Tharisa PLC Third Quarter Production Report (9639D)

July 12 2016 - 8:00AM

UK Regulatory

TIDMTHS

RNS Number : 9639D

Tharisa PLC

12 July 2016

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

ISIN: CY0103562118

('Tharisa')

Another quarter of solid production from Tharisa Minerals large

scale open pit mine

Tharisa today reported another quarter of solid mining and

production performance, with its strategy of increasing specialty

grade chrome production coming to fruition.

Highlights for the three months ended 30 June 2016

-- Significant recovery in commodity prices

- Average PGM basket price US$745/oz (Q2 FY2016: US$ 685/oz), an increase of 9%

- Average metallurgical grade chrome concentrate price US$105/t

(Q2 FY2016: US$81/t), an increase of 30%

-- Specialty chrome production increases to 27%

-- Reef mined continues to exceed the required run rate of 4.8 Mtpa

-- Processing performance in line with previous quarter

-- PGM production of 33.5 koz

-- Chrome production of 307.1 kt

Phoevos Pouroulis, CEO said:

"This quarter's production is further evidence that Tharisa has

evolved from a development asset to a stable producer and its

continued solid mining and processing performance positions it for

a year of record delivery into an improving commodities market. We

will continue to focus on optimising our operations and delivering

profitable production as we target year-end guidance of 129.4 koz

PGMs and 1.25 Mt chrome concentrates."

Market update

The average PGM basket price for the three months ended June

2016 of US$745 an ounce showed a US$60 an ounce improvement on the

US$685 price achieved in the quarter to end March 2016. This 9%

increase in price also translated into an increase in the Rand

basket price despite the marginal strengthening of the ZAR against

the US$. The average PGM basket price for the quarter was ZAR11 164

per ounce, compared to ZAR10 849 per ounce in the preceding

quarter.

Metallurgical grade chrome prices also improved over the quarter

with an average contracted selling price of US$105 per tonne CIF

main ports China achieved during the quarter. This marked

improvement on the US$81 per tonne CIF contracted selling price

concluded in the March 2016 quarter comes as Chinese ferrochrome

producers began restocking as port stockpiles were depleted to near

all-time lows in the weeks leading up to the Chinese new year in

February 2016. Current contracted selling prices for delivery in

July 2016 are approximately US$150 per tonne CIF main ports

China.

Production update

The production update for the quarter ended 30 June 2016 is as

follows:

Nine months

Nine months Quarter ended Quarter ended ended

Quarter ended ended 30 June 31 March 30 June

30 June 2015 30 June 2015 2016 2016 2016

-------------- --------------- ------------------ --------------- --------------- -------------- ---------------

1 132.9 3 080.9 Reef mined kt 1 235.4 1 234.2 3 594.0

m(3)

waste/m(3)

10.7 10.2 Stripping ratio reef 7.4 7.1 7.0

1 105.0 3 303.8 Reef milled kt 1 192.2 1 199.6 3 389.2

PGM flotation

880.6 2 592.8 feed tonnes kt 929.6 942.3 2 637.7

PGM rougher feed

1.65 1.65 grade g/t 1.64 1.74 1.67

33.5 90.9 6E PGMs produced koz 33.5 36.0 93.5

71.8 66.0 PGM recovery % 68.5 68.5 66.2

Average PGM

contained metal

887 924 basket price US$/oz 745 685 708

Average PGM

contained metal

10 732 10 828 basket price ZAR/oz 11 162 10 849 10 713

17.3 18.2 Cr O RoM grade % 17.7 18.3 18.1

57.7 57.0 Chrome recovery % 61.6 63.9 62.4

23.9 25.0 Chrome yield % 25.8 27.7 26.9

Chrome

concentrates

263.8 827.0 produced kt 307.1 332.3 911.5

-------------- --------------- --------------- -------------- ---------------

Metallurgical

240.9 756.8 grade kt 225.6 259.9 724.2

Specialty

22.9 70.2 grades kt 81.5 72.4 187.3

-------------- --------------- --------------- -------------- ---------------

Metallurgical

grade chrome

concentrate US$/t CIF

159 157 contract price China 105 81 105

Metallurgical

grade chrome

concentrate ZAR/t CIF

1 919 1 828 contract price China 1 589 1 262 1 573

Average exchange

12.1 11.7 rate ZAR:US$ 15.0 15.8 15.0

-------------- --------------- ------------------ --------------- --------------- -------------- ---------------

Mining

Tharisa's mining operations, which are characterised by the

large shallow open pit, produced a steady quarter with reef mined

of 1 235.4 kt contributing to the current RoM levels ahead of the

processing plants at the planned level of 200 kt (being half of the

monthly nameplate processing capacity of the plants). This

stockpile allows for improved reef layer blending and better feed

grade consistency into the plants.

The stripping ratio at 7.4 on a per m(3) basis, is below the

life of open pit average stripping ratio of 8.9 on a m(3) basis as

the focus was on interburden waste stripping.

Processing

Tharisa maintained its PGM production while growing its

specialty grade chrome concentrate output. The Voyager Plant chrome

processing circuit was modified in H1 FY2016 to facilitate

increased production of higher value specialty grade chrome

concentrates on the back of prevailing depressed metallurgical

grade chrome concentrate prices. This flexibility has allowed

chrome production to be distributed to more globally diversified

markets. PGM production has not been affected by this shift.

PGM production totalled 33.5 koz, with PGM recoveries at 68.5%.

Total chrome concentrate production was 307.1 kt at a recovery rate

of 61.6%. Of that production 81.5 kt was specialty grade material,

which generates a pricing premium to metallurgical grade

products.

Tharisa remains on track to achieve its targeted recoveries of

70% for PGMs and 65% for chrome recoveries.

With all of its developmental capital spent, Tharisa is

de-risked and in production.

Outlook

Tharisa maintains its year end production guidance of 129.4 koz

PGMs and 1.25 Mt chrome concentrates, of which 300 kt will be

specialty chrome concentrate.

With RoM and plant throughput at steady state Tharisa will

continue to focus on improving the RoM grade and recoveries for

both PGM and chrome concentrates.

The above information has not been reported on or reviewed by

Tharisa's auditors.

Paphos, Cyprus

12 July 2016

JSE Sponsor

Investec Bank Limited

Investor Relations contact:

Sherilee Lakmidas

+27 11 996 3538

+27 79 276 2529

slakmidas@tharisa.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCAKBDQDBKDAOD

(END) Dow Jones Newswires

July 12, 2016 08:00 ET (12:00 GMT)

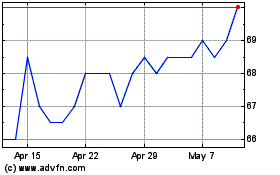

Tharisa (LSE:THS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tharisa (LSE:THS)

Historical Stock Chart

From Apr 2023 to Apr 2024