Vodafone

intends to appoint the current CFO of Vodafone Malta, Caroline

Farrugia, as CFO of the Combined Company. Vodafone will announce a

new role for Amanda Nelson, the current CEO of Vodafone Malta, in

due course.

Conditions to completion and indicative timeline

The transaction is conditional on approval from the Malta

Competition and Consumer Affairs Authority and is expected to close

in the second half of the 2017 calendar year.

1 According to the Malta Communications Authority, in the fourth

quarter of 2016, 78.7% of fixed broadband connections and 68.4% of

postpaid fixed lines were sold in a bundle. See "Key Market

Indicators for Electronic Communications and Post" Q1 2012 to Q4

2016

2 Excluding the dilutive effect of management incentivisation

plans for the Combined Company

3 Melita underlying OpFCF for the twelve months ended December

31, 2016, adjusted to exclude non-recurring capital expenditure

relating to IRU investments

- ends -

For further information:

Vodafone Group

Media Relations Investor Relations

www.vodafone.com/media/contact Telephone: +44 (0) 7919

990 230

Melita

Melita Chris Scicluna

PR Director - Hype

chris@hypepr.co

Apax Partners MidMarket

Coralie Cornet

Communication Director

+ 33 1 53 65 01 35

coralie.cornet@apax.fr

Fortino Capital

Lyzette Martens

Communications Director

+ 32 2 669 10 50

lyzette.martens@fortino.be

About Vodafone Group

Vodafone Group is one of the world's largest telecommunications

companies and provides a range of services including voice,

messaging, data and fixed communications. Vodafone has mobile

operations in 26 countries, partners with mobile networks in 48

more, and fixed broadband operations in 17 markets. As of 31 March

2017, Vodafone had 515.7 million mobile customers and 17.9 million

fixed broadband customers, including India and all of the customers

in Vodafone's joint ventures and associates. For more information,

please visit: www.vodafone.com.

About Vodafone Malta

For the twelve months ended December 31, 2016, Vodafone Malta

generated EUR30 million of underlying EBITDA and EUR14 million of

underlying OpFCF. For the financial year ended March 31, 2016

Vodafone Malta generated a profit before tax of EUR11 million and

had gross assets of EUR77 million.

About Melita

For the twelve months ended December 31, 2016, Melita generated

EUR33 million of underlying EBITDA and EUR20 million of underlying

OpFCF.

About Apax Partners MidMarket

Apax Partners MidMarket is a leading private equity firm in

France and Europe. With more than 45 years of experience, Apax

Partners MidMarket provides long-term equity financing to build and

strengthen world-class companies. Funds managed and advised by Apax

Partners MidMarket exceed EUR3 billion. These funds invest in

fast-growing middle-market companies across four sectors of

specialisation. Apax Partners MidMarket TMT investment includes

Altran, Gfi Informatique, InfoVista, Melita, Nowo-ONI and

Vocalcom.

About Fortino Capital

Belgian based Investment company Fortino Capital invests in

small and medium-sized businesses with growth potential. Fortino

Capital believes in the potential of visionary entrepreneurs with a

focus on technology, E-commerce and digital transformation. Fortino

Capital brings strengthening of capital, expertise and experience

in the areas of innovation, strategy and growth. For more

information: www.fortino.be

Advisors

Akira Partners LLP, DLA Piper UK LLP and Linklaters LLP acted as

exclusive advisors to Vodafone. Lazard, Weil Gotshal & Manges

and Jones Day acted as exclusive advisors to Apax Partners

MidMarket and Fortino Capital.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDDGDUCSDBGRX

(END) Dow Jones Newswires

May 24, 2017 02:01 ET (06:01 GMT)

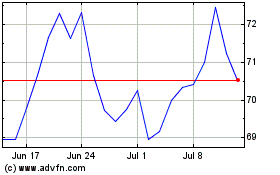

Vodafone (LSE:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

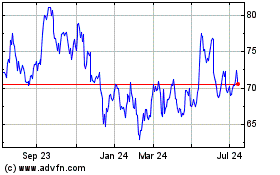

Vodafone (LSE:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024