TIDMTRAK

RNS Number : 5106G

Trakm8 Holdings PLC

23 November 2015

23 November 2015

TRAKM8 HOLDINGS PLC

("Trakm8" or "the Group")

Half Year Results

Significant momentum in revenues and profit

Trakm8 Holdings plc, the telematics and data provider to the

global market place is pleased to announce its unaudited results

for the six months ended 30 September 2015:

Highlights

Six months Six months Year to Change

to 30 September to 30 September 31 March

2015 2014 2015

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 11,726 8,478 17,853 38%

Of which, Recurring

Revenue 3,976 2,404 5,580 65%

Adjusted Earnings before

interest, tax, depreciation

& amortisation* 1,922 1,130 2,597 70%

Adjusted Profit before

tax* 1,478 782 1,819 89%

Net cash and cash equivalents 1,423 1,914 3,408

Adjusted earnings per

share* 5.08p 2.70p 6.24p

*Adjustment for exceptional costs of acquisitions and share

based payments

Financial Highlights

-- Revenues increased by 38%. Like for like revenues up 30%; recurring revenues up by 65%

-- Orders received increased by 29%. Like for like orders received up 21%

-- Adjusted EBITDA increased by 70%

-- Adjusted profit before tax increased by 89% to GBP1.48m (2014: GBP0.78m)

-- Strong net cash generation compared to previous half years

Operating highlights

-- New contract awards and extensions including with Bibby Distribution Ltd

-- Acquisition of trade and assets of DCS Systems Ltd ("DCS")

o Integrated and earnings enhancing

-- Installed base continues to grow

o approximately 135,000 units (2014: 77,000) reporting to our

servers

Current trading

-- Benefit of new contracts together with strong order pipeline

-- Expect to modestly exceed current expectations

John Watkins, Executive Chairman of Trakm8 said:

"Trakm8 has had another strong period of growth from existing

and new customers leading to today's results being ahead of our

previous expectations. The installed base of devices reporting to

our servers continues to increase rapidly and these recurring

revenues are the core of Trakm8's business model and financial

security. The acquisition of the DCS business is meeting our

initial expectations and is proving a good platform for our

strategic goals to integrate video data with our other data

services.

"We continue to be well placed to grow the Group through

investment and acquisitions. Recent contract wins and the stronger

than budgeted start to the year mean we now believe that we will

modestly exceed the current market expectations for the year as a

whole."

For further information, please visit www.trakm8.com or

contact:

Trakm8 Holdings plc

John Watkins, Executive Chairman

James Hedges, Finance Director 01747 858 444

MHP Communications

Reg Hoare / Jade Neal / Charlotte

Coulson 020 3128 8100

finnCap (Nominated Adviser and

Broker)

Ed Frisby / Simon Hicks - Corporate

finance Joanna Scott - Corporate

broking 020 7220 0500

About Trakm8

Trakm8 uses Big Data analytics to improve driver behaviour, and

to maintain its status as a leading technology designer, developer

and manufacturer of telematics products and solutions.

The Trakm8 Group, based in Shaftesbury, Dorset, distributes its

hardware and software through a network of distributors worldwide.

In addition, the company provides vehicle monitoring and tracking

services direct to the B2B market. Trakm8's IP owned products and

services allow vehicles and drivers to be monitored, giving

organisations the ability to manage their deliveries and services,

or to track stolen vehicles down to a distance of five metres.

In June 2015, the Trakm8 Group acquired the business and assets

of DCS Systems Ltd, who specialise in the design and distribution

of camera systems for the automotive, bicycle and security markets.

This further strengthens Trakm8's offering into the telematics

marketplace, with the acquisition based on the market's demand for

forward facing vehicle cameras which enable customers to record

driving incidents and mitigate the risk from "crash to cash"

accidents.

Trakm8's most recent generation of hardware is the T10 product

range, which includes a self-installed telematics device. The

Group's services also include a driver behaviour management

solution that can reduce fuel consumption by over 10% whilst

reducing the risk of accidents. This is complemented by a logistics

routing and scheduling package, integrated tachograph data

reporting facilities, and the ability to read vehicle DTCs

(Diagnostic Trouble Codes) promoting preventative maintenance and

reducing service downtime.

The Group's customers include the AA, St Gobain, EON, Direct

Line Group, & Young Marmalade.

Trakm8 has been listed on the AIM market of the London Stock

Exchange since 2005.

www.trakm8.com / @Trakm8

Executive Chairman's Statement

Results

I am pleased to report Trakm8's results for the six months ended

30 September 2015.

Revenues grew 38% in the period to GBP11.7m (2014: GBP8.5m).

