TIDMSL.

RNS Number : 5676G

Standard Life plc

08 August 2016

8 August 2016

HDFC Life and Max Group entities agree terms to combine life

insurance businesses

Standard Life plc ("Standard Life") notes the announcement by

its Indian associate, HDFC Standard Life Insurance Company Limited

("HDFC Life") today that it has agreed terms with Max Life

Insurance Company Limited ("Max Life"), Max Financial Services

Limited ("Max FS") and Max India Limited ("Max India") for the

combination of the life insurance businesses of HDFC Life and Max

Life. The transaction will be effected through a composite scheme

of arrangement, the final form of which remains subject to approval

by parties to the transaction and, once finalised, is subject to

approval by the shareholders of HDFC Life, Max Life, Max FS and Max

India as well as regulatory and high court approvals.

Following completion of the transaction, the shares of HDFC Life

will list on The Bombay Stock Exchange and the National Stock

Exchange of India, subject to the approval of these stock exchanges

and the Securities and Exchange Board of India.

Based on current shareholdings, following completion of the

transaction, the shareholders of HDFC Life would hold 69% of the

enlarged HDFC Life. Standard Life, through its wholly owned

subsidiary, would remain the second largest shareholder in HDFC

Life with a shareholding of 24.1%.

Keith Skeoch, CEO of Standard Life plc, said: "I am delighted

with today's announcement of the proposed transaction. Max Life's

bancassurance relationships will complement HDFC Life's already

strong distribution. If approved, we expect it to cement HDFC

Life's position as the leading private sector Indian life insurance

business. As a result of this transaction, we will have strategic

stakes in leading Indian life insurance and asset management

companies."

For further information please contact:

Institutional Equity +44 (0) 131 245 8028*

Investors +44 (0) 7515 298 608

Jakub Rosochowski +44 (0) 131 245 6466*

Neil Longair +44 (0) 7711 357 595

+44 (0) 131 245 6165*

Media +44 (0) 771 248 6463

Barry Cameron +44 (0) 131 245 1365*

Steve Hartley +44 (0) 770 293 4651

Group Secretariat

Paul McKenna +44 (0) 131 245 1168*

* Calls may be monitored and/or recorded to protect both you and

us and help with our training. Call charges will vary.

Notes:

The transaction will be effected by means of a composite scheme

of arrangement. Approximate post-completion shareholdings in HDFC

Life, based on current share holdings in the relevant companies,

would be:

Shareholder Approximate post-transaction

shareholding

----------------------------------------- -----------------------------

Standard Life 24.1%

Housing Development Finance Corporation

Limited 42.5%

Other shareholders in HDFC Life 2.4%

----------------------------------------- -----------------------------

Total shareholders in HDFC Life 69.0%

Shareholders in Max FS 21.7%

Shareholders in Max Life excluding

Max FS 9.3%

----------------------------------------- -----------------------------

Total existing shareholders in

Max Life and Max FS 31.0%

----------------------------------------- -----------------------------

Total 100.0%

========================================= =============================

Treatment of Standard Life's shareholding in HDFC Life

Completion of the proposed transaction would result in Standard

Life's current shareholding of 35% in HDFC Life becoming 24.1% of

the enlarged HDFC Life entity at completion. As a result, if the

transaction is completed, Standard Life expects to recognise a

dilution gain in its consolidated income statement, with a

corresponding increase in the carrying value of its investment in

HDFC Life. The amount of the dilution gain will be dependent on a

number of factors including the share price of Max FS at

completion, foreign exchange rates and the profit or loss reported

by HDFC Life until completion of the transaction. Standard Life

would remain the second largest shareholder in the enlarged HDFC

Life. The dilution gain is not expected to give rise to a tax

charge. Profits or losses arising on the disposal of associates are

not included in operating profit.

About Standard Life

-- Standard Life is an investment company with over 190 years'

experience of helping people invest and manage their money.

-- Standard Life employs around 6,500 people internationally -

through businesses in the UK, Europe, North America, Asia and

Australia.

-- Around 4.5 million customers and clients across 46 countries

trust Standard Life with their financial future. Standard Life is

responsible for the administration of GBP314 billion of their

assets, with Standard Life Investments, actively managing GBP259

billion of these assets globally, as at 31 March 2016. Standard

Life also supports over 25 million customers through Indian and

Chinese associate and joint venture businesses(#) .

-- Standard Life plc is listed on the London Stock Exchange with around 1.2 million individual shareholders.

-- Standard Life is proud to be listed as a leader for corporate

sustainability in its industry in the Dow Jones Sustainability

Indices (DJSI World and DJSI Europe).

-- You can follow Standard Life on www.twitter.com/StandardLifeplc

(#) All figures as at 31 March 2016

About HDFC Life

-- HDFC Life was established in 2000 and was the first private

life insurance company to be granted a licence following the

liberalisation of the Indian insurance market.

-- HDFC Life is one of the leading life insurance companies in

India offering a range of individual and group insurance solutions

that meet various customer needs such as Protection, Pension,

Savings & Investment and Health, along with Children's &

Women's Plan.

Forward-looking statements

This announcement may contain 'forward-looking statements' about

certain of the Standard Life Group's current plans, goals and

expectations relating to future financial conditions, performance,

results, strategy and objectives. Statements containing the words:

'believes', 'intends', 'targets', 'estimates', 'expects', 'plans',

'seeks' and 'anticipates' and any other words of similar meaning

are forward-looking. By their nature, all forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances which may be beyond the Group's

control. As a result, the Group's actual financial condition,

performance and results may differ materially from the plans, goals

and expectations set out in the forward-looking statements, and

persons reading this announcement should not place undue reliance

on forward-looking statements. The Standard Life Group undertakes

no obligation to update any of the forward-looking statements in

this announcement or any other forward-looking statements it may

make.

Inside Information

Prior to publication, this announcement contained information

treated as inside information for the purposes of the Market Abuse

Regulation which came into effect on 3 July 2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEADPPEEPKEFF

(END) Dow Jones Newswires

August 08, 2016 09:11 ET (13:11 GMT)

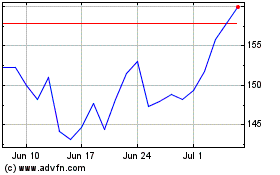

Abrdn (LSE:ABDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn (LSE:ABDN)

Historical Stock Chart

From Apr 2023 to Apr 2024