Today's Top Supply Chain and Logistics News From WSJ

October 04 2017 - 6:55AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

America's top investor is placing a long-haul bet on trucking.

Warren Buffett's Berkshire Hathaway Inc. is taking a nearly 40%

stake in the operator of Pilot and Flying J travel centers, the

WSJ's Nicole Friedman writes, and plans eventually to take control

of a business Mr. Buffett says is tied to the intractable need to

move more goods "to more people." It's the latest investment in

traditional transportation at Berkshire, which also owns BNSF

Railway, and marks an indirect move into the trucking business that

the Knoxville, Tenn.-based family-owned Pilot Travel Centers LLC

serves. Still, the deal seems to run counter to big changes

percolating in the business: Some analysts project massive growth

in electric and autonomous vehicles, which would cut into the fuel

sales that provide Pilot Flying J more than $20 billion in annual

revenue. Pilot Chief Executive Jimmy Haslam expects "diesel fuel

will power trucks for a long time to come," however, giving the

operator a steady business tapping into shipping growth.

Europe is getting more expensive for Amazon.com Inc. and the

e-commerce giant has barely expanded its business there. European

Union antitrust regulators are moving aggressively to retrieve

several hundreds of millions of euros in allegedly unpaid taxes

from Amazon, the WSJ's Natalia Drozdiak and Sam Schechner report,

as Brussels cracks down on sweetheart tax deals that governments

have granted to multinationals. The move against Amazon is over

taxation in Luxembourg that was set in a 2003 tax deal with Amazon,

one that regulators believe amounts to illegal state aid. The case

highlights the complicated efforts multinationals are undertaking

to rein in costs even as they expand internationally. That's a big

concern for Amazon as it looks to bulk up its presence in the U.K.

and spread out across Europe. The French newspaper Le Monde

reported this week the company is looking for acquisitions and

partnerships in France, including physical locations and deals with

distributors.

American eating habits aren't keeping up with pork production.

U.S. meatpacking plants are sending record numbers of hogs to

slaughterhouses this year, the WSJ's Benjamin Parkin and Jacob

Bunge report, pushing pork futures down nearly 40% since the middle

of the summer. Wholesale prices for pork bellies are off over 50%

since July and retail prices are sliding as American consumption

falls behind supply. It's the latest example of agriculture

production spinning beyond market demand, and the big supply

imbalance carries heavy stakes because farmers and meatpackers are

depending on selling abroad. Pork exports rose 11% in the first

seven months of 2017 and a fifth of the pork produced in the U.S.

this year will be exported as companies sell to countries like

Mexico and South Korea where demand is growing. Those shipments

depend on politically vulnerable trade agreements, however, and

U.S. agriculture can figure prominently when tough trade talk gets

more contentious.

SHIPPING OUTLOOK

Retailers are projecting a robust holiday shopping season but

the wealth won't be spread around equally. The National Retail

Federation forecasts sales will grow between 3.6% and 4% in

November and December from a year ago, the WSJ's Sarah Nassauer

reports, a rosy outlook in line with outlooks from Deloitte,

AlixPartners and RetailNext Inc. Retailers certainly have been

bringing in goods with confidence: The NRF says imports at major

gateways in its Global Port Tracker report reached the highest

volume ever in July, and loaded inbound volume at the Port of Los

Angeles grew by more than 15,000 containers from July to August.

The broad retail figures belie an industry in turmoil amid big

changes in shopping and distribution, however. The NRF predicts

"nonstore sales" -- online business -- will grow up to 15% this

season. Several big chains have filed for bankruptcy protection

this year, while others have closed hundreds of weaker stores, a

trend likely to push even more sales online.

QUOTABLE

IN OTHER NEWS

U.S. auto sales set the briskest monthly pace for the year in

September, growing 6.1% year-over-year. (WSJ)

Wal-Mart Stores Inc. is buying New York same-day delivery

startup Parcel. (Associated Press)

Sears Canada Inc. is on the verge of liquidation under actions

in bankruptcy court. (WSJ)

Glencore PLC will invest nearly $1 billion in a Peruvian zinc

operation as rebounding commodity prices refill the miner's

coffers. (WSJ)

More companies looking for more cost savings are centralizing

their procurement decisions. (WSJ)

Google parent Alphabet Inc. says Uber Technologies Inc. knew a

former Google engineer had confidential files before buying his

self-driving truck startup Ottomotto. (WSJ)

A backlog of relief supplies at Puerto Rico's main port is

easing as trucks get better access to distribution centers.

(CNBC)

Spot rates to ship sea containers from Asia to Europe and the

U.S. are sinking despite the crush of holiday-season orders.

(Nikkei Asian Review)

A gauge of factory employment in Europe rose at the fastest pace

since 1997. (Bloomberg)

Low water levels and other problems are slowing barge traffic on

U.S. rivers, triggering higher shipping rates. (AgWeb)

North Carolina's transport chief says electric-car sales and

improving fuel efficiency may cut state gas-tax collections

markedly by 2021. (Associated Press)

Pennsylvania is considering ending a longtime tax break for

warehouse operations. (PennLIve)

Third-party logistics provider NFI Industries bought port

trucker California Cartage Co. (DC Velocity)

Ace Hardware Corp. bought a controlling stake in e-commerce

startup The Grommet. (Chicago Sun-Times)

A group representing ship operators says shippers and forwarders

must do more to ensure invasive species don't get into shipping

containers. (Lloyd's List)

Dubai's Drydocks World is invoking local rules to restrict

payments to creditors ahead of its sale to terminal operator DP

World. (Splash 24/7)

The U.S. is reviving a complaint over limits on imported wine in

Canada's British Columbia province. (BBC)

U.S. ethanol producers are fighting new tariffs Brazil is

imposing on imports of the fuel. (Omaha World-Herald)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

October 04, 2017 06:40 ET (10:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

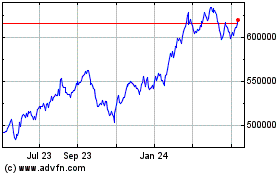

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

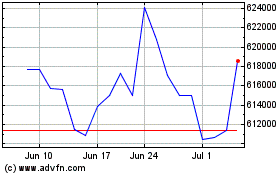

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024