Statoil Submits NOK1 Billion Plan for Norway Oil and Gas Project--Update

August 19 2016 - 6:59AM

Dow Jones News

(Adds oil price, background)

By Kjetil Malkenes Hovland

OSLO--Norway's Statoil said Friday that it was moving forward

with another North Sea oil and gas field after a 70% reduction in

project costs, a sign that the oil and gas producer is adapting to

weak prices.

The company said it had submitted a plan to the Norwegian

government for the NOK1 billion ($121.84 million) Byrding oil and

gas project in the North Sea, its second such plan this month.

"Byrding shows that successful improvement efforts in Statoil,

and in this case particularly within drilling and well, allow new

development projects to be realized," said Torger Rod, Statoil's

head of project development.

Statoil said the cost of the project, set to hold 11 million

barrels of oil equivalent, had been reduced from NOK3.5 billion to

NOK1 billion. Byrding is set to produce 8,000 barrels a day at its

peak, and will connect to the existing Troll C platform, helping to

boost its activity and production.

The company said Byrding, which was formerly known as Astero,

would be profitable even at today's oil prices.

Brent crude trades at $50 a barrel, roughly 70% higher from

January when it dropped below $30 a barrel. Since the summer of

2014, global oil companies have struggled to cope with an oil-price

rout that followed three years of stable prices mostly above $100 a

barrel.

Statoil started cutting costs in early 2014, even before prices

started dropping, and has reduced capital spending and delayed

projects in a bid to maintain shareholder dividends.

The 67% state-owned oil and gas producer said earlier this year

that it had cut the oil price required for upcoming projects to be

profitable--the break-even price--to $41 a barrel on average from

$70 a barrel three years ago.

Statoil is picking up more debt to finance its operations, but

has said it expects to generate enough cash to cover its dividend

and capital spending at an oil price of $60 a barrel next year and

$50 a barrel in 2018.

Statoil expects Byrding to start producing in the third quarter

of 2017 and to keep producing for up to 10 years.

Statoil last week handed in the plan to Norwegian and U.K.

authorities to develop the Utgard field, a NOK3.5 billion project

straddling the U.K.-Norway median line in the North Sea.

Write to Kjetil Malkenes Hovland at

kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

August 19, 2016 06:44 ET (10:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

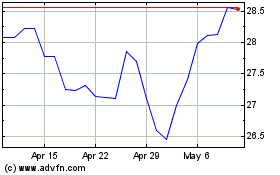

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Apr 2023 to Apr 2024