Standard Chartered PLC SCPLC statement on BoE 2016 stress test results (5139Q)

November 30 2016 - 2:05AM

UK Regulatory

TIDMSTAN

RNS Number : 5139Q

Standard Chartered PLC

30 November 2016

30 November 2016

Standard Chartered PLC statement on the Bank of England 2016

stress test results

Standard Chartered PLC (the "Group") along with certain other UK

based financial institutions has been subject to the 2016 stress

test (the "Stress Test") conducted by the Bank of England ("BoE").

The Stress Test is designed to assess the capital adequacy of the

UK banking system based on the banks' balance sheets as at 31

December 2015.

The scenario for the Stress Test was severe for the Group's

business operations as it includes a synchronised global downturn

with particularly severe impact on Asia, as well as a generalised

downturn in emerging market economies. This scenario was applied to

the Group's balance sheet as at 31 December 2015 and compared the

theoretical Common Equity Tier 1 capital ("CET1 Capital") ratio and

Tier 1 leverage ("Leverage") ratio low point positions of the Group

before and after the impact of strategic management actions.

Stress Test results

The results of the Stress Test announced by the BoE this morning

showed that the Group met both the CET1 Capital ratio and the

Leverage ratio requirements after the impact of strategic

management actions.

The Stress Test resulted in a hypothetical low point CET1

Capital ratio for the Group of 7.2 per cent after the impact of all

strategic management actions and conversion of Additional Tier 1

("AT1") capital compared to the CET1 Capital ratio hurdle rate of

6.1 per cent.

The Group had a hypothetical low point Leverage ratio of 4.3 per

cent in the Stress Test scenario after the impact of all strategic

management actions compared to the Leverage ratio hurdle rate of

3.0 per cent.

The Prudential Regulation Authority Board concluded that the

Group did not meet its Tier 1 risk-weighted capital requirement

including Pillar 2A but determined that in light of the steps the

Group has subsequently taken to strengthen its capital position it

does not require it to submit a revised capital plan.

Since 31 December 2015 these actions include:

-- The Group's CET1 Capital ratio has improved 40bps to 13.0 per

cent as at 30 September 2016, at the top of its 12-13 per cent

target range

-- The Group issued $2 billion AT1 capital in August 2016 that,

together with the increase in CET1 Capital in the period, resulted

in its Tier 1 capital ratio improving around 90bps to 15.0 per cent

at the end of the third quarter

-- Progress reducing the Group's liquidation portfolio and other

restructuring actions are expected to add around 50bps to its CET1

Capital and Tier 1 capital ratios in the fourth quarter of 2016

The Group has a strong and liquid balance sheet and the results

of the Stress Test demonstrate its resilience to a severe global

stress scenario.

Additional information

Minimum Minimum

stressed stressed

ratio ratio

before after

the impact the impact

of strategic of strategic

management management

Actual actions actions Systemic Actual

(end or AT1 and conversion Hurdle reference (2016

2015) conversion of AT1 rate point Q3)

--------------------- ------- -------------- ---------------- ------- ----------- -------

CET1 Capital

ratio (%) 12.6 5.5 7.2 6.1 6.6 13.0

Tier 1 capital

ratio (%) 14.1 6.3 7.7 15.0

Total capital

ratio (%) 19.5 9.4 11.0 20.5

Memo: risk-weighted

assets ($bn) 303 390 371 292

Memo: CET1

($bn) 38 21 27 38

--------------------- ------- -------------- ---------------- ------- ----------- -------

Tier 1 leverage

ratio (%) 5.5 4.0 4.3 3.0 3.1 5.6

Memo: leverage

exposure

($bn) 729 607 591 745

--------------------- ------- -------------- ---------------- ------- ----------- -------

1. Further information on the Group's financial performance will

be available on 24 February 2017 when its 2016 annual results are

published. The Group's 2015 annual results are at

https://www.sc.com/annual-report/2015/

2. The Stress Test scenario incorporated a synchronised global

downturn in output growth, which included particularly adverse

effects on growth in China and Hong Kong. Details of the BoE's

approach to the Stress Test and the detailed results in relation to

all participating banks are available from the BoE website:

http://www.bankofengland.co.uk/financialstability/Pages/fpc/stresstest.aspx

3. The stress scenarios incorporated in the Stress Test are not

forecasts. Rather, they are 'tail-risk' scenarios designed to be

severe and broad enough to assess the resilience of UK banks to

adverse shocks

4. The projections of the Group's financial performance under

the hypothetical stress scenario included in this announcement are

based on the methodology and calculations of the BoE. These do not

represent the Group's projections, or base capital plan

assumptions

For further information, please contact:

Mark Stride

Global Head, Investor Relations

+44 (0)20 7885 8596

mark.stride@sc.com

Simon Kutner

Executive Director, Group Media Relations

+44 (0) 20 7885 8696

Simon.kutner@sc.com

Note to Editors

Standard Chartered

We are a leading international banking group, with around 84,000

employees and a 150-year history in some of the world's most

dynamic markets. We bank the people and companies driving

investment, trade and the creation of wealth across Asia, Africa

and the Middle East. Our heritage and values are expressed in our

brand promise, Here for good.

Standard Chartered PLC is listed on the London and Hong Kong

Stock Exchanges as well as the Bombay and National Stock Exchanges

in India.

For more information please visit www.sc.com. Explore our

insights and comment on our blog, BeyondBorders. Follow Standard

Chartered on Twitter, LinkedIn and Facebook.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGLBDBDSXBGLG

(END) Dow Jones Newswires

November 30, 2016 02:05 ET (07:05 GMT)

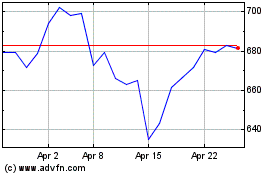

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

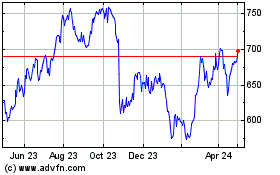

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024