Tristel PLC Half Yearly Report -3-

February 25 2015 - 2:00AM

UK Regulatory

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

transactions

with owners 5 233 - 3 (617) (376) 169 (207)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Profit for the

period ended

31 Dec 2014 - - - - 773 773 - 773

Other

comprehensive

income:-

Exchange

differences

on

translation

of foreign

operations - - - (11) - (11) - (11)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

comprehensive

income - - - (11) 773 762 - 762

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

31 Dec 2014 407 9,517 478 (101) 2,323 12,624 7 12,631

========= ========= ========= ========== =========== ============== ============= ===========

CONDENSED CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2014

31-Dec-14 31-Dec-13 30-Jun-14

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 667 667 667

Intangible assets 5,593 5,584 5,637

Property, plant and equipment 1,319 1,159 1,277

Deferred tax 44 306 83

7,623 7,716 7,664

------------- ------------- -----------

Current assets

Inventories 1,997 1,836 2,063

Trade and other receivables 2,764 2,431 2,690

Cash and cash equivalents 2,945 1,621 2,664

7,706 5,888 7,417

Total assets 15,329 13,604 15,081

============= ============= ===========

Capital and reserves attributable to the

Company's equity holders

Called up share capital 407 400 402

Share premium account 9,517 9,151 9,284

Merger reserve 478 478 478

Foreign exchange reserves (101) (105) (93)

Retained earnings 2,323 1,434 2,167

Equity attributable to equity

holders of parent 12,624 11,358 12,238

------------- ------------- -----------

Minority interest 7 14 (162)

Total Equity 12,631 11,372 12,076

------------- ------------- -----------

Current liabilities

Trade and other payables 2,109 1,955 2,538

Interest bearing loans and borrowings 27 55 42

Current tax liabilities 329 196 213

Total current liabilities 2,465 2,206 2,793

------------- ------------- -----------

Non-current liabilities

Interest bearing loans and borrowings - 26 8

Deferred tax 233 - 204

------------- ------------- -----------

Total liabilities 2,698 2,232 3,005

Total equity and liabilities 15,329 13,604 15,081

============= ============= ===========

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 31 DECEMBER 2014

6 months 6 months

ended ended Year ended

31-Dec-14 31-Dec-13 30-Jun-14

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows generated from

operating activities

Cash generated from operating Note

activities 6 1,070 1,628 3,250

Corporation tax (70) (28) 21

1,000 1,600 3,271

------------- ------------- ------------

Cash flows used in investing

activities

Interest received 7 2 6

Purchase of intangible assets (181) (197) (479)

Purchase of property, plant

and equipment (244) (285) (677)

Proceeds on sale of property,

plant and equipment 8 16 72

(410) (464) (1,078)

------------- ------------- ------------

Cash flows used in financing

activities

Loans repaid (25) (36) (66)

Interest paid - (6) (10)

Share issues 238 - 135

Equity dividends paid (512) (128) (272)

(299) (170) (213)

------------- ------------- ------------

Increase in cash and cash

equivalents 291 966 1,980

Cash and cash equivalents

at the beginning of the

period 2,664 627 627

Exchange difference on cash

and cash equivalents (10) 28 57

Cash and cash equivalents

at the end of the period 2,945 1,621 2,664

============= ============= ============

NOTES TO THE ACCOUNTS

FOR THE SIX MONTHS ENDED 31 DECEMBER 2014

1. PRINCIPal ACCOUNTING POLICIES

Basis of Preparation

For the year ended 30 June 2014, the Group prepared consolidated

financial statements under International Financial Reporting

Standards ('IFRS') as adopted by the European Commission. These

will be those International Accounting Standards, International

Financial Reporting Standards and related interpretations

(SIC-IFRIC interpretations), subsequent amendments to those

standards and related interpretations, future standards and related

interpretations issued or adopted by the IASB that have been

endorsed by the European Commission. This process is ongoing and

the Commission has yet to endorse certain standards issued by the

IASB.

These condensed consolidated interim financial statements (the

interim financial statements) have been prepared under the

historical cost convention. They are based on the recognition and

measurement principles of IFRS in issue as adopted by the European

Union (EU) and which are, or are expected to be, effective at 30

June 2015. They do not include all of the information required for

full annual financial statements, and should be read in conjunction

with the consolidated financial statements of the Group for the

year ended 30 June 2014. The interim financial statements have been

prepared in accordance with the accounting policies adopted in the

last annual financial statements for the year to 30 June 2014. The

accounting policies have been applied consistently throughout the

Group for the purposes of preparation of these condensed

consolidated interim financial statements.

Accounting Policies

The interim report is unaudited and has been prepared on the

basis of IFRS accounting policies.

The accounting policies adopted in the preparation of this

unaudited interim financial report are consistent with the most

recent annual financial statements being those for the year ended

30 June 2014.

2 Publication of non-statutory accounts

The financial information for the six months ended 31 December

2014 and 31 December 2013 has not been audited and does not

constitute full financial statements within the meaning of Section

434 of the Companies Act 2006.

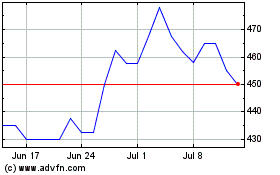

Tristel (LSE:TSTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

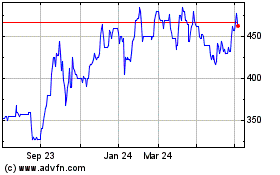

Tristel (LSE:TSTL)

Historical Stock Chart

From Apr 2023 to Apr 2024