Ubiquiti Networks Beats on Q3 Earnings and Revs - Analyst Blog

May 09 2014 - 10:00AM

Zacks

Ubiquiti Networks,

Inc. (UBNT) reported strong third-quarter fiscal 2014

results with non-GAAP earnings of 50 cents per share, exceeding the

Zacks Consensus Estimate of 48 cents by 4.2%. Earnings also beat

the prior-year quarter earnings of 24 cents by a robust 108%. The

company reported non-GAAP net income of $45.2 million compared with

$21.1 million in the year-ago quarter, reflecting an increase of

114.2%.

Growth in the company’s core

business primarily drove the earnings. Ubiquiti’s consistent focus

on enhancing services by increasingly investing in innovation and

development also supported the upside. Management’s executive

abilities and the opportunities in the enterprise business also

contributed to the strong results.

Revenues

Ubiquiti’s total revenue for the

third quarter surged 78.2% year over year and 7.2% sequentially to

$148.3 million. Top-line growth was driven by increased transaction

volumes and addition of new services for existing customers.

Additionally, strong performance by the Enterprise Technology

segment contributed to the top-line growth. Revenues also surpassed

the Zacks Consensus Estimate of $141 million by 5.2%.

Segment

Performance

TheService Provider

Technology segment’s sales increased 60.3% year over year

to $121 million driven by strong performance across all its

businesses, including airMAX, airFiber and EdgeMAX.

TheEnterprise Technology

segment’s sales reflected a phenomenal increase of 254.5%

year over year to $27.3 million. The improvement was supported by a

significant sales increase in its UniFi platform business.

Income and

Expenses

The company reported operating

income of $50.1 million, up 113.2% from $23.5 million in the

prior-year quarter. Gross margins also expanded 156 basis points to

44.2% from 42.7% in the year-earlier quarter.

The company’s research and

development expenses totaled $9.4 million, up 65.8% year over year

from $5.7 million. Meanwhile, sales, general and administration

expenses stood at $6.1 million versus $6.3 million in the

prior-year quarter.

Balance Sheet and Cash

Flow

Cash and cash equivalents were

$291.7 million at quarter-end compared with $227.8 million as of

Jun 30, 2013. The company reported total equity of $283.9 million

against $147.4 million as on Jun 30, 2013. The company’s long-term

debt declined 7.0% in the last nine months to $66.1 million.

Cash flow from operating activities

for the quarter aggregated $14.0 million compared with $27.6

million in the prior quarter. The deterioration resulted from

increased investments in inventories during the third quarter.

Outlook

Management expects revenues for the

fourth quarter of fiscal 2014 in the range of $147–$153

million.

The company projects non-GAAP

earnings per share between 48 cents and 52 cents, while GAAP

earnings are expected to lie in the 47–51 cents band.

Other Stocks to

Consider

Ubiquiti currently carries a Zacks

Rank #3 (Hold). Some better–ranked stocks operating in the same

sector worth reckoning include ShoreTel, Inc.

(SHOR), Juniper Networks Inc. (JNPR) and

Nokia Corp. (NOK). While SHoreTel sports a Zacks

Rank #1 (Strong Buy), Juniper Networks and Nokia carry a Zacks Rank

#2 (Buy).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

JUNIPER NETWRKS (JNPR): Free Stock Analysis Report

NOKIA CP-ADR A (NOK): Free Stock Analysis Report

SHORETEL INC (SHOR): Free Stock Analysis Report

UBIQUITI NETWRK (UBNT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

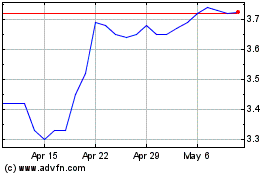

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024