TIDMTSCO

RNS Number : 8023N

Tesco PLC

21 May 2015

21 May 2015

Tesco PLC

Annual Financial Report and Notice of Annual General Meeting

2015

Tesco PLC (the "Company") announces that its Notice of Annual

General Meeting 2015 has been sent to shareholders. The Annual

General Meeting will be held at The QEII Centre, Broad Sanctuary,

Westminster, London SW1P 3EE at 11.00 a.m. on Friday 26 June

2015.

The Notice of Annual General Meeting 2015, together with the

Company's Annual Report and Financial Statements 2015 and Strategic

Report 2015, can be viewed on the Company's website at

www.tescoplc.com.

In accordance with Listing Rule 9.6.1R, copies of the following

documents have been submitted to the National Storage Mechanism and

will shortly be available for inspection at

www.morningstar.co.uk/uk/NSM:

-- Annual Report and Financial Statements 2015;

-- Strategic Report 2015;

-- Notice of Annual General Meeting 2015; and

-- Proxy Forms for the 2015 Annual General Meeting.

The Company's preliminary consolidated financial information and

information on important events that have occurred during the year

and their impact on the financial statements were included in the

Company's preliminary results announcement on 22 April 2015. That

information, together with the information set out below, which is

extracted from the Annual Report and Financial Statements 2015,

constitute regulated information, which is to be communicated to

the media in full unedited text through a Regulatory Information

Service in accordance with Disclosure and Transparency Rule ("DTR")

6.3.5R. This announcement is not a substitute for reading the full

Annual Report and Financial Statements 2015. Page and note

references in the text below refer to page numbers and note

references in the Annual Report and Financial Statements 2015. To

view the preliminary results announcement, visit the Company's

website: www.tescoplc.com

Enquiries: Paul Moore

Company Secretary

Tesco PLC

Delamare Road

Cheshunt

Hertfordshire

EN8 9SL

Telephone: 01992 632222

Principal risks and uncertainties

We have an established risk management process to identify the

principal risks that we face as a business. The risk management

process relies on our judgement of the risk likelihood and impact

and also developing and monitoring appropriate controls. We

maintain a Group Key Risk Register of the principal risks faced by

the Group and this is an important component of our governance

framework and how we manage our business. Our risk management

process is cascaded down the Group. The content of the Group Key

Risk Register is considered and discussed through regular meetings

with senior management and review by the Executive Committee and

the Board. Our process for identifying and managing risk is set out

in more detail on page 44 of the Annual Report and Financial

Statements 2015.

The table below sets out our key risks, their movement during

the year and examples of relevant controls and mitigating factors.

The Board considers these to be the most significant risks faced by

our Group that may impact the achievement of our three strategic

priorities as set out on page 3 of the Annual Report and Financial

Statements 2015. They do not comprise all of the risks associated

with our business and are not set out in priority order.

Additional risks not presently known to management, or currently

deemed to be less material, may also have an adverse effect on the

business.

In September 2014, we identified an overstatement of the

expected financial results. This is now the subject of an

investigation by the Serious Fraud Office and civil proceedings in

the United States. Details can be found on page 33 and in Note 32

on page 136 of the Annual Report and Financial Statements 2015.

There are significant uncertainties as to the outcome of the

existing investigation and proceedings, as to whether further

proceedings may be brought against the Group in connection with the

overstatement of the expected financial results and as to whether

any proceedings brought against the Group would be likely to have a

significant effect on the results of its operations or its

financial condition.