This comprises 58% growth in Trakm8's core Solutions business to

GBP7.9m (2014: GBP5.0m). Products sales increased by 10% to GBP3.8m

(2014: GBP3.5m). The value of new orders received during the period

continued the good trend of recent years and were up by 21%

(excluding DCS). This reinforces the confidence we have that strong

organic growth can be maintained.

Adjusted profit before tax increased by 89% to GBP1.48m (2014:

GBP0.78m). The adjusted profit excludes the share based payment

charge of GBP0.08m and exceptional costs of GBP0.16m related to the

acquisition of DCS. Adjusted earnings per share has increased by

88% to 5.08p (2014: 2.70p).

Total recurring revenues increased by 65% during the period to

GBP4.0m (2014: GBP2.4m), which are generated from increased numbers

of units reporting to our servers. These revenues remain the core

of the Group's business model and financial security. Gross margin

percentages have also benefited from the higher levels of service

revenues.

It is pleasing to note the positive cash generation during the

period. Total cash generated in the six months from operating

activities was GBP1.29m which exceeds the total cash from operating

activities we generated during the year to March 2015. Our total

cash balance as at September 2015 was GBP1.4m. To assist with the

funding of the DCS acquisition in June which cost GBP3.3m, Trakm8

obtained a further debt facility from HSBC Bank of an additional

GBP2 million taking its total debt facility to GBP5.7 million.

Operations

During the period we introduced a new Bluetooth variant of our

self-install telematics device - the T10 micro (BLE) - and have

delivered it to customers in the UK and USA. Further T10 versions

will be ready for manufacturing launch in January 2016.

The data analytics from our data science team has been used to

create service, driver risk scoring and FNOL (first notification of

loss) algorithms that are proving to be of great interest to

current and potential customers. We have also identified

opportunities to sell some of our data in an anonymised format.

A suite of Apps for deeper customer interaction has been

developed for both the B2B and B2C markets.

First customers are seeing Swift 7 front end as part of our move

to a completely new system architecture in readiness for much

higher levels of device and data management.

Following the acquisition of the DCS business, we have scaled up

the development of the deeper integration of video with our

telematics data services. We have launched the first of these

solutions and expect to follow these with further generations with

greater functionality and more valuable data.

We continue to invest in human resources and fixed assets. Our

capex of GBP0.5m has been high during this period but we believe we

have now completed some key short term investments in order to

prepare for stronger growth levels. The IT investment in customer

support and device management has significantly improved the

service levels to our customers. A second new automated pcb

assembly line has been installed, with a number of automated test

processes built into the line for improved quality assurance. Our

engineering teams have been further expanded to meet the growing

opportunities that we have. Total investment in research and

development in the period was in excess of GBP1 million and we have

capitalised GBP0.58m of these costs. The benefits of these

developments continue to be realised in the range of new solutions

described above.

We analyse our revenues in two ways:

Solution Sales

This area of sales comprises Fleet Management, Insurance and

Vehicle Service Solution revenues including associated engineering

services.

Recurring revenues from this base have grown by 66% to GBP4.0m

(2014: GBP2.4m) and now represents 34% of Group revenues. There has

been strong growth of both our Fleet Management and Insurance

Solutions. The first customer for our Vehicle Service Solution

launched during this period. At the period end we had approximately

135,000 units reporting to our servers being an increase of 74%

over last year.

In addition there were several small customer funded engineering

projects completed during the period.

(MORE TO FOLLOW) Dow Jones Newswires

November 23, 2015 02:00 ET (07:00 GMT)

Overall, Solution sales were 58% greater than the same period of

2014 at GBP7.9m (2014: GBP5.0m) and represent 68% of the Group

total (2014: 59%)

We have expanded our sales resource and as a result developed a

good pipeline of opportunities, with a large number of significant

trials in progress. We anticipate that revenues will continue to

grow strongly in this area.

Product Sales

This area of sales comprises all the hardware revenues from our

sales to other telematics integrators and to our manufacturing

services customers.

Total revenues amounted to GBP3.8m representing 32% of the Group

total and an increase of 10% on last year (2014: GBP3.5m). Sales of

products, excluding DCS camera sales of GBP0.6m, were GBP0.4m down

on last year due to the elimination of a number of lower value

added manufacturing service customers and the focus onto core

telematics device shipments to our Solutions customers. In

addition, during the period, BOX manufactured GBP1.8m of telematics

devices for Trakm8, an increase of 63% on the previous year, which

has had a positive impact on Group profitability.

Since the acquisition in June of the trade and assets of DCS,

sales of cameras have performed well and in line with our

expectations. Volvo Car UK have recently listed the Roadhawk camera

in their official accessories as part of a new contract and TNT

have placed an order after a trial that found 56% of drivers stated

the camera's presence had caused them to change their driving

behaviour for the better and three quarters felt the cameras

improved their personal safety and security.

