Tullett Prebon PLC Half Yearly Report -5-

July 28 2015 - 2:02AM

UK Regulatory

Taxation (4.6) (9.9)

Net dividends received from associates/paid

to minorities - 0.1

Acquisitions/investments (0.5) (1.2)

Cash flow 99.3 4.2

======== ========

The operating cash flow of GBP46.1m for the first half of 2015

is lower than the underlying operating profit reflecting the usual

seasonal working capital outflow.

The working capital outflow reflects the higher level of trade

receivables and settlement balances at June compared with the level

at the previous year end, due to the higher level of business

activity towards the end of the half year compared with that

towards the year end, and the reduction in bonus accruals which are

at their highest at the year end.

During the first half the group made GBP3.8m of cash payments

relating to actions taken under the 2014 cost improvement

programme, and GBP0.2m relating to the 2011/12 restructuring

programme.

The major legal actions net cash inflow of GBP64.4m is in line

with the credit in the income statement, and reflects the

settlement from BGC net of the costs incurred in 2015.

The movement in cash and debt is summarised below.

GBPm Cash Debt Net

At 31 December 2014 297.8 (219.7) 78.1

Cash flow 99.3 - 99.3

Dividends (27.4) - (27.4)

Debt and bank facility arrangement

fees (1.7) - (1.7)

Amortisation of debt issue costs - (0.3) (0.3)

Cash sold with subsidiaries (0.3) - (0.3)

Effect of movement in exchange

rates (3.1) - (3.1)

At 30 June 2015 364.6 (220.0) 144.6

======= ======== =======

At 30 June 2015 the group's outstanding debt comprised GBP141.1m

Sterling Notes due July 2016 and GBP80m Sterling Notes due June

2019. The group renewed its committed GBP150m revolving credit

facility during the first half, and the new facility matures in

April 2018. No drawings were made on either the old or new facility

during the period.

Outlook

Our recent strategic review concluded that the central role

played by interdealer brokers at the heart of the global wholesale

OTC markets remains secure. However, in a number of traditional

interdealer broker products, revenue declines are likely to

continue. In contrast, Energy and commodities do not currently face

the same pressures and we expect to benefit from the recent

investments we have made in developing our presence in this sector.

We will continue to invest in the business's capabilities to

identify and implement business initiatives and we will look to

further invest in revenue growth opportunities.

We will also continue to roll out our cultural, legal,

compliance and risk governance frameworks to deliver our commitment

to instil and embed the highest standards of conduct. These

investments, increasing regulatory related costs, and the impact of

the areas of business weakness, are expected to offset the

improvement in the operating margin compared with that delivered

last year. The investments are important for the Company to retain

its competitive advantage and to deliver our strategy to increase

revenue and earnings for the medium and longer term.

Condensed Consolidated Income Statement

for the six months ended 30 June 2015

Six months ended Underlying Exceptional Total

30 June 2015 (unaudited) and

acquisition

related

items

Notes GBPm GBPm GBPm

---------------------------------- ------ ------------ ------------- ------------

Revenue 5 415.7 - 415.7

---------------------------------- ------ ------------ ------------- ------------

Administrative expenses (358.2) (8.9) (367.1)

---------------------------------- ------ ------------ ------------- ------------

Other operating income 7 3.1 67.1 70.2

---------------------------------- ------ ------------ ------------- ------------

Operating profit 5,6 60.6 58.2 118.8

---------------------------------- ------ ------------ ------------- ------------

Finance income 8 1.9 - 1.9

---------------------------------- ------ ------------ ------------- ------------

Finance costs 9 (9.6) - (9.6)

---------------------------------- ------ ------------ ------------- ------------

Profit before tax 52.9 58.2 111.1

---------------------------------- ------ ------------ ------------- ------------

Taxation (10.8) (12.9) (23.7)

---------------------------------- ------ ------------ ------------- ------------

Profit of consolidated companies 42.1 45.3 87.4

---------------------------------- ------ ------------ ------------- ------------

Share of results of associates 1.2 - 1.2

---------------------------------- ------ ------------ ------------- ------------

Profit for the period 43.3 45.3 88.6

================================== ====== ============ ============= ============

Attributable to:

---------------------------------- ------ ------------ ------------- ------------

Equity holders of the parent 43.0 45.3 88.3

---------------------------------- ------ ------------ ------------- ------------

Minority interests 0.3 - 0.3

---------------------------------- ------ ------------ ------------- ------------

43.3 45.3 88.6

================================== ====== ============ ============= ============

Earnings per share

---------------------------------- ------ ------------ ------------- ------------

- Basic 10 17.7p 36.2p

---------------------------------- ------ ------------ ------------- ------------

- Diluted 10 17.4p 35.8p

---------------------------------- ------ ------------ ------------- ------------

Six months ended Underlying Exceptional Total

30 June 2014 (unaudited) and

acquisition

related

items

Notes GBPm GBPm GBPm

---------------------------------- ------ ------------ ------------- ------------

Revenue 5 360.3 - 360.3

---------------------------------- ------ ------------ ------------- ------------

Administrative expenses (312.3) (34.3) (346.6)

---------------------------------- ------ ------------ ------------- ------------

Other operating income 7 2.3 - 2.3

---------------------------------- ------ ------------ ------------- ------------

Operating profit 5,6 50.3 (34.3) 16.0

---------------------------------- ------ ------------ ------------- ------------

Finance income 8 1.8 - 1.8

---------------------------------- ------ ------------ ------------- ------------

Finance costs 9 (8.9) - (8.9)

---------------------------------- ------ ------------ ------------- ------------

Profit before tax 43.2 (34.3) 8.9

---------------------------------- ------ ------------ ------------- ------------

Taxation (9.3) 2.2 (7.1)

---------------------------------- ------ ------------ ------------- ------------

Profit of consolidated companies 33.9 (32.1) 1.8

---------------------------------- ------ ------------ ------------- ------------

Share of results of associates 1.2 - 1.2

---------------------------------- ------ ------------ ------------- ------------

Profit for the period 35.1 (32.1) 3.0

================================== ====== ============ ============= ============

Attributable to:

---------------------------------- ------ ------------ ------------- ------------

Equity holders of the parent 34.9 (32.1) 2.8

---------------------------------- ------ ------------ ------------- ------------

Minority interests 0.2 - 0.2

---------------------------------- ------ ------------ ------------- ------------

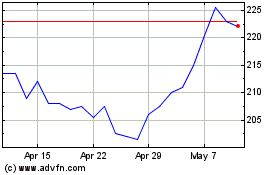

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

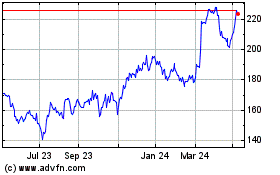

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Apr 2023 to Apr 2024