Tullett Prebon Confirms Acquisition of ICAP's Brokering Unit

November 11 2015 - 4:10AM

Dow Jones News

LONDON—Interdealer broker Tullett Prebon PLC confirmed Wednesday

it is buying ICAP PLC's global hybrid voice brokering and

information business in return for shares representing 56% of the

enlarged issued share capital.

The two companies announced last week that they were in talks

and a person close to the situation told The Wall Street Journal

the deal could be worth more than £ 1 billion ($1.5 billion).

Upon completion of the deal ICAP shareholders will hold 36.1% of

the enlarged group, ICAP will hold 19.9% and existing Tullett

Prebon shareholders will hold 44% of the enlarged share

capital.

Tullett Prebon Chairman Rupert Robson said the acquisition would

deliver attractive financial returns for shareholders.

Separately ICAP reported a 17% rise in its headline trading

profit before tax and said it remains well positioned to benefit

from any future improvement in trading conditions.

For the half year ended Sept. 30 ICAP made a trading profit,

which strips exceptional and other one-off items, of £ 101 million,

compared with £ 86 million a year earlier, on revenue of £ 595

million and £ 620 million respectively.

Profit before tax for the half year was £ 83 million, compared

with £ 36 million for the first half of fiscal 2015.

The dividend has been maintained at 6.6 pence.

Write to Ian Walker at ian.walker@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 03:55 ET (08:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

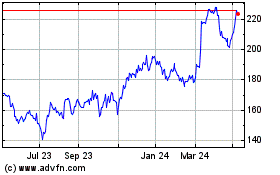

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

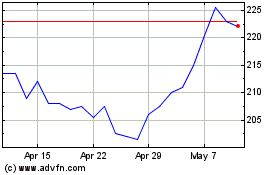

Tp Icap (LSE:TCAP)

Historical Stock Chart

From Apr 2023 to Apr 2024