Strategy

The Group has been following the strategy outlined in the 2015

Annual Report. Our focus is to sell more devices reporting to our

servers and their associated service revenues, along with the use

of the considerable data we now derive from these devices to sell

driver behaviour, risk analysis and vehicle service management

knowledge.

In addition to the excellent organic growth potential of this

market, we have consistently stated that Trakm8's strong financial

business model, the cash generation and solid balance sheet would

enable the Group to consider further acquisitions alongside the

organic growth strategy. We believe that the acquisition of the DCS

business met our strategic objectives. Now that DCS is operating to

our satisfaction, we continue to assess further acquisition

opportunities to enhance our organic growth.

Outlook

The Group believes that we will continue to successfully execute

our outlined strategy and as a consequence deliver growth in

shareholder value. The second halves of our financial years have

consistently shown increasing revenues including service revenues

over the first half. This year we expect that this will be true

again. This, along with a full period effect of DCS, means that we

expect second half of the year revenues will be considerably ahead

of the first six months.

At the time of our Final Results in July we indicated that we

expected to modestly exceed the market's then current expectations.

The Board is now confident that the results for the year ending

31(st) March 2016 will again modestly exceed the market's current

expectations.

JOHN WATKINS

Executive Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months to 30 September 2015

Six months Six months Year to

to 30 September to 30 September 31 March

2015 2014 2015

Note Unaudited Unaudited Audited

Continuing operations GBP'000 GBP'000 GBP'000

Revenue 11,726 8,478 17,853

Cost of sales (6,140) (4,545) (9,792)

Gross profit 5,586 3,933 8,061

Administrative

expenses (4,145) (3,181) (6,301)

Operating Profit

before exceptional

items 1,441 752 1,760

Exceptional items 5 (159) - -

Operating Profit 1,282 752 1,760

Finance costs (41) (35) (58)

Profit before taxation 1,241 717 1,702

Income tax - - (13)

Profit attributable to

the owners of the parent 1,241 717 1,689

Other Comprehensive

Income

Currency translation

differences - - (4)

Total Comprehensive Income

for the period attributable

to owners of the parent 1,241 717 1,685

================= ================= ==========

Adjusted EBITDA 1,922 1,130 2,597

------------------------------ ------- ----------------- ----------------- ----------

Basic earnings per

share (pence) 6 4.26 2.48 5.84

Diluted earnings

per share (pence) 6 4.00 2.35 5.48

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months to 30 September 2015

Share Share Merger Translation Treasury Retained Total

capital premium reserve reserve Reserve earnings equity

attributable

to owners

of the

parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1

April 2014 289 3,641 510 200 - 492 5,132

--------- --------- --------- ------------ --------- ---------- --------------

Comprehensive income

Profit for the period - - - - - 717 717

Total comprehensive

income - - - - - 717 717

Transactions with

owners

Shares issued 1 12 - - - - 13

Sale of own shares - - - - - 48 48

IFRS2 Share based

payments - - - - - 65 65

--------- --------- --------- ------------ --------- ---------- --------------

Transactions with

owners 1 12 - - - 113 126

--------- --------- --------- ------------ --------- ---------- --------------

Balance as at 30

Sept 2014 290 3,653 510 200 - 1,322 5,975

--------- --------- --------- ------------ --------- ---------- --------------

Comprehensive income

Profit for the period - - - - - 972 972

Other comprehensive

income

Exchange differences

on

translation of overseas

operations - - - (4) - - (4)

Total comprehensive

income - - - (4) - 972 968

Transactions with

owners

Shares issued - - - - - - -

Reclassification

of previous Treasury

Share Transactions - 67 - - (23) (44) -

Reclassification

of Sale of own shares - 37 - - 11 (48) -

IFRS2 Share based

payments - - - - - 52 52

--------- --------- --------- ------------ --------- ---------- --------------

Transactions with

owners - 104 - - (12) (40) 52

--------- --------- --------- ------------ --------- ---------- --------------

Balance as at 31

March 2015 290 3,757 510 196 (12) 2,254 6,995

--------- --------- --------- ------------ --------- ---------- --------------

Comprehensive income

Profit for the period - - - - - 1,241 1,241

--------- --------- --------- ------------ --------- ---------- --------------

Total comprehensive

income - - - - - 1,241 1,241

(MORE TO FOLLOW) Dow Jones Newswires

November 23, 2015 02:00 ET (07:00 GMT)

--------- --------- --------- ------------ --------- ---------- --------------

Transactions with

owners

Shares issued 11 129 - - - - 140

Sale of own shares - 73 - - 7 - 80

IFRS2 Share based

payments - - - - - 78 78

--------- --------- --------- ------------ --------- ---------- --------------

Transactions with

owners 11 202 - - 7 78 298

--------- --------- --------- ------------ --------- ---------- --------------

Balance as at 30

Sept 2015 301 3,959 510 196 (5) 3,573 8,534

--------- --------- --------- ------------ --------- ---------- --------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 September 2015