Principal risks Key controls and mitigating factors

Customer (Risk Movement: no risk movement)

If we do not meet customer needs and compete on

price, product range, quality and service * We have strategically re-positioned our business to

in the competitive UK and overseas retail markets, focus on the customer

then we lose our share of customer purchases

By not considering the customer at the heart of our

decision-making processes, we adversely * We are investing further in our customer proposition,

impact our relationship with customers reducing prices across our ranges and improving

service with additional colleague hours

* Our performance is tracked within our business

against measures that customers tell us are important

to their shopping experience

* Customer perceptions of Tesco and our competitors are

regularly monitored to allow us to react quickly and

appropriately

-----------------------------------------------------------------

Financial strategy (Risk Movement: risk increasing)

There is a risk that the financial strategy is

unclear or unsustainable * Strategic matters are regularly reviewed by the

Weak performance could put further pressure on free Executive Committee and Board and we seek external

cash flow and impact our ability to improve advice as required

our credit rating

Our ability to operate successfully in

international markets may be restricted if we * We have clear processes for the evaluation and

cannot identification of underperforming assets to ensure

get the returns required in each market and this that appropriate action is taken

could adversely impact our profitability

There is a risk that future legal and regulatory

changes to the pension scheme could introduce * Our plans and budgets are developed and presented to

more onerous requirements and increase our our Executive Committee and Board for approval to

financial liability and that the deficit on the ensure targets and objectives are clear and

existing scheme could increase due to changes in consistent

assumptions on inflation, mortality and discount

rates applied in determining liabilities of the

scheme and the performance of its assets * Our Group Property strategy ensures that there is a

Investor support may be impacted if it takes longer clear plan to address and control retail space,

than expected to demonstrate that our re-purpose space effectively where needed and ensure

strategy is achieving the turnaround the right balance between freehold and leasehold

space

* We are consulting on the closure of our UK pension

scheme to all future accrual which, if approved,

would stop the future growth of liabilities and

significantly reduce liability risk in the scheme

* External expert advisors and the pension scheme

Trustee are fully engaged to consider the funding

position and fund performance of the pension scheme

as well as the impact of legislative and regulatory

changes

* There has been a triennial revaluation of the pension

scheme assets and liabilities in the year and a

deficit funding plan has been agreed with the Trustee

* We engage regularly with our investors to communicate

details of our strategy and plans

* Further detail on the management of financial risks

is set out on page 25 and in Note 22 on page 120 of

the Annual Report and Financial Statements 2015

-----------------------------------------------------------------

Brand, reputation and trust (Risk Movement: risk increasing)

Our brand will suffer if we do not rebuild trust

and transparency in our business * Rebuilding trust and transparency in our brand is one

If we cannot be firm in the face of ethical, legal, of our three strategic priorities

moral or operational challenges, our reputation

may be damaged

* Our Group processes and policies set out how we can

make the right decisions for our customers,

colleagues, suppliers, communities and investors

* We have developed communication and engagement

programmes to listen to our stakeholders and reflect

their needs in our plans

* We maximise the value and impact of our brand with

the advice of specialist external agencies and

in-house marketing expertise

* We are developing new Corporate Responsibility goals

that are aligned with customer priorities and our

brand

-----------------------------------------------------------------

Data security and privacy (Risk Movement: risk increasing)

Increasing risks of cyber-attack threaten the

security of customer, colleague and supplier * We have active monitoring processes to identify and

data deal with IT security incidents

We must ensure that we understand the types of data

that we hold and secure it adequately

to manage the risk of data breaches * A new Cyber Security team has been established to

investigate and mitigate the risks of cyber-attack

* A Group-wide Information Security Blueprint has been

rolled out across our businesses

* There is a programme of compliance monitoring and

review being rolled out with training across our

businesses

* A programme to review the use, storage and security

of customer data is in progress

-----------------------------------------------------------------

Transformation (Risk Movement: new)

If the scale of the change across our business

disrupts our focus, there is a risk that we * There is Executive sponsorship of the Transformation

will not transform the business to where it needs programme with the creation of a Transformation

to be Director role

There is a risk that we underestimate the wider

impacts of the changes that we are making

* New Group structures have been designed to simplify

our business and clarify accountability

* A new Programme Management Office has been

established to manage the Transformation programme

and will be supported by experienced resource from

within the business and externally as required

-----------------------------------------------------------------

Competition and markets (Risk Movement: risk increasing)

If we fail to address the differing challenges of

the budget retailers, the premium retailers * We actively seek to be competitive on price, range

and online entrants, it may adversely impact our and service as well as developing our online and

market share and profitability multiple formats to allow us to compete in different

markets

* Our Executive Committee and operational units

regularly review markets, trading opportunities and

competitor strategy and activity

-----------------------------------------------------------------

Performance (Risk Movement: no risk movement)

