Sika's Strong Results Strengthen Defense vs Saint-Gobain, Says Chairman

February 26 2016 - 5:11AM

Dow Jones News

By John Revill

ZURICH0--Construction and automotive chemicals maker Sika AG's

(SIK.VX) strongest-ever annual earnings strengthens its opposition

to a $2.78 billion hostile takeover by French rival Saint-Gobain AG

(SGO.FR), the chairman of the Swiss company said Friday.

Baar-based Sika has been embroiled in a takeover battle for more

than a year after Saint-Gobain offered to buy the controlling stake

held by Sika's founding family without making an offer to other

shareholders, which include billionaire Bill Gates.

"I am very pleased that these strong results support our defense

of Sika against Saint-Gobain," said chairman Paul Halg.

He said the results showed that Sika's business hadn't been

damaged by the "difficult situation" with Saint-Gobain, that Sika

could be successful as an independent company, and didn't need

Saint-Gobain.

"The way we have organized ourselves means we can work in this

way for a long time," Mr. Halg said. Sika was prepared to continue

resisting Saint-Gobain for as long as it takes, he said.

The takeover sparked fierce opposition because Paris-based

Saint-Gobain has proposed only to buy the 16% stake held by Sika's

founding Burkard family for 2.75 billion Swiss francs ($2.78

billion). Buying the family's investment vehicle gives control of

Sika as it has 52% of the voting rights in the Swiss company.

Sika's management has responded by limiting the family's voting

rights to 5%, a move that is now being disputed in Swiss courts

with a decision expected this summer.

Earlier Friday, Sika reported a 5.4% rise in net profit for 2015

of CHF465.1 million ($469.8 million) in the 12 months to Dec. 31

from CHF441.2 million a year earlier, beating analyst expectations

of CHF455 million.

Sales dipped 1.5% to CHF5.49 billion from CHF5.57 billion in

2014, slightly ahead of analyst expectations of CHF5.47 billion, as

the highly valued Swiss franc took a toll.

A spokesman for Cascade Investment LLC, the investment vehicle

controlled by Bill and Melinda Gates, said they continued to

"fiercely oppose" a Saint-Gobain takeover.

"There needs to be a solution that fits all the investors and

not just members of one family, and we would like Saint-Gobain

walked away," the spokesman said.

This looks unlikely with Saint-Gobain repeating its commitment

to the deal.

"We are both patient and committed to completing the Sika

transaction," said Saint-Gobain CEO Pierre-Andre de Chalendar as

the Paris company reported its full-year earnings on Thursday.

Write to John Revill at john.revill@wsj.com

(END) Dow Jones Newswires

February 26, 2016 04:56 ET (09:56 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

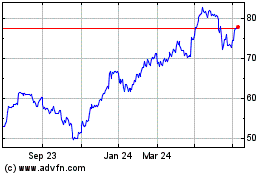

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Apr 2023 to Apr 2024