Spirit Airlines' Revenue Better Than Expected

April 18 2016 - 9:20PM

Dow Jones News

Spirit Airlines Inc. said first-quarter revenue was better than

expected, leading to improved operating-margin guidance, but the

company noted that fares remain low in its markets.

Spirit, known for pairing very low base fares with fees for

things such as carry-on baggage and drinks, said non-ticket revenue

was relatively stable, but faced "modest pressure on take rates for

certain ancillary items."

The carrier increased its operating-margin guidance to about

21.5%, from a range of 19% to 20.5%.

Spirit said total revenue per available seat mile fell about

14%, which was better than expected as revenue-management

strategies helped results.

In January, Spirit replaced Chief Executive Ben Baldanza ,

naming board member Robert Fornaro as its new president and

CEO.

Last week, the company said March traffic increased 25.1% as

load factor rose to 88.5% from 88.1% a year earlier.

Spirit has been hurt by aggressive fare cuts from legacy

carriers. A sharp drop in fuel prices has made it easier for big

airlines to cut prices in response to expansion by discounters.

On Monday, Spirit said its average ticket revenue per passenger

segment declined sequentially in the first quarter.

In after-hours trading, Spirit shares rose 1.9% to $51.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

April 18, 2016 21:05 ET (01:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

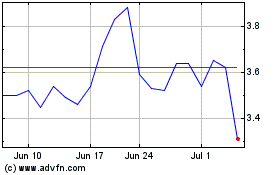

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

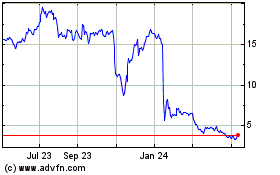

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Apr 2023 to Apr 2024