If our strategy is not effectively communicated or

implemented, our business may underperform * Our Board, Executive Committee and operational units

against plan and competitors meet regularly to review performance risks

The delivery of long term plans may be impacted if

the business focuses on short term targets

only * All businesses have targets based on a new balanced

scorecard of performance against KPIs and financial

targets. Plans are monitored and reviewed regularly

by the Executive Committee and the Board

* An ongoing communication process informs our

colleagues about the long term strategy and ensures

that they understand their part in it

* There are clear guidelines and policies set out to

ensure that there is an appropriate focus on balance

between short term and longer term delivery

-----------------------------------------------------------------

Political and regulatory (Risk Movement: risk increasing)

In each country in which we operate, we may be

impacted by legal and regulatory changes, increased * We engage with government and regulatory bodies to

scrutiny from competition authorities and political represent the views of our customers, colleagues and

changes that affect the retail market communities and to manage the impact of political and

The regulatory landscape is becoming more regulatory changes

restrictive in many markets and may impact our

trading

* We aim to contribute to important discussions in

public policy wherever we operate

* Country developments are monitored by our local

management teams

* Group and country Compliance Committees monitor and

guide legal and regulatory compliance with support

from our Group Regulatory Ethics and Compliance team

* The Tesco Bank Executive and Treating Customers

Fairly Board oversee Tesco Bank's compliance with

regulatory requirements

-----------------------------------------------------------------

Product (Risk Movement: no risk movement)

Our business may suffer if we fail to work with our

suppliers to ensure that our products * Group and country Compliance Committees have been

are designed and delivered to meet a high standard re-structured to simplify the identification and

and to ensure we can trace their provenance monitoring of the risks associated with products,

If we do not build mutual and trusting suppliers and operations

relationships with our suppliers, this could impact

our range and price proposition

If we do not manage our supply chain, we may risk * We publish results of internal testing (e.g.

not being able to ensure the quality and provenance tests of content in our food) and we have

security of product supply for customers in place ethical trading teams working with suppliers

* Appropriate controls are in place around: product

development; supplier management, including the

introduction of a new Supplier Feedback forum and an

independent Protector Line and Helpline; distribution

standards; third party contract management; and

compliance with regulatory standards

* Clear procedures are operated globally to ensure

product integrity and comprehensive supplier audit

programmes are in place to monitor product integrity

and labour standards

* A comprehensive compliance programme is in place to

promote, monitor and review compliance with the

Groceries Supply Code of Practice in the UK.

Appropriate programmes are in place in other markets

* Sustainability considerations are integrated into our

long-term decision making to ensure that the

development of our products is aligned with our goal

of reducing our impact on the environment. We look,

in particular, at sustainable sourcing, improved

security of supply and mitigating the impact of

climate change

-----------------------------------------------------------------

Technology (Risk Movement: no risk movement)

Any significant failure in the IT processes of our

retail operations in stores, online or * Our IT strategy is reviewed and approved by the

in our supply chain could impact our ability to Executive Committee

trade

If we do not invest enough or efficiently or invest

in the wrong areas, we may not be able * We have governance processes in place around new

to deliver our customer proposition which could system implementations and change management of

impact our competitiveness existing IT, adherence to which is closely monitored

As we develop new technologies, we must maintain

the controls over existing platforms or it

may impact systems availability and security * There is a clear programme of investment to maintain

the integrity and efficiency of our IT infrastructure

and its security

* Business continuity plans are in place for key

business processes

-----------------------------------------------------------------

People (Risk Movement: risk increasing)

Failure to attract, retain, develop and motivate

the best people with the right capabilities * The Executive Committee meets regularly to review and

across all levels, geographies and through the monitor people policies and procedures and talent

business transformation process could limit development

our ability to succeed

There is a risk that our leaders may not play their

critical role in shaping the organisation * We seek to understand and respond to employees' needs

that we want to be and that they do not inspire by listening to their feedback from open

great performance from our teams conversations, social media, colleague surveys and

performance reviews

* Talent planning, training and people development

processes are embedded across our Group

* Objectives and remuneration arrangements for senior

management are approved by the Executive Committee

and have been re-designed to reward behaviours as

well as delivery of results

-----------------------------------------------------------------

Safety, fraud, control and compliance (Risk Movement: risk increasing)

