Updated Research Report on Arrow Electronics - Analyst Blog

March 31 2014 - 2:00PM

Zacks

On Mar 28, 2014, we issued an updated research report on

Arrow Electronics Inc. (ARW) after it reported

better-than-expected fourth-quarter results.

Arrow’s year-over-year comparisons were modestly up and it had a

favorable book-to-bill ratio. In addition, positive commentary

about enhanced productivity, annual cost savings and continued

higher contributions from Europe were encouraging.

Arrow’s strong distribution channels are being preferred by

original equipment manufacturers, contract manufacturers and

commercial customers to market their products. The company’s core

strength in providing best-in-class services and easy-to-acquire

technologies will act as growth catalysts.

Moreover, the company has secured a significant market share

through a broad portfolio of products and services, and continued

efforts to maximize consumer satisfaction. Additionally,

incremental sales from the strategic acquisitions, such as

Computerlinks, are expected to boost Arrow’s top line.

It is worth noting that, spending on electronic equipments are

dependent on the overall IT spending. Per the U.S. research firm

Gartner, overall IT spending is expected to grow 3.1% in 2014,

primarily driven by enterprise software and IT services. As a

specialized distributor of these products and services, Arrow

Electronics stands to benefit from the projected increase.

However, Arrow derives a significant portion of its revenues

from the sale of semiconductors — a cyclical industry characterized

by changes in technology and manufacturing capacity and is subject

to significant market upturns and downturns. According to World

Semiconductor Trade Statistics (WSTS) data, worldwide semiconductor

sales are expected to grow at 4.1% in 2014, followed by 3.4% growth

in 2015. Therefore, a slowdown in this market might decelerate the

company’s business in 2015.

Moreover, Arrow has a highly leveraged balance sheet. As of Dec

31, 2013, the company’s net debt amounted to $1.86 billion, which

deteriorated from a net debt position of $1.69 billion as on Sep

28, 2013. Additionally, competition from Avnet

(AVT) and Ingram Micro (IM) remain the

headwind.

Currently, Arrow Electronics has a Zacks Rank #3 (Hold).

Investors may consider a better-ranked stock like Juniper

Networks (JNPR) sporting a Zacks Rank #1 (Strong Buy).

ARROW ELECTRONI (ARW): Free Stock Analysis Report

AVNET (AVT): Free Stock Analysis Report

INGRAM MICRO (IM): Free Stock Analysis Report

JUNIPER NETWRKS (JNPR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

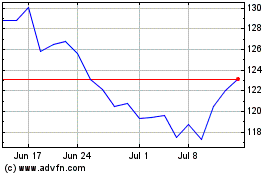

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

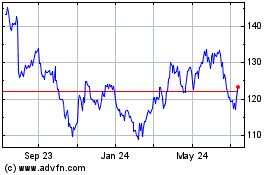

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024