30 September 30 September 31 March

2015 2014 2015

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 6,379 3,415 3,599

Plant, property and equipment 1,656 1,289 1,300

Deferred income tax asset 666 753 666

-------------- -------------- ----------

8,701 5,457 5,565

-------------- -------------- ----------

Current assets

Inventories 2,579 1,288 1,493

Trade and other receivables 4,588 4,052 4,912

Cash and cash equivalents 1,423 1,914 3,408

8,590 7,254 9,813

-------------- -------------- ----------

Current liabilities

Trade and other payables (4,964) (4,533) (5,431)

Borrowings (583) (500) (576)

Obligations under finance leases (26) - -

and hire purchase Agreements

Provisions (92) - (92)

-------------- -------------- ----------

(5,665) (5,033) (6,099)

-------------- -------------- ----------

Current assets less current liabilities 2,925 2,221 3,714

-------------- -------------- ----------

Total assets less current liabilities 11,626 7,678 9,279

-------------- -------------- ----------

Non-current liabilities

Borrowings (2,943) (1,542) (2,236)

Obligations under finance leases (101) - -

and hire purchase Agreements

Provisions (48) (161) (48)

(3,092) (1,703) (2,284)

-------------- -------------- ----------

Net assets 8,534 5,975 6,995

============== ============== ==========

Equity

Note

Called up share capital 6 301 290 290

Share premium 3,959 3,653 3,757

Merger reserve 510 510 510

Translation reserve 196 200 196

Treasury reserve (5) - (12)

Retained profit / (loss) 3,573 1,322 2,254

------ ------ ------

Total equity attributable

to owners of the parent 8,534 5,975 6,995

====== ====== ======

CONSOLIDATED CASH FLOW STATEMENT

for the six months to 30 September 2015

Six months Six months Year to

to to 31 March

30 September 30 September 2015

2015 2014 Audited

Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000

Net cash inflow / (outflow)

from operating activities 7 1,295 (197) 1,128

-------------- -------------- ----------

Cash flows from investing activities

Acquisition of trade and assets (3,275) - -

of DCS Systems Ltd

Acquisition of subsidiary

(net of cash) - - (5)

Purchases of property, plant

and equipment (505) (243) (355)

Proceeds from sale of plant 48 - 10

Capitalised Development costs (581) (368) (862)

-------------- -------------- ----------

Net cash used in investing

activities (4,314) (611) (1,212)

-------------- -------------- ----------

Cash flows from financing activities

Issue of new shares 140 12 12

Sale of treasury shares 80 49 49

New bank loan 1,000 - 3,000

New hire purchase contract 102 - -

Repayment of loans (288) (250) (2,480)

Net cash used in financing

activities 1,034 (189) 581

-------------- -------------- ----------

Net increase / (decrease) in cash

and cash equivalents (1,985) (997) 497

Cash and cash equivalents at beginning

of period 3,408 2,911 2,911

-------------- -------------- ----------

Cash and cash equivalents

at end of period 1,423 1,914 3,408

============== ============== ==========

Notes to the financial information (unaudited)

1. The financial information contained in this interim statement

has not been audited or reviewed by the Group's auditor and does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Directors approved and authorised this

interim statement on 20 November 2015. The financial information

for the preceding full year is extracted from the statutory

accounts for the financial year ended 31 March 2015. Those

accounts, upon which the auditor issued an unqualified opinion and

did not include a statement under Section 498(2) or (3) of the

Companies Act 2006, have been delivered to the Registrar of

Companies.

2. Trakm8 Holdings PLC is a public limited company incorporated

in the United Kingdom under the Companies Act 2006. Trakm8 is

domiciled in the United Kingdom and its ordinary shares are traded

on AIM, the market operated by the London Stock Exchange plc.

3. As permitted this Interim Report has been prepared in

accordance with UK AIM Rules for Companies and not in accordance

with IAS 34 "Interim Financial Reporting" and therefore is not

fully in compliance with IFRS. The Interim results have been

prepared in a manner consistent with the accounting policies set

out in the statutory accounts for the financial year ending 31

March 2015.

4. Profit per ordinary share attributable to the owners of the parent

Six months Six months Year to

to to 31 March

30 September 30 September 2015

2015 2014 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Profit attributable

to the owners of

the parent 1,241 717 1,685

-------------- -------------- ----------

5. Exceptional costs

(MORE TO FOLLOW) Dow Jones Newswires

November 23, 2015 02:00 ET (07:00 GMT)

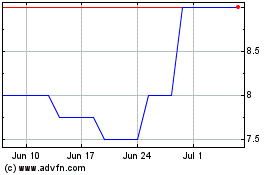

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Apr 2023 to Apr 2024