Symplmed Wins Rights from XOMA - Analyst Blog

July 05 2013 - 4:39PM

Zacks

XOMA Corporation (XOMA) recently announced that

it has entered into an agreement with Symplmed Pharmaceuticals, LLC

(founded by some ex- XOMA employees) to transfer the US development

and marketing rights to the perindopril franchise to the latter. In

exchange, XOMA will get a stake in Symplmed.

We note that the perindopril franchise includes Aceon (perindopril

erbumine), an angiotensin converting enzyme (ACE) inhibitor and

three other fixed dose combination (FDC) candidates.

Aceon is approved for treating patients suffering from essential

hypertension. The drug is also marketed for reducing the risk of

cardiovascular death or nonfatal myocardial infarction in patients

with stable coronary artery disease. Generic versions of the drug

are available in the US since 2009.

As per the terms of the agreement, XOMA will be entitled to

double-digit royalties on sales of FDC Aceon and

Pfizer’s (PFE) Norvasc (amlodipine besylate).

We note that Symplmed was founded by ex-Xoma employees including

Erik Emerson and Jeffrey Feldstein. They were responsible for the

management of the phase III study PATH (Perindopril Amlodipine for

the Treatment of Hypertension: n=837), which evaluated the

candidate in patients suffering from hypertension. Encouraging

results from the trial were presented in Nov 2012.

The phase III study compared the efficacy and safely of FDC

Aceon/Norvasc with Aceon or Norvasc alone. Data from the study

revealed a statistically significant reduction in both sitting

diastolic and sitting systolic blood pressure in patients in the

FDC arm compared to those treated with Aceon and Norvasc alone.

Symplmed plans to submit a new drug application (NDA) to the US

Food and Drug Administration (FDA) for the candidate by year end.

FDC Aceon/Norvasc is already marketed in 91 ex-US countries by

Laboratoires Servier, a privately-owned French pharmaceutical

company, under the trade name Coveram. Notably, in Jan 2011, XOMA

inked a deal with Les Laboratoires Servier to acquire the US rights

to the perindopril franchise from the latter.

XOMA carries a Zacks Rank #3 (Hold). Companies that currently look

attractive include Santarus, Inc. (SNTS) and

Jazz Pharmaceuticals (JAZZ). Both carry a Zacks

Rank #1 (Strong Buy).

JAZZ PHARMACEUT (JAZZ): Free Stock Analysis Report

PFIZER INC (PFE): Free Stock Analysis Report

SANTARUS INC (SNTS): Free Stock Analysis Report

XOMA CORP (XOMA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

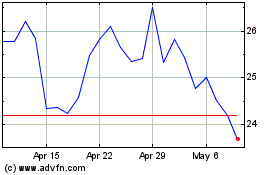

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024