If we do not implement safety standards

effectively, we may endanger our customers or * Standards for Health and Safety are defined for all

colleagues of our sites, monitoring processes are in place and

Given the existing size, geographical scope and we have created a Group team whose primary objective

complexity of our Group, the potential for is to ensure that safety standards are met

fraud and dishonest activity by our suppliers,

customers and employees increases

There is a risk that if the compliance monitoring * Product safety standards are communicated to our

to our Group standards and policies is not suppliers and tested through audit programmes

sufficient, we could fail to identify weaknesses or

breaches

* Procedures and controls are set out across the

business to reduce fraud and compliance risks,

including our Group Accounting Policy, key financial

controls self-assessment programme, IT access

controls and appropriate segregation of duties. Group

Loss Prevention and Security monitors fraud, bribery

and other compliance risks

* Compliance Committees monitor compliance with

relevant laws and regulations

* Our Group Code of Conduct has been recently refreshed

and re-launched with appropriate training across the

Group. This sets out clear behavioural guidance,

consistent with our Values

* We have comprehensive guidance across the Group to

ensure compliance with the UK Bribery Act (and

applicable local legislation) and use an externally

managed Whistleblowing service (Protector Line) to

allow colleagues to report any instances of

inappropriate behaviour

* A Fraud Blueprint setting out risks, controls and

operational strategies informs a preventative

approach

-----------------------------------------------------------------

Tesco Bank (Risk Movement: no risk movement)

The continually changing regulatory environment

could impact the levels of capital and liquidity * The Bank has a defined 'Risk Appetite', approved and

the Bank expects to hold, could impact the earnings regularly reviewed by both the Bank's Board and the

profile as a result of interchange fee Tesco PLC Board, which sets out the key risks, their

caps, and may affect the governance of the Bank as optimum ranges, alert limits and the controls

the new regulatory Senior Managers Regime required to manage them within their approved

is finalised tolerance limits

* The Bank has formed good working relationships with

the Prudential Regulation Authority and Financial

Conduct Authority

* There is a comprehensive structure of governance and

oversight in place, including through the Bank's

Governance and Conduct Committees, to help ensure the

Bank's compliance with applicable laws and

regulations

* The Group is actively engaged in developing and

implementing plans to respond to interchange fee

developments to manage the impact on our

profitability

-----------------------------------------------------------------

Financial risks review

The main financial risks faced by the Group relate to the

availability of funds to meet business needs, fluctuations in

interest and foreign exchange rates and credit risks relating to

the risk of default by parties to financial transactions. Further

explanation of these risks is set out in Note 22 on page 120 of the

Annual Report and Financial Statements 2015. An overview of the

management of these risks is set out below. Details of the main

financial risks relating to Tesco Bank and the management of those

risks can be found in Note 22 on page 123 of the Annual Report and

Financial Statements 2015.

Financial risks Key controls and mitigating factors

Funding and liquidity risk

The risk of being unable

to continue to fund our * The Group finances its operations by a combination of

operations on an ongoing retained profits, disposals of assets, debt capital

basis market issues, commercial paper, bank borrowings and

leases

* New funding of GBP2.3 billion was raised during the

year, including GBP2.1 billion from long term debt

and GBP0.2 billion from property disposals. At the

year end, net debt was GBP8.5 billion (2014: GBP6.6

billion)

