Sports Direct International Plc Potential Acquisition (4583B)

October 07 2015 - 2:00AM

UK Regulatory

TIDMSPD

RNS Number : 4583B

Sports Direct International Plc

07 October 2015

7 October 2015

Sports Direct International plc

Potential acquisition of Irish company Warrnambool (Heatons)

Sports Direct International plc ("Sports Direct" or the

"Group"), the UK's leading sports retailer, announces that it has

entered into: (i) a sale and purchase agreement with Sandra Minor

(a minority shareholder in Warrnambool) to purchase shares in

Warrnambool which, following completion of that purchase will

result in Sports Direct owning just over 50% of Warrnambool (the

Purchase Agreement); and (ii) a conditional put and call option

agreement (the Option Agreement) with Mark Heaton, Hugh Heaton,

John O'Neill, Warrnambool and Katipo Limited in relation to the

remaining shares in Warrnambool which are not already owned by

Sports Direct (Sports Direct currently holds 50% of the issued

share capital of Warrnambool).

Warrnambool is the holding company of Heatons, a retail business

which specialises in retailing men's, women's and children's

clothing together with homewares, with 44 stores in the Republic of

Ireland and ten stores in Northern Ireland. 27 of the 44 stores in

the Republic of Ireland incorporate a dedicated "SportsWorld"

section within the store and each of the ten stores in Northern

Ireland either incorporates a "Sports Direct" branded section or is

located immediately adjacent to a "Sports Direct" outlet which

forms part of the premises. In addition, Warrnambool owns and

operates a further five standalone "Sports Direct" branded stores

in Northern Ireland.

The total cash consideration payable under the Purchase

Agreement and the conditional Option Agreement is EUR47.5m, which

will be funded from the Group's operating cashflow and existing

bank facilities. The Purchase Agreement and the conditional Option

Agreement are both conditional upon merger clearance from the Irish

Competition and Consumer Protection Commission being obtained. If

such merger clearance is obtained, completion of the purchase of

shares from Sandra Minor under the Purchase Agreement will take

place shortly thereafter. The options are exercisable at various

times during a period commencing after such merger clearance has

been obtained and ending on 2 July 2017.

For the year ended 30 April 2015, Warrnambool had consolidated

revenue of EUR219.3 million, gross assets of EUR158.0 million,

EBITDA of EUR17.2 million and profit before tax of EUR10.0

million.

Dave Forsey, Chief Executive Officer of Sports Direct,

commented: "We look forward to accelerating investment into the

existing store portfolio and strengthening the Heatons and Sports

Direct brands across Ireland".

For further information, please contact:

Sports Direct International T. 0344 245 9200

plc

Dave Forsey, Chief Executive

Officer

Matt Pearson, Acting

Chief Financial Officer

Powerscourt T. 0207 250 1446

Rory Godson

Peter Ogden

Nick Brown

Notes to Editors

Sports Direct is the UK's leading sports retailer by revenue and

operating profit, with approximately 400 stores across the UK. The

Group provides an unrivalled range of products, offering

exceptional quality and unbeatable value, from a wide variety of

third-party and Group-owned brands, both in-store and online.

Sports Direct now operates in 20 countries in Europe.

For more information please visit: www.sportsdirectplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCMFBMTMBAMTJA

(END) Dow Jones Newswires

October 07, 2015 02:00 ET (06:00 GMT)

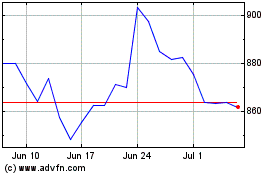

Frasers (LSE:FRAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Frasers (LSE:FRAS)

Historical Stock Chart

From Apr 2023 to Apr 2024