Tristel PLC Trading update, Special dividend & Acquisition (7820E)

July 21 2016 - 2:00AM

UK Regulatory

TIDMTSTL

RNS Number : 7820E

Tristel PLC

21 July 2016

Tristel plc

("Tristel", the "Group" or the "Company")

Trading update and special dividend

Acquisition of the business and assets of its Australian

distributor

& Notice of results

Tristel plc (AIM: TSTL), the manufacturer of infection

prevention, contamination control and hygiene products provides a

trading update for the year ended 30 June 2016, declares a special

dividend and announces the acquisition of the business and assets

of its Australian distributor.

Trading update and special dividend

For the year ended 30 June 2016 Tristel will record turnover in

excess of GBP17 million (2015: GBP15.3 million) and pre-tax profit

(before share-based payments and unrealised currency gains) of at

least GBP3.1 million (2015: GBP2.6 million). Both turnover and

pre-tax profit are ahead of market expectations.

In the second half, revenue from overseas markets contributed

41% of the Group total compared to 36% in the first half, and for

the full year overseas revenue represented 39% of Group revenue - a

record level.

Tristel has continued to generate significant levels of cash and

at 30 June 2016 cash balances were GBP5.7 million compared to

GBP4.0 million at 30 June 2015. The Company has no debt.

Accordingly the Board has decided to return to shareholders the

portion of this cash that it considers surplus to its investment

and operational requirements and announces a special dividend of

three pence per share payable on 5 August 2016 to shareholders on

the register on 29 July 2016. The corresponding ex-dividend date is

28 July 2016. The Company expects to declare a final dividend for

the year at the time of the preliminary results to be announced in

October. The level of the final dividend will be determined in

accordance with the Company's prevailing normal dividend policy:

earnings per share to cover the dividend by at least two times.

After the payment of this special dividend and payment of the

consideration associated with the acquisition referred to below,

the Company's ongoing intention is to retain cash reserves in

excess of GBP3.0 million. The Company last paid a special dividend

of 3 pence per share in August 2015.

Acquisition of Australian distributor's business

Tristel has acquired the assets and business of Ashmed Pty Ltd,

Melbourne. Since 2011 Ashmed has acted as the Company's distributor

in Australia for the Tristel Wipes System. The consideration is

AU$1.35 million plus certain compensation payments for the

re-purchase of inventory. The management team is staying with the

business.

The distributorship achieved sales of approximately AU$3 million

during the year ended 30 June 2016 and is profitable. Tristel

expects the acquisition to improve significantly its margins on

sales to the Australian hospital market and the acquisition will be

earnings enhancing. The Company expects the business to contribute

incremental earnings of at least GBP100,000 during the current

financial year.

Trading outlook

Tristel continues to make solid progress both in the United

Kingdom and overseas. The Company's plans to enter the United

States market remain on track following a successful meeting with

the Food and Drug Administration (FDA) in Washington on 28 April

2016. The Company also continues to actively pursue registrations

with the Environmental Protection Agency (EPA). Following the FDA

meeting and detailed investigation into the product approval

requirements of the EPA, Tristel has multiple test programmes

underway. The Board expects to be in a position to provide a

detailed assessment of progress at the time of the preliminary

results.

Shareholder Open Day

Tristel is today hosting an Open Day for Shareholders at the

Company headquarters in Snailwell, Cambridgeshire. A presentation

will be made during the Open Day; however, no new material

information will be disclosed during the course of the day. The

presentation will be available shortly on the Company website:

www.tristel.com/investor-centre

Notice of results

The Company expects to announce its preliminary results for the

year ended 30 June 2016 on 17 October 2016.

Francisco Soler, Chairman of Tristel plc, comments:

"The Company enjoyed very strong second half growth in both the

UK and overseas compared to last year. UK revenues in the second

half were GBP5.3 million, an increase of 10.4% on last year's

GBP4.8 million. An excellent performance overseas resulted in

second half revenue of GBP3.7 million compared to GBP3.1 million

last year, an increase of 19.4%.The proportion of our revenues that

are generated overseas continues to increase, and we intend to

maintain this trend. I look forward to the Group continuing its

expansion in the years ahead and to providing further detail with

regards to the United States regulatory project in October."

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

For further information please contact:

Tristel plc Tel: 01638 721 500

Paul Swinney, Chief Executive

Officer

Liz Dixon, Finance Director

Walbrook PR Ltd Tel: 020 7933 8780 or tristel@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

finnCap Tel: 020 7220 0500

Geoff Nash/ Giles Rolls (Corporate

Finance)

Alice Lane (Corporate Broking)

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGMGZNKGNGVZM

(END) Dow Jones Newswires

July 21, 2016 02:00 ET (06:00 GMT)

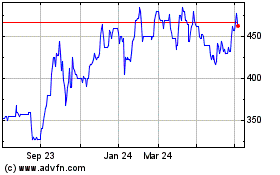

Tristel (LSE:TSTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

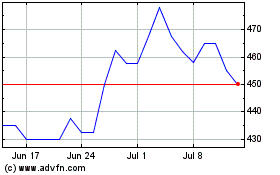

Tristel (LSE:TSTL)

Historical Stock Chart

From Apr 2023 to Apr 2024