* The policy is to smooth the debt maturity profile, to

arrange funding ahead of requirements and to maintain

sufficient undrawn committed bank facilities and to

maintain access to capital markets so that maturing

debt may be refinanced as it falls due

* Tesco has put in place GBP5 billion of committed

facilities consisting of a revolving credit facility

and bilateral lines as alternate sources of liquidity

* At the year end, the Group had a long-term credit

rating of BBB- (negative) from Fitch, Ba1 (stable)

from Moody's and BB+ (stable) from Standard & Poor's

------------------------------------------------------------------

Interest rate risk

The risk to our profit

and loss account resulting * Forward rate agreements, interest rate swaps, caps

from rising interest rates and floors may be used to achieve the desired mix of

fixed and floating rate debt

* Our policy is to fix interest rates for the year on a

minimum of 40% of actual and projected debt interest

costs of the Group excluding Tesco Bank. At the year

end, the percentage of interest-bearing debt at fixed

rates was 79% (2014: 84%). The remaining balance of

our debt is in floating rate form. The average rate

of interest paid on an historic cost basis this year,

excluding joint ventures and associates, was 4.09%

(2014: 4.5%)

------------------------------------------------------------------

Foreign exchange risk

The risk that exchange

rate volatility may have * Transactional currency exposures that could

an adverse impact on our significantly impact the Group Income Statement are

balance sheet or profit managed, typically using forward purchases or sales

and loss account of foreign currencies and purchased currency options.

At the year end, forward foreign currency

transactions, designated as cash flow hedges,

equivalent to GBP2.2 billion were outstanding (2014:

GBP2.9 billion) as detailed in Note 21 on page 116 of

the Annual Report and Financial Statements 2015. We

translate overseas profits at average foreign

exchange rates

* We only hedge a proportion of the investment in our

international subsidiaries as well as ensuring that

each subsidiary is appropriately hedged in respect of

its non-functional currency assets. During the year,

currency movements increased the net value, after the

effects of hedging, of the Group's overseas assets by

GBP5 million (last year decrease of GBP1,102 million)

------------------------------------------------------------------

Counterparty risk

The risk of loss arising

from default by parties * The Group holds positions with an approved list of

to financial transactions highly rated counterparties

* Tesco monitors the exposure, credit rating, outlook

and credit default swap levels of these

counterparties on a regular basis

------------------------------------------------------------------

Insurance risk

The risk of being inadequately

protected from liabilities * We purchased assets, earnings and combined liability

arising from unforeseen protection from the open insurance market for higher

events value losses only

* The risk not transferred to the insurance market is

retained within the business with some cover being

provided by our captive insurance companies, ELH

Insurance Limited in Guernsey and Valiant Insurance

Company Limited in the Republic of Ireland. ELH

Insurance Limited covers Assets, Earnings and

Combined Liability, while Valiant Insurance Company

Limited covers Combined Liability only

------------------------------------------------------------------

Related Party Transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and its

joint ventures and associates are disclosed below:

Trading transactions

Amounts owed

Sales to Purchases from by related Amounts owed

related parties related parties parties to related parties

2015 2014 2015 2014 2015 2014 2015 2014

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------- -------- -------- -------- ------ ------ ---------- ---------

Joint ventures 430 366 549 533 17 19 22 6

-------- -------- -------- -------- ------ ------ ---------- ---------

Associates - 7 14 18 26 - 1 17

-------- -------- -------- -------- ------ ------ ---------- ---------

Sales to related parties consists of services/management fees

and loan interest.

Purchases from related parties include GBP430m (2014: GBP412m)

of rentals payable to the Group's joint ventures (including those

joint ventures formed as part of the sale and leaseback

programme).

Non-trading transactions

Sale and

leaseback of Loans to Loans from Injection of

assets related parties related parties equity funding

2015 2014 2015 2014 2015 2014 2015 2014

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------- ------ -------- -------- -------- -------- -------- -------

Joint ventures - - 207 218 16 16 14 3

------- ------ -------- -------- -------- -------- -------- -------

Associates - 46 - 37 - - 10 7

------- ------ -------- -------- -------- -------- -------- -------

Transactions between the Group and the Group's pension plans are

disclosed in Note 26 to the Annual Report and Financial Statements

2015.

A number of the Group's subsidiaries are members of one or more

partnerships to whom the provisions of the Partnerships (Accounts)

Regulations 2008 ('Regulations') apply. The accounts for those

partnerships have been consolidated into these accounts pursuant to

Regulation 7 of the Regulations.

