UPDATE: Whirlpool Petitions US For Trade Probe Of Samsung, LG

March 30 2011 - 1:58PM

Dow Jones News

Whirlpool Corp. (WHR) is accusing South Korean rivals Samsung

Electronics Co. (SSNHY, 005930.SE) and LG Electronics Inc.

(066570.SE) of violating trade laws in their marketing of

foreign-built refrigerators in the U.S.

Whirlpool, the world's largest manufacturer of household

appliances, has asked the U.S. Commerce Department to investigate

the two companies, which have been grabbing market share from

Whirlpool and Electrolux AB (ELUXY, ELUX-B.SK) by offering lower

prices on appliances. Whirlpool alleges that the companies are

"dumping" refrigerators in the U.S. from South Korea and Mexico, a

practice that involves selling appliances in the U.S. for much less

than their cost in the overseas markets where they were

manufactured.

"Dumping is an unfair trade practice used to drive out

competitors, which means consumers end up with fewer choices," said

Marc Bitzer, Whirlpool's president for North American operations,

in a written statement.

Whirlpool's complaint specifically cites Samsung and LG's

discounting of high-end refrigerators featuring a pull-out freezer

drawer on the bottom of the box. Bottom-mounted refrigerators are

about $3 billion a year business in North America. Whirlpool's

market share in the category was about 35% in 2008, but had fallen

to below 15% in 2010. Meanwhile, imported bottom-mounted boxes, led

by Samsung and LG, accounted for 84% of the North American market

last year, according to Whirlpool's filing. Neither Samsung nor LG

had any presence in the category a decade ago, said Sam Darkatsh,

an analyst for Raymond James.

Whirlpool, which is based in Benton Harbor, Mich., alleges

Samsung and LG also have received "substantial unfair subsidies"

from the South Korean government that allow the companies to offer

big discounts in the U.S. and maintain an advantage over other

appliance makers. Whirlpool wants the U.S. government to assign a

duty on the companies' imported appliances.

"The fact that this petition has come about should not be a

shocker," Darkatsh said. "There's been a lot of industry chatter

about the fact that the Koreans are not focused on profitability

let alone return on capital. They're trying to buy market

share."

Samsung and LG did not immediately respond to requests for

comments on the complaint.

Samsung has said it's targeting world-wide appliance sales of

about $30 billion a year by 2015, up from more than $10 billion

last year.

Aggressive discounting during the U.S. Christmas shopping season

put pressure on Whirlpool's fourth-quarter profits at a time when

the company is facing rising costs for materials, such as steel and

copper. Whirlpool and Electrolux have said they plan to raise U.S.

appliance prices by between 8% and 10% in April.

"It will be interesting to see how sticky those price increases

will be," Darkatsh said. "Pricing has been very soft and very

promotional since the end of 2009 because the demand hasn't been

there."

Whirlpool's stock was recently trading up 2.3% at $83.44 a

share.

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

--Nathan Becker contributed to this article.

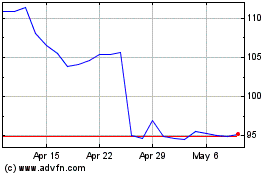

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

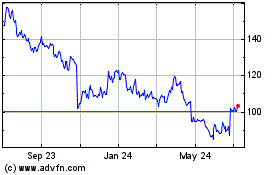

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024