In the prior year, the Group completed one sale and leaseback

transaction involving property assets in Thailand. On 24 January

2014, one trading mall was sold to the Tesco Lotus Growth Fund, an

associated entity of the Group, for a consideration of GBP46m.

There were no sale and leaseback transactions in the current

year.

Transactions with key management personnel

Members of the Board of Directors and Executive Committee of

Tesco PLC are deemed to be key management personnel.

Key management personnel compensation for the financial year was

as follows:

2015 2014

GBPm GBPm

Salaries and short-term benefits 14 16

----- -----

Pensions 3 3

----- -----

Share-based payments 4 2

----- -----

Joining costs and loss of office costs 8 1

----- -----

29 22

----- -----

Of the total remuneration to key management personnel, GBP16m

(2014: GBP16m) relates to Executive Committee members who are not

on the PLC Board.

Of the key management personnel who had transactions with Tesco

Bank during the financial year, the following are the balances at

the year end:

Credit card and personal Current and saving

loan balances deposit accounts

Number of Number of

key management key management

personnel GBPm personnel GBPm

------------------- ----- ---------------- ----

At 28 February 2015 19 1 16 1

------------------- ----- ---------------- ----

At 22 February 2014 12 - 4 -

------------------- ----- ---------------- ----

Statement of Directors' responsibilities

In compliance with DTR 4.1.12R, the Annual Report and Financial

Statements 2015 contains a Directors' responsibility statement.

This is reproduced below, in line with DTR 6.3.5R. The statement

relates to and is extracted from the Annual Report and Financial

Statements 2015 and does not attach to the extracted information

presented in this announcement or the preliminary results

announcement released on 22 April 2015.

The Directors are required by the Companies Act 2006 to prepare

financial statements for each financial year which give a true and

fair view of the state of affairs of the Group and the Company as

at the end of the financial year and of the profit or loss of the

Group for the financial year. Under that law the Directors are

required to prepare the Group financial statements in accordance

with International Financial Reporting Standards ('IFRS') as

adopted by the European Union ('EU') and have elected to prepare

the Parent Company financial statements in accordance with UK

Generally Accepted Accounting Practice (UK Accounting Standards and

applicable law).

In preparing these financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether IFRSs as adopted by the European Union and

applicable UK Accounting Standards have been followed, subject to

any material departures disclosed and explained in the Group and

Parent Company financial statements respectively; and

-- prepare the financial statements on the going concern basis,

unless it is inappropriate to presume that the Group and the

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that disclose with reasonable accuracy at any time the

financial position of the Group and the Company and which enable

them to ensure that the financial statements and the Directors'

Remuneration Report comply with the Companies Act 2006 and, as

regards the Group financial statements, Article 4 of the IAS

Regulation. They also have general responsibility for taking such

steps as are reasonably open to them to safeguard the assets of the

Group and the Company and to prevent and detect fraud and other

irregularities.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the UK governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

The Directors consider that the Annual Report and Financial

Statements, taken as a whole, is fair, balanced and understandable

and provides the information necessary for shareholders to assess

the Group's and the Company's performance, business model and

strategy.

Each of the Directors, whose names and functions are set out on

pages 28 and 29 of the Annual Report and Financial Statements 2015

confirm that, to the best of their knowledge:

-- the Group financial statements, which have been prepared in

accordance with IFRS as adopted by the EU, give a true and fair

view of the assets, liabilities, financial position and loss of the

Group; and

-- the Strategic report contained within this document includes

a fair review of the development and performance of the business

and the position of the Group, together with a description of the

principal risks and uncertainties that it faces.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NOAAMMTTMBJTBAA

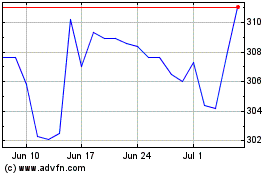

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

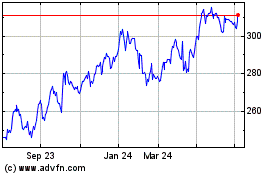

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024